Key Highlights:

Liquidity

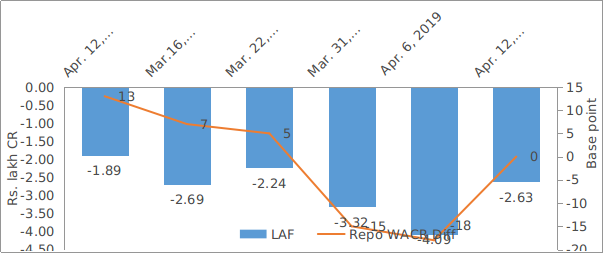

During second week of April, 2019, liquidity in the domestic banking system has improved from deficit to ex-ante neutrality. The weighted average call money rate stands at par with repo rate during the said period. A week ago, the overnight lending rate was 18 bps higher than the repo rate. The higher differential is a result of cut in repo rate by 25 bps during 4th April MPC meeting. As a major event of this month, RBI’s second currency swap agreement worth of $5 billion is due on April 25, 2019. Therefore, in coming months, banking system will have surplus liquidity.

Capital Market

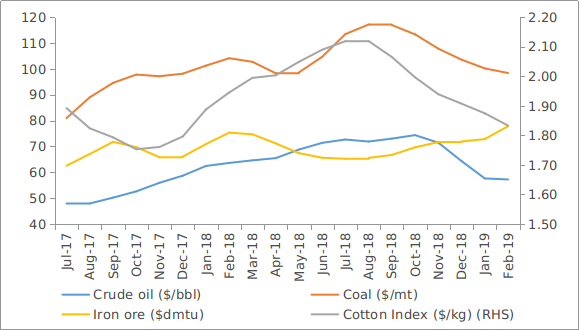

On the domestic capital market, the 10 year Indian sovereign bond yield increased by 6 bps to 7.43% during the second week of April, 2019. The G-Sec yield was hovering at around 7.33% during March, 2019. However, the yield started increasing with the commencing of new financial year, as a result of fresh issuances. It is known that as per budget estimate, net issuances (Central Government) are estimated to be Rs. 4.74 lakh crore for FY20, which is 13% higher than the previous year; State issuances will be incremental. Globally, the sovereign bond yields are on an upward trend on account of higher commodity prices – as investors are anticipating upward bias in inflation rate.

Currency Trend

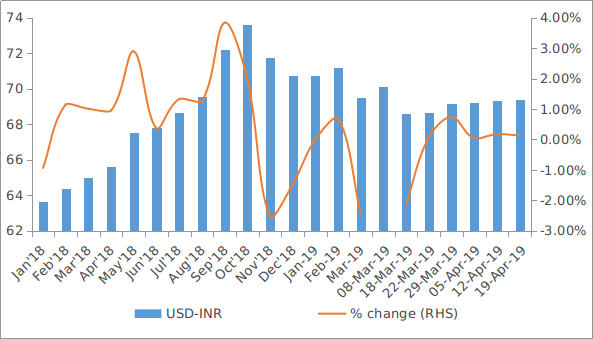

The currency of emerging markets has been weakening against the USD for past couple of weeks. Indian rupee has been following a similar trend. In the short term, an uptick in commodity prices is expected to undermine the purchasing power of net commodity importers including India. However, A surge in India’s forex reserve, which stand at $415 billion will help in controlling exchange rate volatility.

Interest rates and ratio:

|

Interest Rate |

Apr 13

2018

|

Mar 15

2019

|

Mar 22

2019

|

Mar 29

2019

|

Apr 05

2019

|

Apr 12

2019

|

|

Policy Repo Rate |

6.00 |

6.25 |

6.25 |

6.25 |

6.00 |

6.00 |

|

Call Money Rate (WA) |

5.87 |

6.18 |

6.20 |

6.35 |

6.18 |

6.00 |

|

364-Day Treasury Bill Yield |

6.49 |

6.49 |

6.42 |

6.39 |

6.31 |

6.39 |

|

2-Yr Indian G-Sec |

6.89 |

6.59 |

6.51 |

6.57 |

6.69 |

6.81 |

|

10-Yr Indian G-Sec |

7.46 |

7.33 |

7.33 |

7.34 |

7.37 |

7.43 |

|

10-Yr US G-Sec |

2.82 |

2.44 |

2.43 |

2.48 |

2.55 |

2.57 |

|

Spread in bps (10Yr Indian-10Yr US) |

464 |

489 |

490 |

486 |

482 |

486 |

|

Credit/Deposit Ratio |

74.49 |

78.14 |

- |

77.69 |

- |

- |

|

USD LIBOR (3 month) |

2.59 |

2.60 |

2.59 |

2.59 |

2.60 |

2.58 |

Acuité Portfolio Debt Instrument Benchmark Estimates (as on 22 April

2019):

|

Category |

10-Yr Corporate Yield to Maturity |

|

AAA* |

NA |

|

AA+ |

7.82% |

|

AA |

8.61% |

|

|

Deposit (In Rs. Lakh cr) |

Bank Credit (In Rs. Lakh cr) |

|

As on Mar 29, 2019 |

125.7 |

97.7 |

|

As on Jan 04, 2019 |

120.3 |

93.3 |

|

As on Mar 30, 2018 |

114.2 |

86.2 |

|

YTD (% change) |

4.48% |

4.60% |

|

YoY (% change) |

10.03% |

13.24% |

Money Market

Performance

|

Commercial Paper (Fortnight): |

Outstanding (In Rs. Lakh cr) |

Amount issued (In Rs. Lakh cr) |

|

31-Mar-2019 |

4,830.8 |

1013.0 |

|

28-Feb-2019 |

5,208.1 |

900.8 |

|

31-Mar-2018 |

3,725.8 |

999.2 |

|

% Change (MoM) |

-7.24% |

12.45% |

|

% Change (YoY) |

29.66% |

1.38% |

Indices

|

|

20-Apr-18 |

29-Mar-19 |

05-Apr-19 |

12-Apr-19 |

18-Apr-19 |

|

NSE Index |

10,564.05 |

11,623.90 |

11,665.95 |

11,643.45 |

11,752.80 |

|

NSE Index Return |

0.8 |

0.47 |

0.59 |

0.4 |

-0.29 |

|

BSE Index |

34,415.58 |

38,672.91 |

38,862.23 |

38,767.11 |

39,140.28 |

|

BSE Index Return |

0.65 |

0.33 |

0.46 |

0.41 |

-0.34 |

Source: RBI

Source: RBI

Note: Net injection (+) and Net absorption (-)

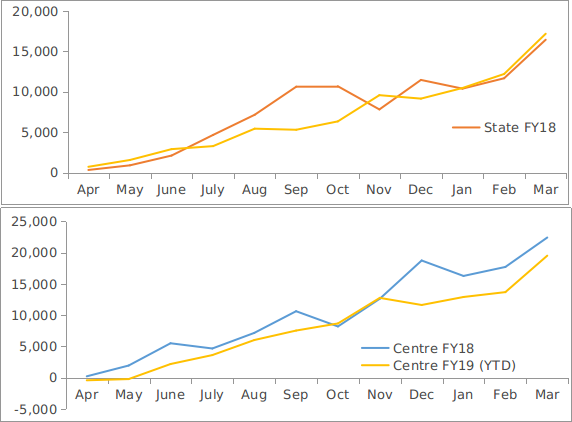

Net Debt Issuance by Centre and State Government (Rs. Billion):

Commodity Price Index (3 Month Moving Average):

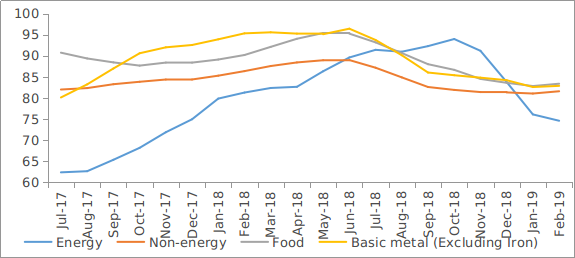

Commodity Price Movement (3 Month Moving Average):

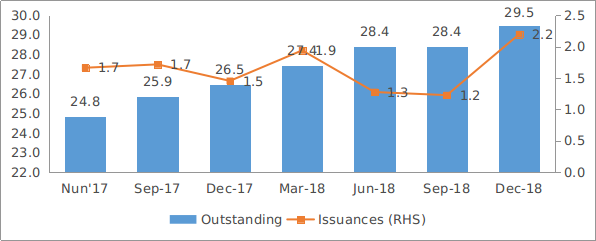

Corporate debt (in Rs. Lakh Cr):

USD-INR Movement:

Source: RBI, Acuité Research

Source: RBI, Acuité Research