Key Highlights:

Liquidity

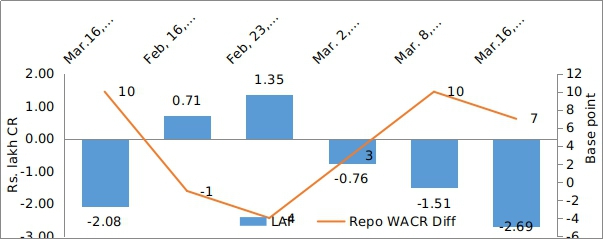

The spread between Repo and WACR stands at 7 bps during second week of March, 2019. With this positive number, the banking sector has been experiencing sufficient liquidity for the past three weeks; this is a result of RBI’s massive interventions. On its part, the central bank has infused Rs. 37,500 crore through OMO operation over the last three weeks alone. We however believe that the liquidity situation is expected to remain tight as financial year FY19 draws to a close. Credit deposit ratio that is reaching the level of 78 also hints residual tightness. During this period, RBI’s buy/sell currency swap agreement worth of $5billion with banks will give relief to the commercial banks in the short term period. In Swap, the RBI has opened a third avenue in India’s monetary management. Under the new window, the requirement of a collateral for liquidity infusion is made redundant. Moreover, in a positive development, India’s forex reserve has surged to a six month high of $405 billion. It is known that increase in forex reserve will positively impact the liquidity situation in the domestic market.

Capital Market:

In the global capital market, the 10-year US G-Sec bond yield has been in a downward trajectory for the past three weeks. The yield has decelerated to 2.44% in March, 15, 2019 from 2.76% during February 22, 2019. The global benchmark yield has been softening after Fed gave hints to pause the normalization. The 10-year Indian sovereign bond yield has been in a similar trend. The yield has decelerated to 7.33% in March, 15, 2019 from 7.58% during February 15, 2019. The improvement in G-Sec bond yield is due to RBI’s OMO operation along with a fall in US bond yields. Despite the worry pertaining to safe haven outflows to the US debt market, Indian instruments seem to retain their attractiveness as the spread between 10-year US and Indian bond yield has increased to 490 bps in March 15, 2019 from 466 bps a month earlier.

Currency Trend:

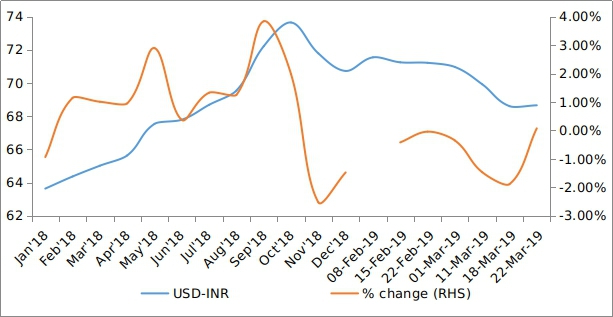

With the improvement in capital flows, the Indian rupee has been strengthening against the US dollar. It is known that the forex reserve has reached to six month high during second week of March, 2019. In post currency swap agreement with commercial banks RBI’s forex reserve will strengthen. This will leverage the central bank in managing forex volatility in the short to medium term. Therefore, we expect stability in the USD-INR in a short term.

Interest rates and ratio:

| Interest Rate | Mar.,162018 | Feb.,152019 | Feb.,222018 | Mar.,012019 | Mar.,082019 | Mar.,152019 |

| Policy Repo Rate | 6.00 | 6.25 | 6.25 | 6.25 | 6.25 | 6.25 |

| Call Money Rate (WA) | 5.90 | 6.26 | 6.29 | 6.22 | 6.15 | 6.18 |

| 364-Day Treasury Bill Yield | 6.59 | 6.51 | 6.53 | 6.55 | 6.51 | 6.49 |

| 2-Yr Indian G-Sec | 6.82 | 6.80 | 6.67 | 6.64 | 6.55 | 6.59 |

| 10-Yr Indian G-Sec | 7.58 | 7.58 | 7.42 | 7.37 | 7.36 | 7.33 |

| 10-Yr US G-Sec | 2.84 | 2.68 | 2.76 | 2.64 | 2.59 | 2.44 |

| Spread in bps (10Yr Indian-10Yr US) | 474 | 490 | 466 | 473 | 477 | 489 |

| AAA Indian Corporate | 8.21 | 8.78 | 8.32 | 8.61 | 8.58 | 8.55 |

| AA Indian Corporate | 8.18 | - | - | 8.56 | - | - |

| Spread AAA to10 YR Indian bond | 63 | 120 | 90 | 124 | 122 | 122 |

| Credit/Deposit Ratio | 75.02 | 77.89 | - | 77.92 | - | - |

| USD LIBOR (3 month) | 2.73 | 2.68 | 2.59 | 2.59 | 2.62 | 2.60 |

Acuité Portfolio Debt Instrument Benchmark Estimates (as on 25 March 2019):

|

Category |

10-Yr Corporate Yield to Maturity |

|

AAA* |

8.32% |

|

AA+ |

8.39% |

|

AA |

8.85% |

| Deposit (In Rs. Lakh cr) | Bank Credit (In Rs. Lakh cr) | |

| As on Mar 01, 2019 | 1,22,301.8 | 95,294.8 |

| As on Jan 04, 2019 | 1,20,337.6 | 93,374.5 |

| As on Mar 02, 2018 | 1,11,370.5 | 83,190.3 |

| YTD (% change) | 1.63% | 2.06% |

| YoY (% change) | 9.82% | 14.55% |

Money Market Performance

| Commercial Paper (Fortnight): | Outstanding (In Rs. Lakh cr) | Amount issued (In Rs. Lakh cr) |

| 15-Mar-2019 | 5,309.5 | 1,240.6 |

| 15-Feb-2019 | 5,242.3 | 1,035.5 |

| 15-Mar-2018 | 4,605.0 | 1154.5 |

| % Change (MoM) | 1.28% | 19.81% |

| % Change (YoY) | 15.30% | 7.46% |

Indices

| 23-Mar-18 | 01-Mar-19 | 08-Mar-19 | 15-Mar-19 | 22-Mar-19 | |

| NSE Index | 9,998.05 | 10,863.50 | 11,035.40 | 11,426.85 | 11,456.90 |

| NSE Index Return | -1.93 | 0.66 | -0.21 | 0.74 | -0.56 |

| BSE Index | 32,596.54 | 36,063.81 | 36,671.43 | 38,024.32 | 38,164.61 |

| BSE Index Return | -1.75 | 0.55 | -0.15 | 0.71 | -0.58 |

Source: RBI

Source: RBI

Note: Net injection (+) and Net absorption (-)

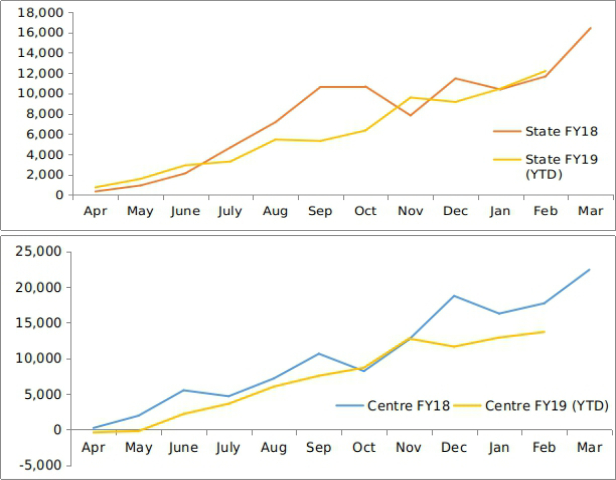

Net Debt Issuance by Centre and State Government:

Source: Acuité Research, RBI

Source: Acuité Research, RBI

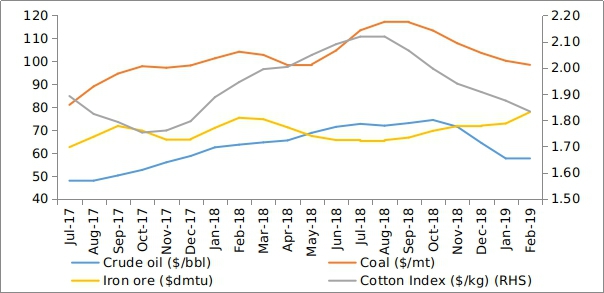

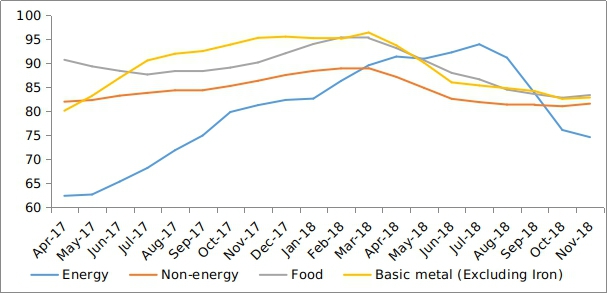

Commodity Price Index (3 Month Moving Average):

Commodity Price Movement (3 Month Moving Average):

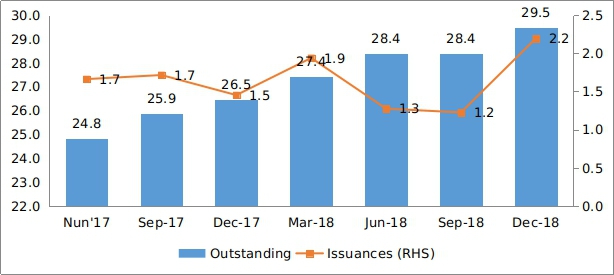

Corporate debt (in Rs. Lakh Cr):

USD-INR Movement:

Source: RBI, Acuité Research

Source: RBI, Acuité Research