Key Highlights:

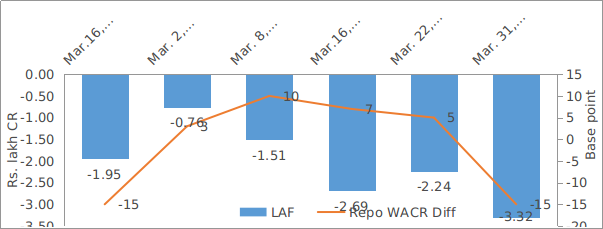

·The Repo-WACR stands at (-)10 bps during last week of FY19

·The spread between Repo and WACR had remained in the positive trend for four weeks before turning negative during last week of March, 2019

·With the improvement in FII inflows and piling up forex reserves, the liquidity condition is expected to remain in ex-ante positive

·10-year G-Sec yield remains steady at 7.34%. The yield was under control over last two months due to OMO operations

·Going ahead, movement in yield will be driven by fresh issuances

·In the post ‘Currency Swap’ situation, India’s forex reserve has surged to an all-time high of $411.9 billion during last week of March, 2019

Liquidity

The Repo-WACR stands at (-) 10 bps during last week of FY19. The spread between Repo and WACR had remained in the positive trend for four weeks before turning negative during last week of March, 2019. It is known that the RBI had infused Rs. 37,500 crore during this month with a series of open market operations. Moreover, the central bank had opened its third avenue in the name of Currency Swap agreement, during the end of this month to deal with liquidity scarcity. The tight liquidity condition during this week is due to year end pressure in the banking sector. Going ahead, we are optimistic about the liquidity condition in the medium term. With the improvement in FII inflows and piling up forex reserve, the liquidity condition is expected to remain in the ex-ante positive. Moreover, the RBI is expected to conduct a number of Currency Swaps in the near term as per requirements.

Capital Market

On the domestic capital market front, the 10-year G-Sec yield remains steady at 7.34%. The yield was under control over last two months due to OMO operations. Moreover, the RBI has ended the speculation over rate cut by trimming repo by another 25bps during the first MPC meeting of this fiscal year. Going forward, we do not expect another rate cut in the short to medium term primarily because the window has now closed. Therefore, movement in yield will be driven by fresh issuances. From the American perspective, the US 10-year G-Sec yield has increased by 5 bps to 2.48% over a week on March 29, 2019 on account of weak consumer confidence index.

Currency Trend

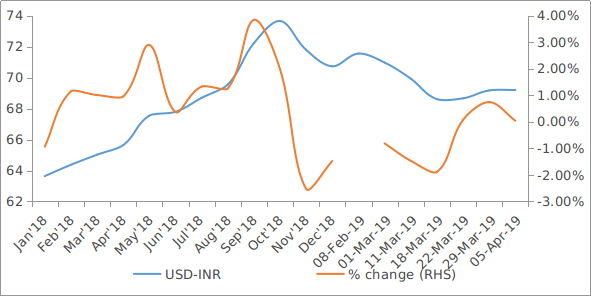

Indian rupee along with

other Emerging Market currencies has been strengthening against the US dollar. The

upbeat scenario seen in EM currencies is a result of higher capital inflows to

the emerging market. In the post ‘Currency Swap’ scenario, India’s forex

reserve has surged to an all-time high of $411.9 billion during last week of

March, 2019. A higher forex reserve will strengthen central bank’s hand in

controlling exchange rate volatility.

Market

Perspectives from Rating Operations Team:

Supreme Court decision rescinding the February 12 circular from RBI

We believe that the recent Supreme Court decision rescinding the February 12 circular from RBI will definitelyprovide some relief to distressed companies in sectors like power & steel. The stress in power companies hasemanated from structural supply side and demand side issues and any sustainable solution to the stress in these sectors isdifficult untill these aspects are addressed. Notwithstanding, we believe that the February 12 circular provided a strong negotiating tool to the lenders as it provided a time bound approach to resolution of stressed assets. The circular prescribed a reference to NCLT in case of any challenges in arriving at an acceptable resolution plan within the stipulated time frame. The CoC (Committee of Creditors) formed after the referral to NCLT provided a strong platform for all lenders to arrive at a mutually acceptable resolution solution.

The delaying tactics by defaulting borrowers through various legal means, and the concomitant deterioration in collateral values has been the bane of the recovery system in India. Post the Supreme Court decision, the lenders will still have the flexibility to refer any unit to NCLT, however the time aspect will be left to their discretion. The past track record of our lenders has not been encouraging in this regard. We believe that a prescriptive approach from RBI will have to be the order of the day till our lenders cultivate a disciplined approach to recovery. The proposed revised circular from RBI will be much awaited in this regard.

Vinayak Ramkrishna Nayak

Head - Rating

Operations, Large Corporate

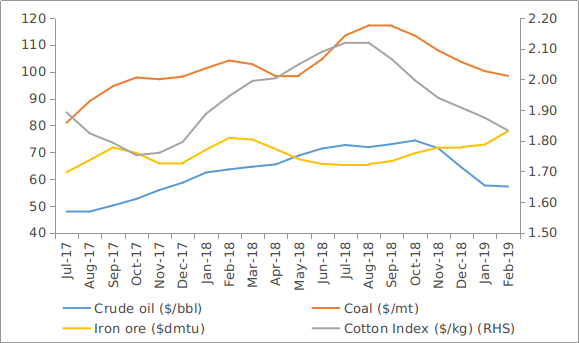

Margins of domestic steel manufacturers likely to remain under pressure as a result of increasing imports and firm raw material cost

We believe that the operating margins of domestic steel manufacturers will remain under pressure during 2019-20 on account of higher imports from Japan, China and Korea finding their way to Indian ports. India’s exports have witnessed a decline of 17% during April to December 2018 period on account of additional duties imposed by USA. Domestic steel prices therefore are likely to be under pressure over near to medium term, despite improving domestic consumption on account of higher impetus on infrastructure development. HRC imported from Japan and Korea is 10% cheaper compared to the domestic produce, while that of China with 12.5% customs and freight is still competitive compared to domestic prices of $675 per tonne. On the flip side, coking coal and iron ore prices are likely to remain firm, leading to pressure on operating margins of domestic manufacturers.

Aditya Gupta

Head - Rating

Operations, Mid-Corporate

Interest rates and ratio:

|

Interest Rate |

Mar.,30 2018 |

Mar.,01 2019 |

Mar.,08 2019 |

Mar.,15 2019 |

Mar.,22 2019 |

Mar.,29 2019 |

|

Policy Repo Rate |

6.00 |

6.25 |

6.25 |

6.25 |

6.25 |

6.25 |

|

Call Money Rate (WA) |

6.15 |

6.22 |

6.15 |

6.18 |

6.20 |

6.35 |

|

364-Day Treasury Bill Yield |

6.49 |

6.55 |

6.51 |

6.49 |

6.42 |

6.39 |

|

2-Yr Indian G-Sec |

6.84 |

6.64 |

6.55 |

6.59 |

6.51 |

6.57 |

|

10-Yr Indian G-Sec |

7.42 |

7.37 |

7.36 |

7.33 |

7.33 |

7.34 |

|

10-Yr US G-Sec |

2.74 |

2.64 |

2.59 |

2.44 |

2.43 |

2.48 |

|

Spread in bps (10Yr Indian-10Yr US) |

468 |

473 |

477 |

489 |

490 |

486 |

|

AAA Indian Corporate |

8.21 |

8.61 |

8.58 |

8.55 |

8.36 |

8.38 |

|

AA Indian Corporate |

8.18 |

8.56 |

- |

- |

- |

- |

|

Spread AAA to10 YR Indian bond |

79 |

124 |

122 |

122 |

103 |

104 |

|

Credit/Deposit Ratio |

75.39 |

77.92 |

- |

78.14 |

- |

- |

|

USD LIBOR (3 month) |

2.73 |

2.59 |

2.62 |

2.60 |

2.59 |

2.59 |

Source: RBI, Investing.com

Acuité Portfolio Debt Instrument Benchmark Estimates (as on 25 March 2019):

|

Category |

10-Yr Corporate Yield to Maturity |

|

AAA* |

8.32% |

|

AA+ |

8.39% |

|

AA |

8.85% |

Source: Acuité Research; # Discount Factor: 0.0625; *Outside Benchmark

|

|

Deposit (In Rs. Lakh cr) |

Bank Credit (In Rs. Lakh cr) |

|

As on Mar 15, 2019 |

122.6 |

95.5 |

|

As on Jan 04, 2019 |

120.3 |

93.4 |

|

As on Mar 16, 2018 |

111.1 |

83.4 |

|

YTD (% change) |

1.91% |

2.25% |

|

YoY (% change) |

10.35% |

14.51% |

Source: RBI

Money Market Performance

|

Commercial Paper (Fortnight): |

Outstanding (In Rs. Lakh cr) |

Amount issued (In Rs. Lakh cr) |

|

31-Mar-2019 |

4,830.8 |

1013.0 |

|

28-Feb-2019 |

5,208.1 |

900.8 |

|

31-Mar-2018 |

3,725.8 |

999.2 |

|

% Change (MoM) |

-7.24% |

12.45% |

|

% Change (YoY) |

29.66% |

1.38% |

Source: RBI

Indices

|

|

06-Apr-18 |

15-Mar-19 |

22-Mar-19 |

29-Mar-19 |

05-Apr-19 |

|

NSE Index |

10,331.60 |

11,426.85 |

11,456.90 |

11,623.90 |

11,665.95 |

|

NSE Index Return |

2.15 |

0.74 |

-0.56 |

0.47 |

0.59 |

|

BSE Index |

33,626.97 |

38,024.32 |

38,164.61 |

38,672.91 |

38,862.23 |

|

BSE Index Return |

2 |

0.71 |

-0.58 |

0.33 |

0.46 |

Source: RBI

Source: RBI

Note: Net injection (+) and Net absorption (-)

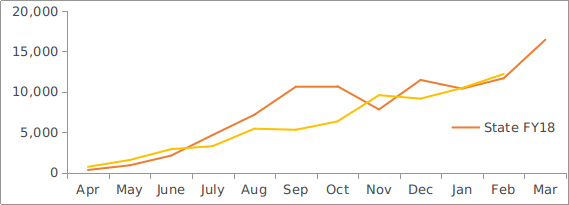

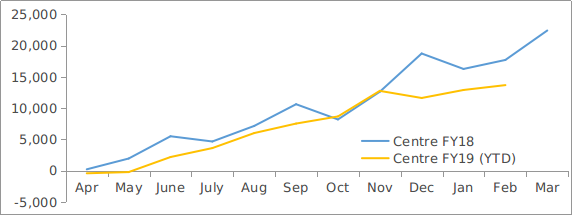

Net Debt Issuance by Centre and State Government (Rs. Billion):

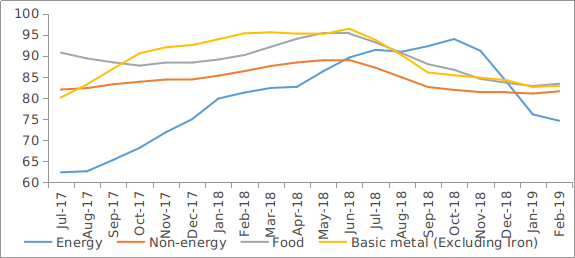

Commodity Price Index (3 Month Moving Average):

Commodity Price Movement (3 Month Moving Average):

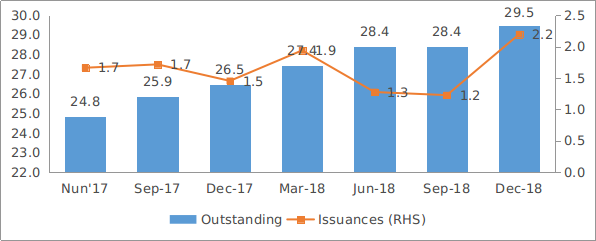

Corporate debt (in Rs. Lakh Cr):

USD-INR Movement:

Source: RBI, Acuité Research

Source: RBI, Acuité Research