Impact: Positive (Interest Rates)

Brief: Headline inflation for the month of November records 0.48%, puling the overall (combined) inflation number to 3.3%. Recording a negative growth, food prices are actually deflating inflationary pressures by a factor of 10 bps. Considering these trends, which are following those of financial year 2017, the current year combined CPI number may significantly undershoot our original estimates.

Combined CPI number has been recorded at 3.3% in October 2018 and food inflation remains the culprit. While core inflation continues to record a strong momentum of nearly 6%, non-core categories are pegged at just 0.48%. Food inflation is actually deflating by -0.86% over a base of 2.26%, YoY. The situation can be considered an anomaly given the significant rise in MSPs for the year. While it is understood that seasonal vegetables, which are not part of the MSP are primarily responsible for the situation, what is not understood is the inability of included agro commodities to increase price expectations. As Khariff produce begins to enter the market, there appears to be a supply glut resulting in farmers receiving even lower prices than even the MSP. We reckon this to be associated with the typical hog cycles, given higher MSPs are inducing farmers to over produce, eventually leading to a supply glut and lower realizable prices.

We have long held that MSP does not translate into a higher inflation; in fact, on the contrary, it reduces the pressures. The current developments are leading to precisely this condition. Another situation developing in the background is the evolution of core inflation, which is expanding at a very healthy 5.8% YTD. This is signifying a reasonable consumption pattern ultimately prepping the economy for capacity augmentations. However, since the RBI records only headline inflation in its assessments, the real picture is somehow missed since the combined number is deflated by the non-core category. Resultantly, stabilizing interest rates are therefore unable to fathom the underlying consumption and the connected inflationary trend developing unnoticed.

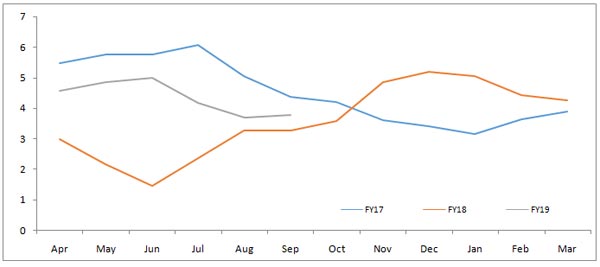

As per our analysis, the food category supply glut is deflating the overall CPI number by almost 10 bps, almost neutralizing the impact of a volatile Fuel price. Considering these trends, which are following those of financial year 2017, the current year CPI number may significantly undershoot our original estimates. We are seeing the H1 FY19 combined CPI number at 4.1%, which is nearly 100 bps lower than same time, FY17. With this logic, the H2 number for the current year may come at around 3.5% - translating in an overall annual financial year number of sub 4%. Having said this, oil price volatility may add 20 to 30 bps (±), which should be factored in this assumption.

Inflationary Trends (3-year comparison)

Source: CSO; Acuité Research