Impact: Neutral (Liquidity)

Brief: RBI holds the repo rate at 6.5% in the 4th MPC meeting, but changed the stance from neutral to so called, 'calibrated tightening'. The liquidity conditions are seen normalizing by the central bank despite visible signs of shortage. As the Repo and WACR converge, a neutral stance has been apparently reached. The trouble in paradise however stems from their differential turning negative in recent weeks and RBI trying to douse the fire via OMO infusions that included term Repos.

RBI holds the repo rate at 6.5% in the 4th MPC meeting, but changed the stance from neutral to so called, 'calibrated tightening'. As reiterated by the Governor, the primary target of the central bank remains headline inflation targeting, which has to deal with both upside and downside risk. With that perspective, falling value of Indian rupee, oil price, and MSP are the up side risk to the consumer inflation. On the other hand, food production surplus, revised GST rate and expected lower tariff are expected to be downside risk. This uncertainty in the movement of consumer inflation prompted the RBI to wait for further clarity of the number. Interestingly, the RBI revised down the inflation expectation by 60 bps to 4% for Q2, FY19. It also expects the H2 inflation rate to be in the range of 3.9% and 4.5% as against 5% in August.

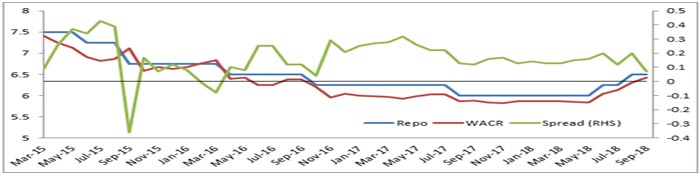

The liquidity conditions are seen normalizing by the central bank despite visible signs of shortage. As the Repo and WACR converge, a neutral stance has been apparently reached. The trouble in paradise however stems from their differential turning negative in recent weeks and RBI trying to douse the fire via OMO infusions that included term Repos. Technically, the situation signifies a liquidity crunch and a rate hike would have signaled RBI's liquidity expectations - officially changing its neutral stance. However, the MPC abstained from such a move and changed its official stance without tweaking the interest rates. We believe that the RBI is trying to keep the market expectation alive regarding future tightening without spooking the capital market, which may witness a spurt in yields.

As far as the domestic economy is concerned, the RBI is confidence as both industry and agricultural sectors have been exhibiting healthy expansion. Similarly, from the demand side, strong private and public consumption is underpinning the overall economic outlook. The RBI is particularly concerned about the global economic perspective, as Emerging Economies are facing headwind from geo-political tensions, Fed normalization and commodity price volatility.

Rate Spreads

Source: CMIE; RBI; Acuité Research