Key Highlights:

Liquidity

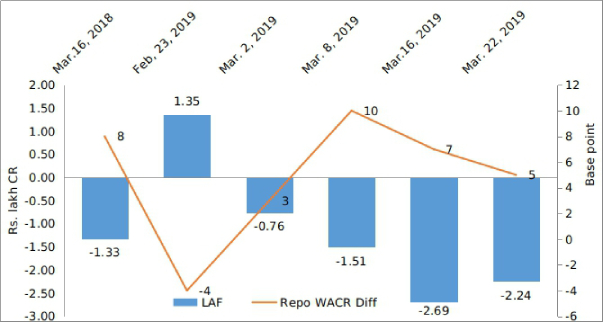

The repo-WACR differential stands at 5bps during the third week of March, 2019. With the positive number, the liquidity condition remains on the surplus side for consecutive four weeks. During this month, RBI has already infused Rs. 37,500 crore through OMO operation to maintain sufficient liquidity in the system. In addition, previous week, the central bank has opened up a third avenue in the form of Currency Swap (3 years forward) to eke out liquidity in the system. This operation has added Rs. 34,500 crore in the system, providing a comfortable cushion to the banking sector. Looking forward, with the currency swap agreement and improvement in capital inflows, we are expecting the liquidity condition to remain in the comfortable zone for a medium term.

Capital Market:

On the global capital market front, the US 10 year sovereign bond is yielding 2.43% during the third week of March, 2019. This is 38 bps lower than the same time, the previous year. With a strong demand, the global benchmark G-Sec yield is in downward trend for over past four weeks. The short term instrument such as 3-month T-Bill rate is yielding 2.4% as on March 29, 2019, which is 67 bps higher than the previous year. 10-yr G-Sec, on the other hand, has been yielding 30 bps lower at 2.43%. This gives a sense of higher demand for the US long term bonds. In the domestic market, Indian 10-year G-Sec yield remains stable at 7.33% over past two weeks. As a result, the spread between Indian and US 10-yr G-Sec yield has further increased to 490 bps. A higher spread indicates that Indian sovereign bond has been becoming more attractive.

Currency Trend:

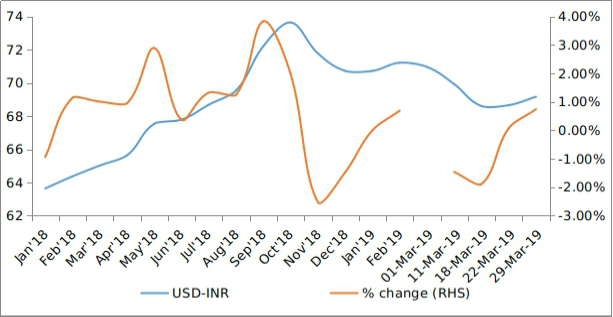

Over past three weeks, USD-INR currency pair has been hovering at 68. The recent currency swap agreement by the RBI has helped the domestic currency to strengthen against the US dollar. With the higher capital inflows and fall in crude price, the Indian rupee has remained upbeat for over a month. The domestic currency has appreciated by 2.8% against the US dollar over a month period.

The forex reserve has also reached all time high of $406.67 billion during second week of March, 2019.

Interest rates and ratio:

|

Interest Rate |

Mar.,23 2018 |

Feb.,22 2018 |

Mar.,01 2019 |

Mar.,08 2019 |

Mar.,15 2019 |

Mar.,22 2019 |

|

Policy Repo Rate |

6.00 |

6.25 |

6.25 |

6.25 |

6.25 |

6.25 |

|

Call Money Rate (WA) |

5.92 |

6.29 |

6.22 |

6.15 |

6.18 |

6.20 |

|

364-Day Treasury Bill Yield |

6.54 |

6.53 |

6.55 |

6.51 |

6.49 |

6.42 |

|

2-Yr Indian G-Sec |

6.89 |

6.67 |

6.64 |

6.55 |

6.59 |

6.51 |

|

10-Yr Indian G-Sec |

7.59 |

7.42 |

7.37 |

7.36 |

7.33 |

7.33 |

|

10-Yr US G-Sec |

2.81 |

2.76 |

2.64 |

2.59 |

2.44 |

2.43 |

|

Spread in bps (10Yr Indian-10Yr US) |

478 |

466 |

473 |

477 |

489 |

490 |

|

AAA Indian Corporate |

8.21 |

8.32 |

8.61 |

8.58 |

8.55 |

8.36 |

|

AA Indian Corporate |

8.18 |

- |

8.56 |

- |

- |

- |

|

Spread AAA to10 YR Indian bond |

62 |

90 |

124 |

122 |

122 |

103 |

|

Credit/Deposit Ratio |

- |

- |

77.92 |

- |

78.14 |

- |

|

USD LIBOR (3 month) |

2.35 |

2.59 |

2.59 |

2.62 |

2.60 |

2.59 |

Source: RBI, Investing.com

Acuité Portfolio Debt Instrument Benchmark Estimates (as on 25 March

2019):

| Category | 10-Yr Corporate Yield to Maturity |

| AAA* | 8.32% |

| AA+ | 8.39% |

| AA | 8.85% |

|

|

Deposit (In Rs. Lakh cr) |

Bank Credit (In Rs. Lakh cr) |

|

As on Mar 15, 2019 |

122.6 |

95.5 |

|

As on Jan 04, 2019 |

120.3 |

93.4 |

|

As on Mar 16, 2018 |

111.1 |

83.4 |

|

YTD (% change) |

1.91% |

2.25% |

|

YoY (% change) |

10.35% |

14.51% |

Source: RBI

Money Market Performance

|

Commercial Paper (Fortnight): |

Outstanding (In Rs. Lakh cr) |

Amount issued (In Rs. Lakh cr) |

|

15-Mar-2019 |

5,309.5 |

1,240.6 |

|

15-Feb-2019 |

5,242.3 |

1,035.5 |

|

15-Mar-2018 |

4,605.0 |

1154.5 |

|

% Change (MoM) |

1.28% |

19.81% |

|

% Change (YoY) |

15.30% |

7.46% |

Source: RBI

Indices

|

|

30-Mar-18 |

08-Mar-19 |

15-Mar-19 |

22-Mar-19 |

29-Mar-19 |

|

NSE Index |

10,113.70 |

11,035.40 |

11,426.85 |

11,456.90 |

11,623.90 |

|

NSE Index Return |

1.16 |

-0.21 |

0.74 |

-0.56 |

0.47 |

|

BSE Index |

32,968.68 |

36,671.43 |

38,024.32 |

38,164.61 |

38,672.91 |

|

BSE Index Return |

1.14 |

-0.15 |

0.71 |

-0.58 |

0.33 |

Source: RBI

Source: RBI

Note: Net injection (+) and Net absorption (-)

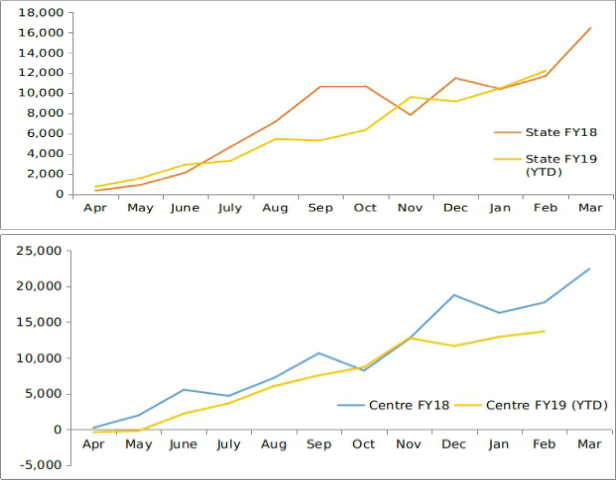

Net Debt Issuance by Centre and State Government:

Source: Acuité Research, RBI

Source: Acuité Research, RBI

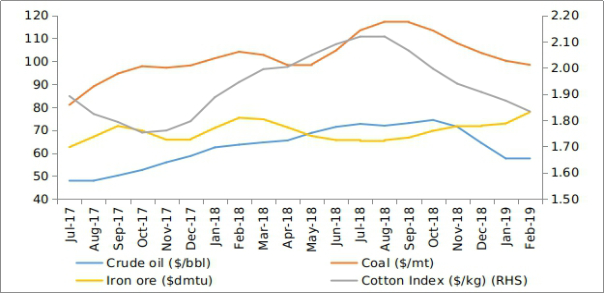

Commodity Price Index (3 Month Moving Average):

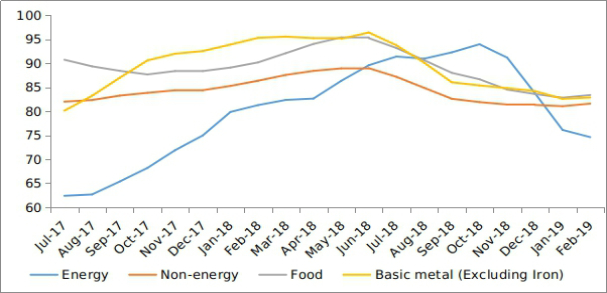

Commodity Price Movement (3 Month Moving Average):

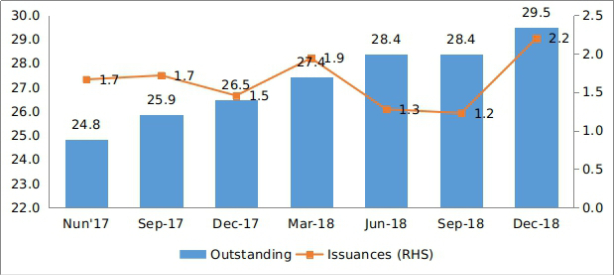

Corporate debt (in Rs. Lakh Cr):

USD-INR Movement:

Source: RBI, Acuité Research

Source: RBI, Acuité Research