Impact: Neutral

Brief: For the past four months, the Intermediate Category (partial value add), which is also a feeder to finished good production cycle - is growing at around 1.5%. This is strange because overall, the IIP is growing at an average of over 5%.

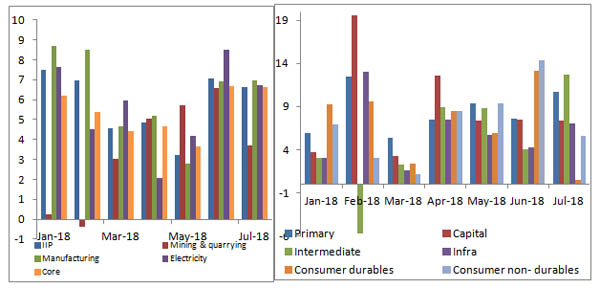

The IIP index has recorded a solid growth rate of 6.6% in July, 2018 as against 1.03% growth during the same period, the previous year. With this print the IIP index continues to remain in the positive outlook for almost ten months. During first half of FY19, the IIP growth was held up by a favorable base effect in the manufacturing sector (accounting for 77%) – which withers off August onwards. Therefore, we believe that the actual expansion in the industrial production can be deemed sustainable, if the pace continues in second half as well. Same story goes for the Capital Goods category, which is on tenterhooks given the dawning reality check, August onwards. Infrastructure (Use Base) and Electricity (Economic Base) are the only categories on a YTD basis that are base effect agnostic and primarily driven by the Government’s capital expenditure.

While the Consumer Category, including both Consumer Durables and Non-Durables recorded solid growth YTD, the pull factor is apparently absent - concerning us. For the past four months, the Intermediate Category (partial value add), which is also a feeder to finished good production cycle - is growing at around 1.5%. This is strange because overall, the IIP is growing at an average of over 5%. This indicates that inventory levels in the system are still very high. This assessment is further corroborated with the higher ratio of raw material inventory to sales (23.8) during Q3 and Q4 of FY18 – according to the recent RBI Forward Survey. We await further data to assess the growth sustainability in the coming months as typically higher growth should eventually pull the lower side of the supply chain. A connection that is at present, missing in the supply chain.