Impact: Neutral

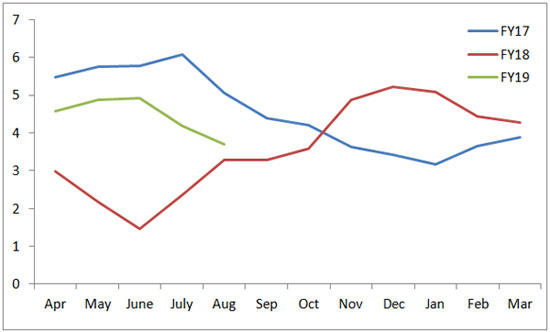

Brief: On a year on year basis, consumer inflation rate (CPI) has further decelerated to 3.7% in August. In July, 2018, the inflation rate had dropped to a 9-month low of 4.2%. The lower inflation rate is primarily attributed to softer food prices. Inflation rate for food categories stands at 0.29%.

India's consumer inflation continues to decline for second consecutive month in August. The price index has dropped by 48 bps to 3.7% in August, 2018 and is in line with our expectation. We were expecting the inflation rate to soften further in August due to favourable base effect and reduction in GST rate.

From the sub-category level perspective, core index (excluding food & fuel) has expanded by 5.6%. Food inflation, on the other hand, has increased by only 0.3% and offset the growth in core category. It is known that food articles account for 39% in the overall CPI basket. Therefore, it has a signification impact on the overall inflation rate. Among the food items, vegetables, pulses and sugar are recording negative growth and attributed (-) 22 bps in the August's inflation rate. Fuel (8.5%) and housing price (7.6%), on the other hand, contributed 40 bps.

In recent months, overall inflation rate is primarily driven by the core categories - reached to a four year high of 6.1% June, 2018. Therefore, a fall in core inflation rate to 5.6% in August will give relief to the central bank and policy makers. The higher core number in recent past was a result of pay commission revision and higher oil price. However, this has been neutralized by the reduction in GST rate over 50 items during 28th GST council meeting (https://www.acuite.in/reduction-of-gst-on-over-50-items.htm). Going ahead, bumper food production and lower GST rates are expected to put downward pressure in the overall inflation rate. However, higher commodity prices and fall in value of Indian rupee may undermine the influence of these factors. We, therefore, expect the inflation rate to remain firm in the second half of this fiscal year.

Source: Acuite Rating & Research, CMIE

Source: Acuite Rating & Research, CMIE

| Commodity | Weight | Inflation rate |

| High positive growth | ||

| Egg | 0.43 | 6.96 |

| Housing | 10.7 | 7.59 |

| Fuel & light | 6.84 | 8.47 |

| High negative growth | ||

| Vegetables | 6.04 | -7.00 |

| Pulses | 2.38 | -7.76 |

| Sugar | 1.36 | -5.45 |