Control on food inflation, close coordination between RBI & Govt. need of the hour

|

Executive Summary

Acuité believes that the inflation headwinds have added to the current economic challenges in India. The supply and logistical bottlenecks arising from the prolonged and intermittent lockdown in certain parts of the country have continued to keep food inflation high despite a good agricultural output over the last two seasons. Further, persisting high food inflation along with shortage of labour have started to have a rub-off effect on prices of non-food products and services or core inflation. Additional factors that have contributed to the inflation are the high transport fuel prices unlike in other economies and the surge in prices of gold, an important item in the purchase basket of Indian households. In our opinion, monetary stimulus programmes will have a limited impact in reviving growth in such an environment and targeted fiscal measures will have to be considered to pull up private consumption as the pandemic scare eases out over the next few months. It will have to be a fine balancing act between the central bank and the government with fiscal programmes to be administered before any change in the accommodative monetary stance by RBI. Lastly, the government also needs to take proactive steps to control food inflation by reducing supply bottlenecks and adopting appropriate policy measures in the short term as also facilitating the proposed agricultural marketing reforms and logistics infrastructure development over the medium term.

|

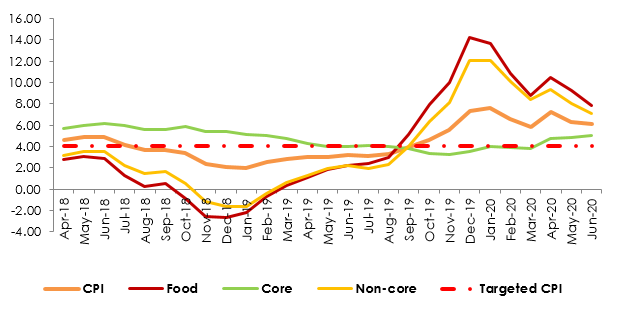

India’s consumer inflation has increased to 6.93% in July 2020, a bit sharp and unexpected rise of 70bps (MoM) over that in June and raised the spectre of stagflation. Since December 2019, CPI print has been on an overdrive and except for the month of March, it has been uncomfortably high over 6.0%, the upper limit set by the monetary policy committee (MPC). While consumption demand has witnessed a severe downturn over the last four months, inflation is yet to respond to it, causing concern to the policy makers and the regulator. The uncertain outlook on inflation in the short term has not only led the MPC to hold the interest rates in August but has also diminished the likelihood of any further rate cut in the near term.

Clearly, consumer food price inflation (CFPI) has been the primary driver of the CPI trajectory and has mostly hovered over 8.0% over the last nine months since October 2019. It may be noted that food and beverages continue to have a large weightage of 54% in the overall CPI. While supply bottlenecks have been a significant factor behind higher food inflation during the Covid lockdown period, the bigger concern is the increase of core inflation by 50 bps to 5.6% in July 2020. Higher core inflation is reflective of cost push pressures and higher money supply in the economy despite the weaker demand environment. Even though an unfavourable base effect is also playing an important role in shaping the inflation trendline, we believe that the stickiness in consumer inflation is due to a play of various factors. Acuité Ratings, therefore has undertaken an item-wise analysis to bring out a complete picture of the inflation landscape.

Food inflation, as measured by CFPI has climbed up again to 9.62% in July 2020 after easing slightly to 8.72% in June from 9.28% in May 2020. The animal protein segment i.e. primarily meat, fish, eggs and milk products which have a combined weightage of over 10% in the CPI, has continued to record high inflation between 18.8% - 6.6% in July (yoy). Secondly, edible oil prices have remained firm particularly since the onset of the pandemic touching 12.4% in July, due to high dependence on imports and supply constraints thereof. The pricing pressures in edible oil have aggravated due to the imposition of restrictions on refined palm oil imports from Malaysia since end of 2019. While the domestic production of oilseeds is expected to increase significantly in the current year amidst a record sowing in the current kharif season, high edible oil prices may continue to persist for a few more months.

Thirdly, vegetable prices have remained elevated despite a timely onset of monsoon and consequent normal rainfall across most of the states across the country. In our opinion, supply chain disruptions in the distribution of perishable agricultural products including limited operations of the APMCs, have been severe since the lockdown and has further intensified due to excess rains and floods in some parts of India in July. Additionally, the inflation in pulses continues to be high (15.9%-July 2020) as import restrictions had been imposed on certain categories of dal and it will take a few more months before the kharif crop will be ready for the market.

Spectre of Stagflation

The classic short run phillips curve envisages that in the near term, there is an inverse correlation between inflation and unemployment. In other words, in a typical economic environment, the inflation slows down as the unemployment rate picks up. Globally, however, it has been seen that a high level of monetary and fiscal stimulus in response to a persistent poor growth scenario, may at times, increase the money supply and push up inflation while not addressing the higher unemployment levels.

The current domestic economic scenario is characterised by output contraction, increased inflation and higher money supply. We note that the growth in M3 or broad money supply has been at 12.7% yoy at July end as compared to 10.1% a year ago. Interestingly, the currency with the public has grown sharply at 23.6% yoy and may have also been a factor in the relentless inflationary pressures.

Clearly, the worry of the policymakers will be to balance the priorities of both higher inflation and weak growth outlook. If the MPC has to strictly go by its inflation target framework, it may have to cast off its accommodative stance and adopt a tight monetary policy, if the price pressures don’t subside over the near term. The consequent reversal of lower interest rates will raise capital costs and impact the outlook towards new investments, complicating the growth and the unemployment problem further. In our opinion, the risks of a stagflationary environment has increased in the case of India and may be a socio-economic challenge if not addressed early.

Graph 1: India- CPI Inflation Dynamics (2018-2020)

Source:CMIE;

RBI, Acuité Research

Source:CMIE;

RBI, Acuité Research