Impact: Neutral

Brief: The June data records significant base effect, which is characteristic to the IIP; Sector performances are therefore linked to this overall constraint.

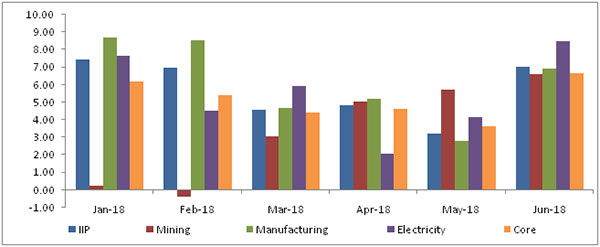

The Industrial production has expanded by 7.04% in June, 2018. However, the strong growth is due to base effect underpinning the IIP, which recorded a contraction of -0.3%, same time last year. Sector wise (use based), the segments, which are driving the industrial production are capital goods, consumer durables and infrastructure.

From the vantage point of the infrastructure segment, cement industry is leading the growth as it has been expanding at 15% on average for the past eight months. A healthy growth in cement industry is invariably a strong indicator of construction and real estate activities picking up pace. The growth in credit offtake in construction and housing also gives further clarity of this trend. IIP performance has been primarily driven by the performance improvements in the manufacturing space, which in turn is benefiting from the above mentioned favorable base effect. Manufacturing activities that account for 75% of overall IIP, have been expanding by around 7% for the past eight months.

From the IIP’s economic perspective, most 8 Core industries recorded significant gains as well - validating the current premise. Albeit, the base effect paying a helpful role. Having said that, an overall strong growth in industrial production is indicative of an equally robust industrial GVA for Q1, FY19. The print is expected to post a strong number and is due 30th of this month.

YTD Performance

| IIP | Mining | Manu | Score | Primary | Capital | Intermediate | Infra | Durable | Non-durable | |

| 2013-14 | 3.28 | -0.18 | 3.59 | 6.04 | 2.31 | -3.7 | 4.55 | 5.71 | 5.64 | 3.66 |

| 2014-15 | 4.02 | -1.34 | 3.75 | 14.83 | 3.74 | -1.13 | 6.11 | 4.98 | 3.97 | 3.86 |

| 2015-16 | 3.33 | 4.34 | 2.9 | 5.69 | 4.97 | 3 | 1.52 | 2.84 | 3.33 | 2.58 |

| 2016-17 | 4.58 | 5.33 | 4.32 | 5.82 | 4.9 | 3.18 | 3.32 | 3.91 | 2.97 | 7.98 |

| 2017-18 | 4.38 | 2.31 | 4.6 | 5.32 | 3.69 | 3.94 | 2.24 | 5.6 | 0.66 | 10.4 |

| 2017-18YTD | 1.89 | 1.12 | 1.59 | 5.29 | 2.16 | -4.19 | 0.97 | 1.79 | -1.2 | 7.8 |

| 2018-19 YTD | 5.23 | 5.48 | 5.26 | 4.87 | 5.95 | 9.4 | 1.63 | 7.66 | 7.95 | 1.88 |