Impact: Positive: (Monetary Easing) Negative: (Tax collection, Corporate Profitability)

Brief: India’s consumer inflation for the month of May stands at 3.05%, that is in line with Acuité expectations. We were expecting the inflation rate at 3% considering the recovery in the food prices. Core inflation has subsided to a multi-month low of 4% on account of weak consumer demand, especially rural. We therefore expect the core segment to offset the spike in food inflation and keep the overall consumer inflation in a range of 3-3.5% during H1, FY20. Considering the market borrowing trend of the Central Government in Q1 FY20, public expenditure will continue to be a major factor contributing to domestic consumption and can be thus treated as a caveat. On the liquidity front, the banking system has surplus liquidity of around Rs. 46,600 crores (as on June 12, 2019), which augurs well and supports an accommodative monetary policy.

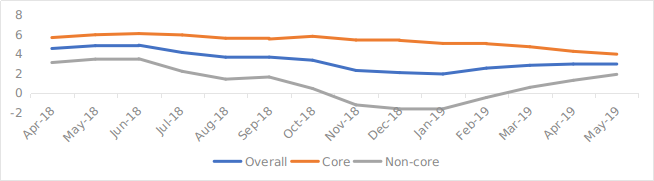

India’s consumer inflation for the month of May stands at 3.05%, which is in line with Acuité expectations. We were expecting the inflation rate at 3% considering the recovery in the food prices. The food inflation has improved to an eleven month high of 1.8% during the reference month. Going ahead, the trend is expected to continue as there has been a steady food production growth in FY19, not to mention the very healthy buffer stock. In addition, low base effect will further drive up the index.

From the core perspective, the non-food and non-fuel inflation has subsided to a multi-month low of 4% on account of weak consumer demand, especially rural. The commodity prices in the global market remain low as well due to weak demand emanating from slowdown in both developed as well as emerging markets. This will attribute to a lower inflation rate in the core segment. Since the core and fuel baskets collectively account for around 60% in the overall index, we expect the combine to offset the rising food inflation in the short to medium term. This will in turn keep the overall consumer inflation in a range of 3-3.5% during H1, FY20. Given these favorable conditions, we expect the RBI to look beyond its inflation target mandate and focus on getting the growth momentum back online; a low inflation rate will therefore offer a room for further rate cuts.

Having said that, considering the market borrowing trend of the Central Government in Q1 FY20, public expenditure will continue to be a major factor contributing to domestic consumption and can be treated as a caveat.

The liquidity in the banking sector has now however improved as we notice normalization of currency in circulation (M1) as well as systemic liquidity, post elections. On a daily basis, the banking sector has surplus liquidity of around Rs. 46,600 crores (as on June 12, 2019), which augurs well and supports an accommodative monetary policy.