Date:

19-02-2019

Impact: Negative (GDP growth, employment)

Brief: Industrial production has languished for another month in December, 2018. The IIP index has expanded by just 2.6% during the said period as against 7.3% a year earlier. Industrial output has been undermined by the poor performance of lower side categories such as primary (-1.17%) and intermediate goods (-1.53). We expect expansionary fiscal as well as monetary policies to soon bring back consumption on track and normalize this trend.

Industrial production has languished for another month in December, 2018. The IIP index has expanded by just 2.6% during the said period as against 7.3% a year earlier. Industrial output has been undermined by the poor performance of lower side categories such as primary (-1.17%) and intermediate goods (-1.53). A de-growth in these categories indicates systemic inventory build-up.

The recent industry outlook survey of RBI also reveals that finished goods inventory in the economy has increased - a condition that gives us a sense of sluggish consumption. This is further corroborated well with the trend in core inflation, which is on a downward roll since November 2018. However, going ahead, we expect expansionary fiscal as well as monetary policies to soon bring back consumption on track and normalize this trend. Therefore, we are certain that industrial production will regain its momentum in a near term.

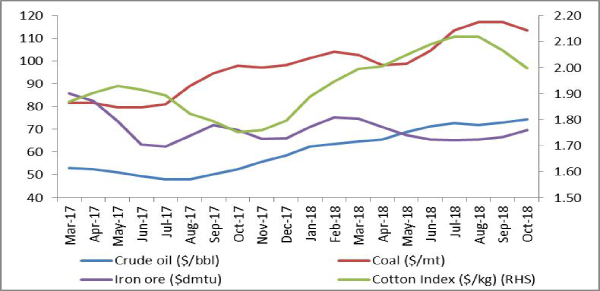

The sectors that upheld their expansionary

path in the December month include food products (13.3%), wearing appeals

(16.5%) and transport equipment (17.9%). We believe that financial outlook of

the food industry is expected to remain robust in FY19. The price of some agro

commodities such as sugar, pulses and vegetables are in negative zone for a

long period of time – a fact that will result in lower input cost for the

industry. Similarly, automobile industry will take advantage of a fall in

non-energy commodity prices such as iron ore, copper, aluminium.

Growth in industrial

production (economic base)

| IIP | Mining | Manu | Core | |

| FY15 | 4.02 | -1.34 | 3.75 | 4.94 |

| FY16 | 3.33 | 4.34 | 2.9 | 2.98 |

| FY17 | 4.58 | 5.33 | 4.32 | 4.76 |

| FY18 | 4.38 | 2.31 | 4.6 | 4.28 |

| Dec-17 | 7.31 | 1.23 | 8.73 | 3.80 |

| Jul-18 | 6.61 | 3.35 | 6.96 | 6.63 |

| Aug-18 | 4.3 | -0.43 | 4.59 | 4.16 |

| Sep-18 | 4.47 | 0.21 | 4.62 | 4.28 |

| Oct-18 | 8.08 | 7.04 | 7.92 | 4.80 |

| Nov-18 | 0.5 | 2.7 | -0.4 | 3.55 |

| Dec-18 | 2.37 | -0.95 | 2.65 | 2.60 |

Growth in industrial production (use base)

| Primary | Capital | Intermediate | Infra | Consumer | Durable | Non-durable | |

| FY15 | 3.74 | -1.13 | 6.11 | 4.98 | 3.9 | 3.97 | 3.86 |

| FY16 | 4.97 | 3 | 1.52 | 2.84 | 2.94 | 3.33 | 2.58 |

| FY17 | 4.9 | 3.18 | 3.32 | 3.91 | 5.67 | 4.26 | 7.04 |

| FY18 | 3.69 | 3.94 | 2.24 | 5.6 | 6.03 | 4.32 | -2.56 |

| Dec-17 | 3.81 | 13.16 | 7.47 | 6.52 | 2.14 | 16.83 | 3.80 |

| Jul-18 | 6.74 | 2.8 | 1 | 9.23 | 14.27 | 5.53 | 6.63 |

| Aug-18 | 2.63 | 5.01 | 2.36 | 7.79 | 5.23 | 6.32 | 4.16 |

| Sep-18 | 2.56 | 5.76 | 1.37 | 9.5 | 5.23 | 6.14 | 4.28 |

| Oct-18 | 5.98 | 16.8 | 1.79 | 8.71 | 17.56 | 7.95 | 4.80 |

| Nov-18 | 3.2 | -3.4 | 4.5 | 5 | 8.2 | 3.9 | 3.55 |

| Dec-18 | -1.17 | 5.9 | -1.53 | 10.07 | 2.93 | 5.35 | 2.60 |

Source: MOSPI, Acuité Research

Global Commodity Prices (3 Month Moving Average):

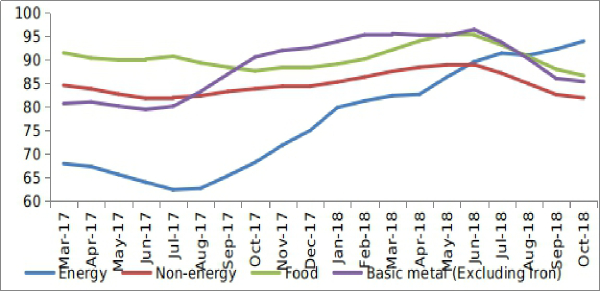

Global Commodity Price Index (3 Month Moving Average):

Source: Acuité Research, World Bank

Source: Acuité Research, World Bank