Key Highlights:

Liquidity:

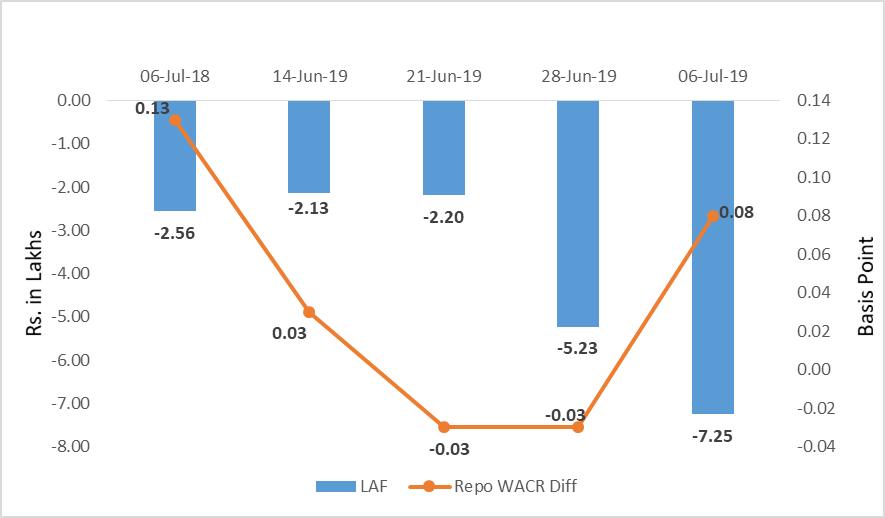

The weighted average call money rate has subsided to 5.67% during the first week of July, 2019. Liquidity in the call money market has improved as the WACR rate stands eight bps lower than the benchmark rate. The average liquidity in the system was Rs. 1.20 cr during this week. As the Federal Reserve hints a dovish stance, the yield chasing capital would inflow to emerging market including India. Therefore, liquidity situation in India is expected to improve.

Capital Market

On the global capital market, the 10-year US G-sec increased to 2.12% during the first week of July, 2019. In the US, investors anticipate higher inflation rate with an increase in MBA purchase index. 10-year Indian G-sec yield, in contrast, declined to 6.76%, which is 100 bps higher than the repo rate. The spread between 10 year Indian G-sec and the US has reduced to 464 bps from 490 bps over a week period indicating strong demand for the Indian sovereign bond.

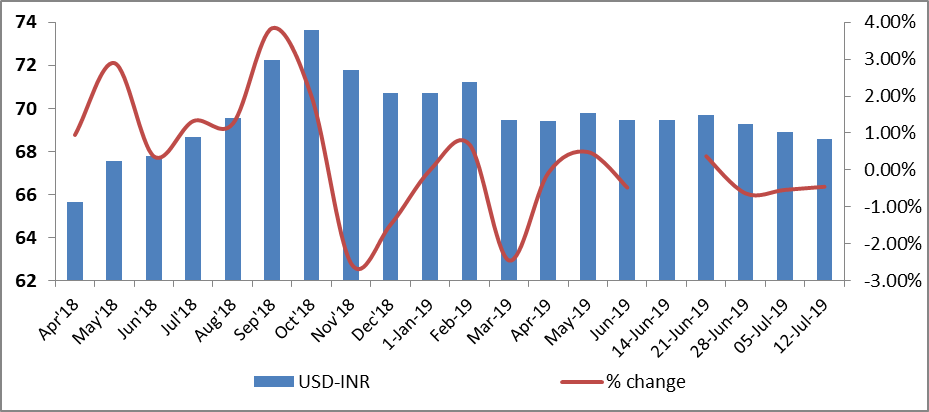

Currency Trend

The USD-INR exchange rate has been oscillating at 68.6 for past two weeks. The factors appreciating the Indian rupee are strong capital inflows, forex reserve and lower oil price. However, higher import bill is neutralizing the positive effect of above factors and curbing the appreciation of the Indian rupee against the UD dollar.

Interest rates and ratio:

|

Interest Rate |

July 6 |

June 7 |

June 14 |

June 21 |

June 28 |

July 5 |

|

2018 |

2019 |

2019 |

2019 |

2019 |

2019 |

|

|

Policy Repo Rate |

6.25 |

5.75 |

5.75 |

5.75 |

5.75 |

5.75 |

|

Call Money Rate (WA) |

6.12 |

5.81 |

5.72 |

5.78 |

5.78 |

5.67 |

|

364-Day Treasury Bill Yield |

7.17 |

6.19 |

6.13 |

6.13 |

6.16 |

6.13 |

|

2-Yr Indian G-Sec |

7.64 |

6.21 |

6.22 |

6.29 |

6.17 |

6.18 |

|

10-Yr Indian G-Sec |

7.87 |

7.04 |

6.99 |

6.91 |

6.93 |

6.76 |

|

10-Yr US G-Sec |

2.83 |

2.08 |

2.06 |

2.01 |

2.04 |

2.12 |

|

AAA (Indian corporate) |

8.86 |

8.11 |

8.27 |

8.09 |

7.95 |

8.04 |

|

Spread in bps (10Yr Indian-10Yr US) |

504 |

496 |

493 |

490 |

489 |

464 |

|

Credit/Deposit Ratio |

75.35 |

76.97 |

- |

77.25 |

- |

- |

|

USD LIBOR (3 month) |

1.9281 |

2.3460 |

2.3466 |

2.3415 |

2.3549 |

2.3564 |

Acuité Portfolio Debt Instrument Benchmark Estimates (as on 10 June

2019):

|

Category |

10-Yr Corporate Yield to Maturity |

|

AAA* |

NA |

|

AA+ |

8.04% |

|

AA |

8.65% |

|

|

Deposit (In Rs. Lakh Cr) |

Bank Credit (In Rs. Lakh Cr) |

|

As on June 21, 2019 |

124.91 |

96.49 |

|

As on May 24,2019 |

124.99 |

96.22 |

|

As on June 22,2018 |

113.53 |

86.14 |

|

YTD (% change) |

-0.06% |

0.28% |

|

YoY (% change) |

10.02% |

12.02% |

Money Market

Performance

|

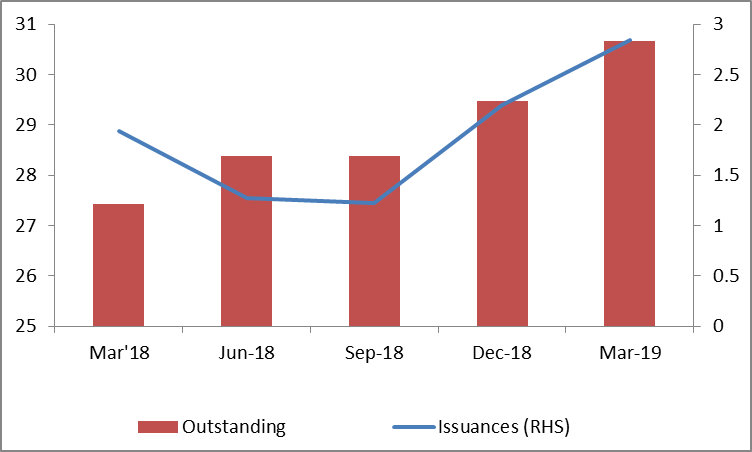

Commercial Paper (Fortnight): |

Outstanding (In Rs. Lakh Cr) |

Amount issued (In Rs. Lakh Cr) |

|

31-Mar-2019 |

4,830.8 |

1013.0 |

|

28-Feb-2019 |

5,208.1 |

900.8 |

|

31-Mar-2018 |

3,725.8 |

999.2 |

|

% Change (MoM) |

-7.24% |

12.45% |

|

% Change (YoY) |

29.66% |

1.38% |

Indices

|

|

13-Jul-18 |

14-Jun-19 |

21-Jun-19 |

05-Jul-19 |

12-Jul-19 |

|

NSE Index |

11,018.90 |

11,724.10 |

11,788.85 |

11,811.15 |

11,552.50 |

|

NSE Index Return |

2.29 |

-0.84 |

0.55 |

0.19 |

-2.19 |

|

BSE Index |

36,541.63 |

39,194.49 |

39,394.64 |

39,513.39 |

38,736.23 |

|

BSE Index Return |

2.48 |

-0.65 |

0.51 |

0.30 |

-1.97 |

Liquidity Operation by RBI

Source: RBI, Acuité Research; Note: Net injection (+) and Net absorption (-)

Corporate debt (in Rs. Lakh Cr)

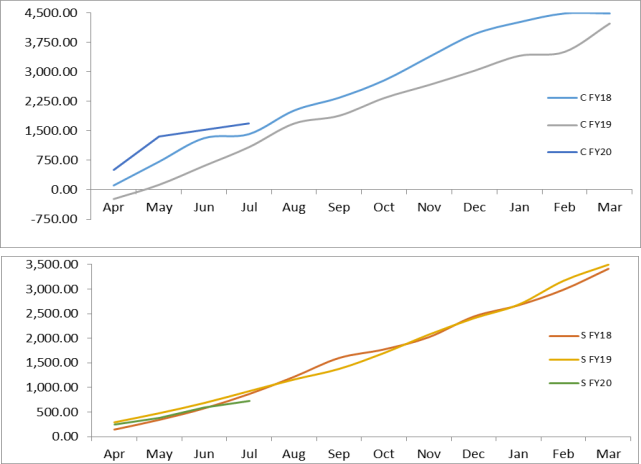

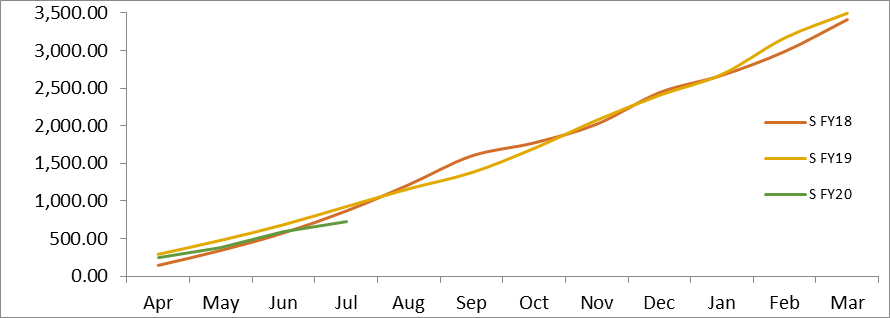

Net Debt Issuance by Centre and State Government (Rs. Billion)

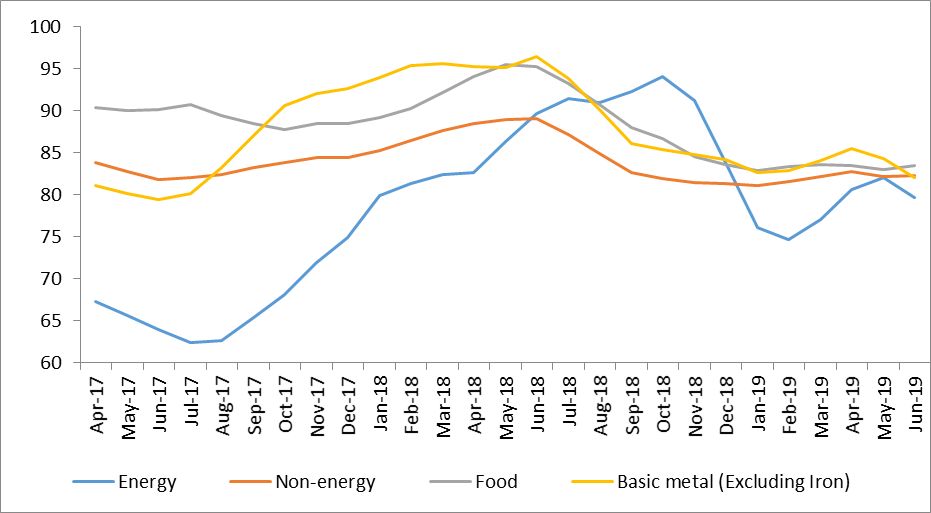

Commodity Price Index (3 Month Moving Average)

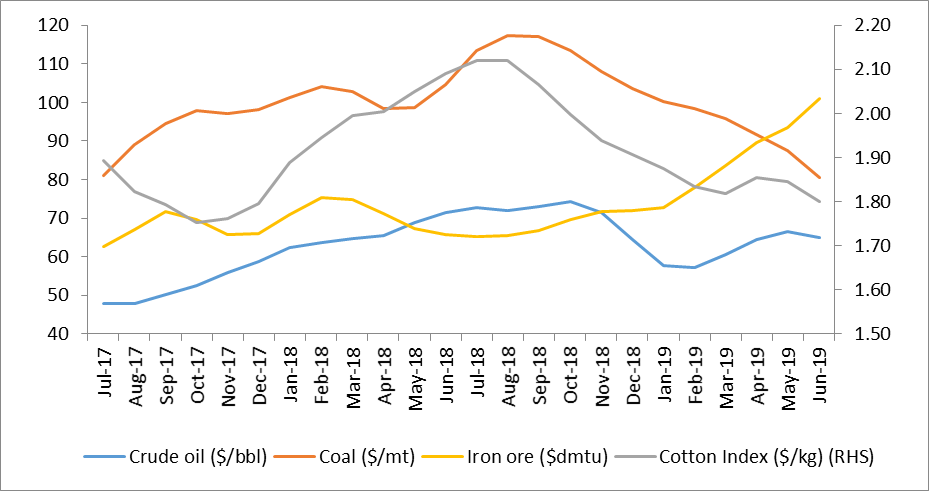

Commodity Price Movement (3 Month Moving Average)

USD-INR Movement

Source: RBI, Acuité Research