UNION BUDGET IMPACT ANALYSIS - FEB 04, 2021

|

Executive Summary

Acuité Ratings & Research is pleased to share its analysis of the Union Budget 2021 presented on Feb 1, 2021. Apart from a comprehensive economic analysis, the ratings team in Acuité has also assessed the impact of the budgetary announcements on the financial sector along with another ten key sectors which have a significant contribution to the Indian economy.

Acuité is one of the leading Credit Rating Agencies in India today, with ratings assigned on over 8,500 companies. SMERA (SME rating Agency of India), a subsidiary of Acuité, have completed over 50,000 SME ratings. Recently, we have launched India’s first ESG Ratings company, ESG Risk Assessments & Insights Ltd which will provide ESG ratings for the top 1000 listed companies in India.

Union Budget 2021 has stood apart from the recent government budgets in ways more than one. In our opinion, it reflects an aspiration of the Government to pull out the economy from the pandemic shock by deciding to adopt an expansive fiscal policy over the medium term and enhance public investments in infrastructure in a very substantial manner. With a significant improvement in the quality of expenditure towards the capital account, a growth multiplier is expected to come in play which can deliver strong and sustainable growth over the longer term. Bolder reforms across different sectors will also play an important role in gearing up the economy for a robust growth regimen and this is also what the budget has attempted through the announcement on divestments in public sector banks, creation of a bad bank along with a dedicated DFI for infrastructure funding. The policy facilitation for REITs and InViTs will also go a long way in bringing a diverse set of investors in infrastructure finance, a critical need of the hour.

Clearly, the decision to go for high fiscal spending is not without its downside risks. The metrics such as the fiscal deficits and the government debt to GDP will remain elevated for a longer period although it should moderate once the growth dividend kicks in. The key to the success of such a budget, needless to say, is solid implementation and ensuring that capital expenditure remains the priority for both the Central and the State Governments. Among others, healthcare is one of the important sectors where a step up in investments will not only cater to the vulnerable population but also generate jobs.

As a Rating Agency, we will continue to track the implementation of the budgetary measures and the economy’s response to the growth vaccine.

Thanks and a happy reading.

Sankar Chakraborti

Group CEO, Acuité Ratings & Research

...

|

Impact on Economy

The Big Fiscal Push to Growth

KEY TAKEAWAYS

- Fiscal deficit for FY21 got pegged at 9.5% of GDP compared to budgeted target of 3.5%.

- For FY22, fiscal deficit is expected to consolidate to 6.8% of GDP, premised on a nominal GDP growth of 14.4%.

- Health, Infrastructure and Finance emerge as three focus areas.

- Improvement in quality of spending and fiscal transparency are commendable steps, besides the credible arithmetic.

- We expect the revised FRBM glidepath to be incorporated basis the 15th Finance Commission Report.

- Elevated market borrowing to provide upside risk to bond yields, but likely to be managed by RBI through OMO (purchases).

- Overall, the Budget is expected to pave way for a V-shaped real GDP growth recovery to 11.0% in FY22.

The FY22 Union Budget has managed to overdeliver, over and above expectations that rode high amidst the pandemic induced economic challenges. The Government clutched the opportunity to open its purse strings, knowing that a higher fiscal deficit may be more amenable in such an environment. The growth inducing nature of the increased budgetary expenditure, the transparency the Budget brought to the fore with respect to off balance sheet funding along with a durable push to investments, infra financing and the new institutions of a Bad bank and DFI are all noteworthy features of the Budget.

Fiscal arithmetic: Realistic

Fiscal deficit for FY21 got pegged at 9.5% of GDP compared to the budgeted target of 3.5%. While the sharp increase, driven by a severe shortfall in revenues amidst the pandemic and an expansion in spending to support the flailing economy was not unanticipated, the magnitude of the upward revision did catch the markets by surprise. At a closer look, a part of the upside (1.4% of GDP) was driven by transfer of the food subsidy ‘on budget’, which earlier was largely met via NSSF (National Small Saving Fund) loan to the FCI (Food Corporation of India).

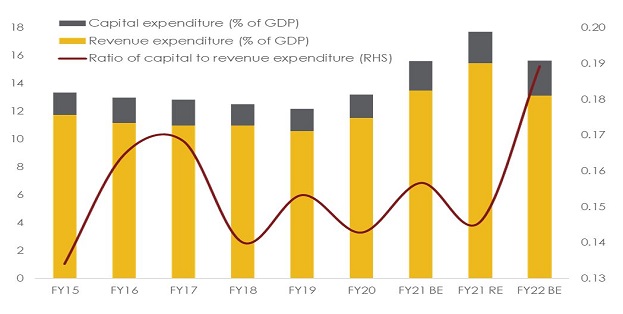

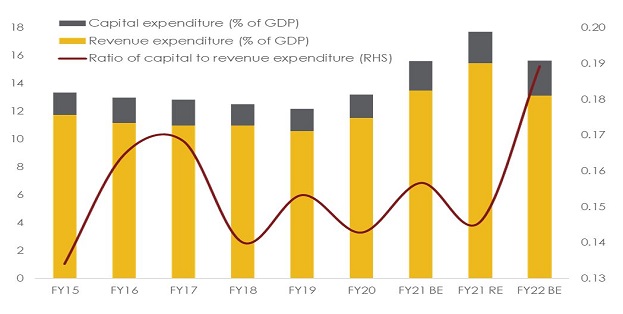

For FY22, fiscal deficit is expected to consolidate to 6.8% of GDP, premised on a nominal GDP growth of 14.4%. Tax revenue projections appear realistic and no major change in tax rates comes as a relief. However, predictably, the Budget banks on disinvestment and asset sales on a large scale to raise incremental resources to the tune of 0.8% of GDP. On the expenditure side, while revenue spending is budgeted to contract by 2.7%YoY, capital spending is pegged to increase by 26.2% in FY22 over and above the 30.8% in FY21, leading to a sharp improvement in quality of spending.

Chart 1: Quality of spending to undergo a sharp improvement in FY22

Infrastructure: Topmost priority

The Budget’s focus on infrastructure creation is unequivocally commendable. The enhanced outlay on capital spending is visible across sectors of roads, ports, railways, urban infrastructure among others, in alignment with the infrastructure needs already identified under the National Infrastructure Pipeline (NIP). To meet the infrastructure funding needs, the Budget proposes two novel means – 1) Creation of a new institution of Development Financial Institution (DFI) with an initial capital of Rs 200 bn 2) Thrust on utilization of funds raised by monetizing operating public infra-asset under the Asset Monetization Program.

Finance sector reforms: Structural liberalization

The Budget proposed -

- To set up a Bad Bank, via an Asset Reconstruction and an Asset Management Company. This is well timed, given the large overhang of NPAs in the banks’ balance sheet subsequent to the Asset Quality Review by RBI in 2015 and the risk of a further rise in stressed assets in the sector as highlighted by RBI in its recently released Financial Stability Report.

- To divest stake in 2 Public Sector Banks in line with the wider disinvestment plan, while also committing to infuse Rs 200 bn in PSBs in FY22 reinforces the government’s intent to consolidate the public sector banking space further.

- Raising of FDI limit in the Insurance sector to 74% from the current level of 49% which is likely to increase FDI in the sector apart from facilitating consolidation

Health spending: A shot in the arm

Spending on ‘Health and wellbeing’ is budgeted to rise by 137% in FY22 over FY21 BE. This includes Rs 350 bn earmarked towards the COVID vaccine along with significant portion of extra spending as ‘transfers’ to States. Further, the Government launched a new centrally sponsored scheme, Pradhan Mantri AtmaNirbhar Swasth Bharat Yojana, with an outlay of Rs 641bn over the next six years to strengthen healthcare infrastructure in the country which is also a continuation of the earlier schemes such as Ayushman Bharat.

Transparency

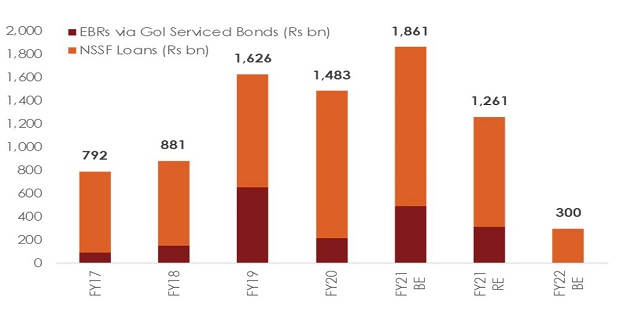

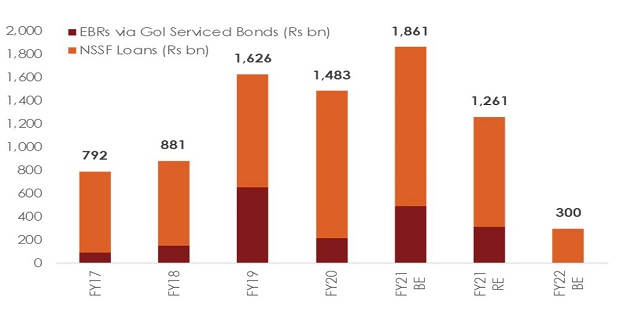

Besides providing a brawny push to capital expenditure led growth, the FY22 Union Budget scores big on transparency. In recent years, ‘off balance sheet’ spending had proliferated with central government shedding a part of subsidy as well as capital expenditure to project a leaner headline fiscal deficit. However, the FY22 Union Budget has significantly downsized dependence on off balance sheet spending. This has resulted in a sharp fall in extra budgetary resources mobilized via GoI serviced bonds as well as in the financial support extended via NSSF loans. As such, the off balance sheet spending (as a ratio to total budgetary expenditure) is slated to fall to 0.9% in FY22 from its peak of 7.0% in FY19. This is a welcome cleanup exercise, which would help boost overall fiscal credibility.

Chart 2: Sharp fall in off balance sheet spending

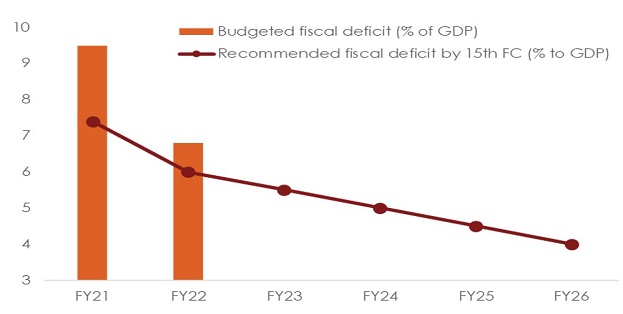

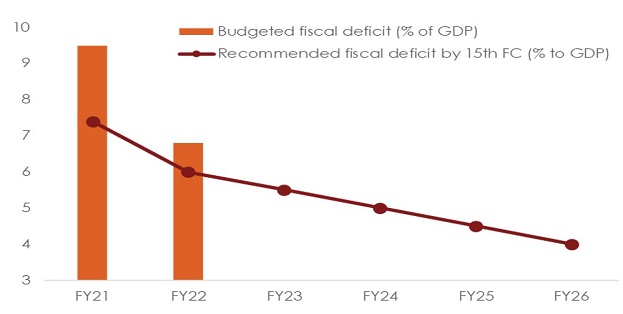

Fiscal responsibility and the FRBM objective

The FY22 Union Budget restores credibility by budgeting for a record consolidation in headline fiscal deficit by 2.7% to 6.8% of GDP. While that is commendable considering the anticipated backdrop of post COVID economic recovery, the Budget remains silent on explicitly codifying the 15th Finance Commission recommendations on fiscal consolidation. We expect this to take a formal shape when the currently void FRBM Act gets operationalized from FY23 onwards.

- It has been recommended by the 15th Finance Commission to bring down fiscal deficit from 7.4% of GDP in FY21 to 6.0% in FY22. The Budget has chosen to exceed the recommended deficit targets in the short term.

- In the long term, the Commission recommends bringing down fiscal deficit to 4.0% of GDP by FY26, compared to an earlier target of 3.0% by FY23. If actualized, this fiscal leeway will provide the government an opportunity to spend aggressively over the next 4-years.

From a longer-term perspective, this extra space of 1% of GDP, if actualized by the revised FRBM Act, needs to be used judiciously, primarily via healthy capital expenditure outlays to enhance the growth potential of the economy without generating inflationary pressures. This will help in preserving debt sustainability in the long run. Further, it is also important to safeguard fiscal discipline by establishing an independent Fiscal Council with requisite statutory powers (as recommended by the 15th Finance Commission) that can play the role of advising the Union and States on short as well as long term fiscal adjustments.

Chart 3: The Budget is yet to formalize the FRBM glidepath

Financing of higher Fiscal Deficit

Understandably, the onus of funding the higher than anticipated fiscal deficit lies on market borrowing through both dated securities and short-term bills.

- Gross and net borrowing via g-secs in FY21 got revised up sharply to Rs 12800 bn and Rs 10528 bn from the initial budget estimate of Rs 7800 bn and Rs 5449 bn respectively. In similar fashion, net funding via T-Bills got scaled up to Rs 2250 bn vis-à-vis the initial budget estimate of Rs 250 bn.

- For FY22, gross and net borrowing via g-secs has been budgeted at Rs 12055 bn and Rs 9247 bn, a marginally lower than FY21, but considerably higher vis-à-vis FY20.

- The reliance on small savings is expected to increase significantly from Rs 2400 bn in FY20 to Rs 4806 bn in FY21 and Rs 3919 bn in FY22. This reflects clean financing via the NSSF with major part of off balance sheet spending now being met by the Budget.

Table 1: Funding of fiscal deficit

| (In Rs bn) |

FY20 |

FY21 BE |

FY21 RE |

FY22 |

| Fiscal Deficit |

9337 |

7963 |

18487 |

15068 |

| External Financing |

87 |

46 |

545 |

15 |

| Domestic Financing |

9250 |

7917 |

17941 |

15053 |

| Dated Securities (Net) |

4740 |

5449 |

10528 |

9247 |

| T-Bills (Net) |

1501 |

250 |

2250 |

500 |

| Small Savings |

2400 |

2400 |

4806 |

3919 |

| Cash Drawdown |

50 |

-530 |

-174 |

714 |

| Others* |

906 |

559 |

348 |

531 |

*Includes State Provident Funds, Internal Debts and Public Account

Conclusion

The FY22 Union Budget does a good job of managing the current macro challenges by maximizing fiscal impulse in an inflation neutral manner. With credibility on its side, we expect the headline deficit targets to be met in FY21 and FY22. This would provide a supportive backdrop for India’s V-shaped GDP growth recovery to 11.0% in FY22 (from a contraction of 7.7% in FY21) with CPI inflation moderating to 5.0% (from 6.0% in FY21).

Clearly, the sine quo non for achieving the headline deficit target is the realization of disinvestment and asset monetization target of Rs 1750 bn, which stands at a record high in rupee terms. While past performance on this front is dominated by slippages, current buoyant equity market sentiment (aided by the global liquidity glut) can provide the necessary facilitation provided the government spaces the dilution and sale exercise in a prompt and timely manner.

Having said so, we also acknowledge the spillover risks from high market borrowing. The 10Y g-sec yield has hardened by approximately 24 bps (to 6.13%) since the announcement of the Budget. This puts at risk our call of 5.85% and 6.20% on the 10Y g-sec yield by Mar-21 and Mar-22 respectively. Going forward, sentiment in the bond market will get influenced by the monetary policy stance post Budget. More importantly, RBI support in partially absorbing the supply pressure would provide some anchoring. Between Apr-Jan FY21, the RBI absorbed Rs 2231 bn of net g-sec borrowing via Net OMO (Open Market Operation) purchases. We expect the central bank to continue lending its balance sheet support to stabilize bond yields in FY22 in order to ensure long term rates in the economy are in sync with the accommodative monetary policy stance.

| (As % of GDP) |

FY20 |

FY21 BE |

FY21 RE |

FY22 |

| Revenue Receipts |

8.3 |

10.4 |

8.0 |

8

.0 |

| Net Tax Revenue |

6.7 |

8.4 |

6.9 |

6.9 |

| Non-Tax Revenue |

1.6 |

2.0 |

1.1 |

1.1 |

| Non-Debt Capital Receipts |

0.3 |

1.2 |

0.2 |

0.8 |

|

|

|

|

|

| Total Expenditure |

13.2 |

15.6 |

17.7 |

15.6 |

| Revenue Expenditure |

11.6 |

13.5 |

15.5 |

13.1 |

| Capital Expenditure |

1.6 |

2.1 |

2.3 |

2.5 |

|

|

|

|

|

| Revenue Deficit |

3.3 |

3.1 |

7.5 |

5.1 |

| Fiscal Deficit |

4.6 |

4.1 |

9.5 |

6.8 |

| Primary Deficit |

1.6 |

0.5 |

5.9 |

3.1 |

Sectoral Impact

Financial Services

Impact Analysis: Acuité Opinion

OVERALL – POSITIVE

Key Budgetary Announcements:

- An Asset Reconstruction Company (ARC) and Asset Management Company (bad bank in common parlance) to take over stressed loans from banks and NBFCs

- Privatization of two Public Sector Banks and one General Insurance company apart from the proposed IPO of Life Insurance Corporation of India, the largest domestic and government owned life insurance company; plans to raise Rs.175 billion from the disinvestment programme

- Recapitalisation of Public Sector Banks to the extent of Rs.200 billion

- FDI limits to be increased to 74% from 49% in Insurance Sector

- Setting up of a Development Financial Institution (DFI) with capital base of Rs.200 billion for infrastructure funding

- Infrastructure Debt Funds (IDFs) to be eligible to issue Zero Coupon Bonds

- For NBFCs with minimum asset size of Rs.1 billion, exposure limit for enforcement of SARFAESI Act has been reduced from Rs.5.0 million to Rs.2.0 million

- Introduction of single Securities Market Code by consolidation of existing securities market laws

- Set up an Institutional Framework for better liquidity in secondary bond market

- Separate administrative structure for Co-operative banks

- Acuite believes that the plan to set up an Asset Reconstruction Company and Asset Management Company is a welcome step to address the issue of stressed assets in banking sector. However, the modalities of the asset sale mechanism including aspects such as ownership of the ARC/AMC, and the mode of transfer of assets, the valuation methodology etc will have an important bearing on the success of this initiative.

- The Government has set a significant disinvestment target of Rs.175 billion for FY2022 with a target to divest stake in three government owned financial institutions including two banks and one general insurance company. Given the past track record of the government in timely divestments and the complexities involved in such transactions, there are significant uncertainties on the timely completion of such sale. Nevertheless, the government has articulated its intent to go ahead with such a plan which will lead to a further consolidation in the domestic banking sector over the medium to long term.

- Regular recapitalization of public sector banks is in line with the Government’s policy of extending support to these banks and facilitate fresh lending. It augurs well for PSBs especially those having capital adequacy close to the regulatory minimum and will help them in shoring up their capital base.

- The increase in foreign shareholding limit in domestic Insurance companies from 49% to 74% is expected to increase FDI and facilitate growth in the insurance sector; further, it can also lead to a consolidation in the sector and help domestic shareholders including banks to monetize their stakes in the insurance ventures.

- The proposed new DFI will have an ambitious lending portfolio target of Rs.5 trillion in 3 years which is expected to augment long term infrastructure financing, a critical need for the success of the National Infrastructure Pipeline (NIP). Also, the decision to permit IDFs to issue ZCBs will enhance their financial flexibility and help them to grow their balance sheet

- The increasing coverage of SARFAESI Act will be positive for NBFCs since their ability to recover from delinquent loans will be enhanced. NBFCs with an asset size of Rs.1 billion or more are expected to benefit with the loans from Rs.2 million being brought under the purview of SARFAESI Act.

- With an objective towards a simplified regulatory structure, the government has proposed to consolidate provisions of SEBI Act, Depositories Act, Securities Contract (Regulation) Act, and Government Securities Act into a single and consolidated Securities Market Code.

- A permanent Institutional Framework is proposed to be created wherein a specified institution/s would purchase investment grade debt securities from the market particularly in a period of stress. This would help in enhancing the liquidity and the depth the domestic bond market, thereby facilitating its further growth.

- Currently Co-operative Banks are subject to dual control of RBI and State Government through the RBI Act, State Co-operative Societies Act and the Multi State Co-operative Societies Act. The Government proposes to set up a separate administrative structure for these banks which will ensure better regulatory oversight over them and mitigate the risks of failures.

Agriculture

Impact Analysis: Acuité Opinion

OVERALL – POSITIVE

- The increase in target for agriculture credit will ensure increased credit flows

Key Budgetary Announcements:

- To provide adequate credit to farmers, the agricultural credit target has been enhanced from Rs.15.00 trillion to in FY21 Rs. 16.5 trillion in FY22

- The allocation to the Rural Infrastructure Development Fund (RIDF) has been increased from Rs. 300 billion to Rs. 400 billion

- The Micro Irrigation Fund, with a corpus of Rs. 50 billion had been created under NABARD, under this budget it is doubled by another Rs. 50 billion

- ‘Operation Green Scheme’ which was limited to tomatoes, onions and potatoes expanded to include additional 22 perishable products

- 1,000 more mandis will be integrated with e-NAM, the digital trading platform

- To benefit farm workers, the custom duty on cotton is being raised from nil to 10% and on raw silk and silk yarn from 10% to 15%.

- Agriculture Infrastructure and Development Cess (AIDC) was proposed on a small number of items. The Agriculture Infrastructure Fund would be made available to APMCs for modernizing or developing their infrastructure facilities

- The MSP regime has undergone changes to assure price that are at least 1.5 times the cost of production across all commodities making agro commodities fairly remunerative for the farm community to animal husbandry, dairy, and fisheries and support rural livelihoods.

- The development of five major fishing harbours like Kochi, Chennai, Visakhapatnam, Paradip, and Petuaghat is likely to provide an economic boost to the fishery sector and improve its export potential. Further, development of multipurpose seaweed park will enhance income of the fishing community.

- The enhanced allocation to RIDF facilitates availability of additional funds for warehousing infrastructure required for perishable products which is likely to improve the pricing power of the farmers.

- In order to boost exports of agro products, the Operation Green Scheme has been expanded to 22 additional perishable products which will have a positive implication on the food processing sector.

- Imposition of AIDC will aid in the agriculture infrastructure development although while applying this cess, the government has restricted the cess to a limited number of items.

- Finally, higher budgetary allocation in agriculture will enhance farm incomes and further boost rural demand for tractors, fertilisers and pesticides.

Overall Industry Risk Score: 14/20 Favourable

Auto and Auto Ancillaries

Impact Analysis: Acuité Opinion

OVERALL – POSITIVE

Key Budgetary Announcements:

- Introduction of a voluntary vehicle scrapping policy with Commercial Vehicles (CVs) over 15 years and Passenger Vehicles (PVs) over 20 years to undergo fitness tests

- Increase in custom duty on specified automobile parts such as ignition wiring sets, safety glass, parts of signalling equipment’s etc. from 7.5/10 percent to 15 percent

- Reduction in customs duty on specified ferrous and non-ferrous metal products which is used by domestic manufacturers

- Increase in overall infrastructure spending including highest ever capital allocation of Rs.1.08 trillion under the Ministry of Road Transport and Highways

- Launch of new scheme of Rs.180 billion to support augmentation of public bus transportation services through Public – Private Partnership Model that will enable private sector players to finance, acquire operate and maintain over 20,000 buses

- Imposition of Agriculture Infrastructure and Development Cess (AIDC) of Rs.2.5 per litre on petrol and Rs.4 per litre on diesel along with a simultaneous reduction on the Basic Excise Duty (BED) and Special Additional Excise Duty (SAED) rates will have no additional burden on the consumers

- Temporary revocation of Anti-Dumping Duty/Countervailing Duty (ADD/CVD) and reduction of custom duty on certain steel products

The formal introduction of the much awaited voluntary vehicle scrappage policy is expected to increase the demand of new vehicle sales.

- HCV demand such as Tippers will get a boost from higher investments in roads and highways.

- The increase in custom duty on certain auto component parts is likely to create more opportunity for localisation and positive for the auto component sector over the medium term.

- While there may be some cost pressures to auto OEMs due to the hike in customs duty on some components, the reduction in customs duty on steel flat and long products may partly mitigate such pressures.

Overall Industry Risk Score: 13/20 – Marginally Favourable

Aviation

Impact Analysis: Acuité Opinion

OVERALL – NEUTRAL

Key Budgetary Announcements:

- Tax holiday on capital gains for aircraft leasing companies and tax exemption for aircraft lease rentals paid to lessors located in the IFSC (International Financial Services Centre) in GIFT City (Gujarat International Finance Tec City)

- Allocation of Rs. 32.24 billion to the Ministry of Civil Aviation

- Disinvestment of Air India and Pavan Hans proposed to be completed in the year 2021-22 for which Rs.22.68 billion has been allocated to Air India Asset Holding Ltd., a special purpose vehicle (SPV) which has been set up as part of financial restructuring of Air India

- Allocation of Rs. 6 billion for the regional connectivity scheme UDAN

- Assets of AAI Airports in Tier-II and Tier-III cities planned to be monetised under the Asset Monetisation Programme

- Introduction of tax exemptions is likely to encourage the aircraft leasing companies to set up its base in India over the medium term, thereby benefiting aviation sector through competitive lease rentals for new fleet, reduced forex fluctuations and broad basing the financial leasing market in the country.

- Other expectations of the industry such as bringing Aviation Turbine Fuel (ATF) under GST regime or reduction in airport charges were not considered in the current budget.

- The industry has been significantly impacted by the ongoing pandemic which is likely to persist over the near term due to safety concerns, leading to sub optimal aircraft fleet utilisation. However, the passenger load factor has seen a gradual albeit steady recovery on back of easing of travel restrictions.

Overall Industry Risk Score: 13/20 – Marginally Favourable

Cement

Impact Analysis: Acuité Opinion

OVERALL – POSITIVE

Key Budgetary Announcements:

- National Infrastructure Pipeline (NIP) which was launched with 6,835 projects will now cover 7,400 projects

- NIP aims to invest in projects spanning across sectors such as energy, social and commercial infrastructure, communication, water and sanitation

- Enhancing the share of capital expenditure to Rs 5.54 trillion for FY2021-22 i.e. 34.5% higher than budget estimate of FY2020-21

- To provide more than Rs 2 trillion for states and autonomous bodies for their capital expenditure

- Expenditure outlay in railways and roadway is proposed at Rs.1.10 trillion and Rs.1.08 trillion respectively

- Prioritising "housing for all” and affordable housing projects

- The cement sector is expected to witness a steady improvement in demand over the medium to long term and benefit from the government’s focus on infrastructure and affordable housing segment.

Overall Industry Risk Score: 14/20 – Favourable

Drugs & Pharmaceuticals

Impact Analysis: Acuité Opinion

OVERALL – POSITIVE

Key Budgetary Announcements:

- Allocation of Rs.350 billion for Covid – 19 vaccine

- Set up of PM Atma Nirbhar Swasth Bharat Yojana (PMANSBY) with an outlay of Rs. 641.8 billion over 6 years

- The Urban Swatch Bharat Mission 2.0 to be implemented with an allocation of Rs.1.42 trillion over next 5 year ending FY2026

- Budget outlay on healthcare sector has witnessed an increase of 137% to Rs.2.24 trillion in FY22 as compared to the previous year

- The cement sector is expected to witness a steady improvement in demand over the medium to long term and benefit from the government’s focus on infrastructure and affordable housing segment.

- We consider the budget announcement under PM Atma Nirbhar Swastha Bharat Yojna as renewed focus of the government to develop the primary, secondary and tertiary health care facilities already in progress under the Ayushman Bharat Programme.

- The announcement also paves the way for establishment of units for detection and cure of new diseases. The massive budgetary support is likely to promote development of health care centre, diagnostic centres (including integrated health labs) in rural and urban areas across the length and breadth of the country.

- We believe that the sizeable allocation of Rs. 350 billion for Covid–19 and Pneumococal vaccine which is estimated to provide vaccine coverage to approximately 43 per cent of the population, is likely to lead to a significant boost to contract manufacturing units in the pharma sector.

- The demand in pharma sector remains robust in a pandemic environment given its essentials commodity tag. Indian OTC products continue to witness robust demand in European and American markets. The supply chain challenges have been largely resolved for the domestic industry though there is import dependence on China for a few bulk drugs.

Overall Industry Risk Score: 14/20 – Favourable

Gems & Jewellery

Impact Analysis: Acuité Opinion

OVERALL – NEUTRAL

Key Budgetary Announcements:

- Rationalisation of custom duties on gold and silver to 7.50 per cent from the current 12.50 per cent. Gold and Silver will also attract Agriculture Infrastructure and Development Cess at the rate of 2.5 per cent

- Reduction of duties on other precious metals were cut down:

- Gold dore bar from 11.85 per cent to 6.9 per cent

- Silver dore bar from 11 per cent to 6.1 per cent

- Platinum from 12.5 per cent to 10 per cent

- Gold/silver findings from 20 per cent to 10 per cent

- Precious metal coins from 12.5 per cent to10 per cent

- Increase in custom duty on cut and polished cubic zirconia, synthetic cut and polished stones to 15 percent from current level of 7.50 percent.

- Jewellery purchase in cash above Rs. 0,2 million still attracts 1.00 per cent tax.

- We believe that the rationalisation of customs duties on precious metals will improve the global competitiveness if Indian exporters.

- The duty rationalisation is also expected to lead to slightly lower cost and improved affordability of gold jewellery in the domestic market

Overall Industry Risk Score: 12/20 – Marginally Favourable

Infrastructure

Impact Analysis: Acuité Opinion

OVERALL – VERY POSITIVE

Key Budgetary Announcements:

Roads and Highways Infrastructure

- Under the National Infrastructure Pipeline (NIP), the project pipeline has now been expanded to 7,400 projects

- Under Bharatmala Pariyojana, projects, the Government would be awarding additional 8,500 kms by March 2022 and economic corridors being planned in states like Tamilnadu, Kerala, West Bengal and Assam

Railway Infrastructure

- Western and Eastern Dedicated Freight Corridor (DFC) to be commissioned by June 2022

- The Government aims at 100% electrification of Broad-Gauge routes by December 2023.

Urban Infrastructure

- A new scheme based on Public Private Partnership model will be launched at a cost of Rs.180 billion (20,000 buses) to support augmentation of public bus transport services.

- Expansion of metro rail network through ‘MetroLite’ and ‘MetroNeo’ for Tier-2 and peripheral areas of Tier-1 cities

Ports

- Seven projects worth Rs. 20 billion to be offered by major ports on PPP model in FY 2021-22

Infrastructure Finance

- Development Financial Institution (DFI) to be set up for long-term debt financing in the infrastructure sector with an initial capital of Rs.200 Bn which can lend at least Rs.5 trillion in next 3 years

- The debt funding of InvITs and REITs by Foreign Portfolio Investors (FPI) will be enabled by making suitable amendments in the relevant legislations

Asset Monetisation

- National Monetisation Pipeline for brownfield infrastructure assets will be launched

- Railways will monetise DFC assets for operations and maintenance after commissioning

- The next lot of Airports will be monetised for operations and management concession.

- Several core infrastructure assets to be monetised including toll roads, transmission assets, pipeline assets, sports stadium, etc., which are owned by the Government/ PSUs such road assets of NHAI and transmission assets of PGCIL

- We believe that the three-pronged approach of asset monetization, setting up of DFI and increase in capital expenditure is likely to very favourable for the sector over the near to medium term.

- Acuite also is of the opinion that the various measures proposed for project finance including the new DFI and introduction of tax efficient IDF bonds can address the funding constraints for infrastructure projects to an extent.

- The proposed legislative amendment for debt financing by FPI will further ease access of finance for InvITs and REITs thus augmenting funds for infrastructure and real estate sectors.

- In the BE 2020-21, Government had provided Rs.4.12 trillion for Capital Expenditure. For 2021-22, there is a sharp increase in capital expenditure to Rs. 5.54 trillion which is 34.5% more than the BE of 2020-21. With announcement of such large investments, the view on the sector remains significantly positive.

Overall Industry Risk Score: 13/20 Marginally Favourable

Power

Impact Analysis: Acuité Opinion

OVERALL – POSITIVE

Key Budgetary Announcements:

- An outlay of Rs. 3.06 trillion over a period of five years for the power distribution sector through a revamped result-linked scheme, wherein funds will be released based on financial performance and viability demonstration by the state utilities.

- Additional fund infusion in the two agencies focused on renewable energy development – Solar Energy Corporation of India (SECI) and Indian Renewable Energy Development Agency (IREDA)

- Monetization of transmission assets through the InvIT model by public sector companies like PGCIL under proposed National Monetization Pipeline of potential brownfield infrastructure assets.

- An enabling framework to give consumers alternatives to choose from among more than one distribution entity

- Hydrogen Energy Mission is set to launch in FY2021-22.

- The reform-based result linked scheme is slated to provide the much-needed funding support to the distribution utilities which continue to struggle due to high commercial losses and poor collections.

- More importantly, the scheme is proposed to be tied to financial improvements, thereby providing the much needed impetus to reduce inefficiencies in power distribution sector. These measures would also improve operating efficiency through the development of distribution infrastructure, feeder separation, and smart meter installation.

- Acuite also observes concrete measures for infrastructure development in transmission sector with monetization of transmission assets through InVIT model, which will enhance funding availability and reduce gap between the pace of increase in generation and transmission capacity.

- Also, the capital infusions in SECI and IREDA is likely to boost capacity additions in the renewable sector which has witnessed a slowdown in the last 1-2 years.

Acuité Industry Risk Score:

- Conventional Electricity: 13/20 Marginally Favourable

- Renewable Electricity: 14/20 Favourable

- Electricity Distribution: 15/20 Favourable

Real Estate

Impact Analysis: Acuité Opinion

OVERALL - POSITIVE

Key Budgetary Announcements:

- The latest budget proposes to extend the timeline for additional deduction of interest paid (upto to Rs.1,50,000) on affordable housing up to March 31, 2022.

- Tax holiday to developers of affordable housing segments announced in the last budget has been extended to March 31, 2022 (u/s 80 IBA).

- Budgetary allocation to Pradhan Mantri Awas Yojana (PMAY – Rural) is of Rs. 195 billion BE FY2021-22.

- Budgetary allocation to Pradhan Mantri Awas Yojana (PMAY – Urban) is of Rs. 80 billion BE FY2021-22. /li>

- On the funding side, dividends paid to REIT have been exempted from TDS. The actual tax liability will be only payable on the declaration of payment of dividends.

- Recapitalisation of Public Sector Banks (PSBs) has been announced with Rs. 200 billion allocation in FY22.

- Safe harbour limit has been increased from 10 percent to 20 percent in November 2020. The latest budget proposes to extend that by one more year.

- The proposals announced in the latest Budget primarily aims at extending the benefits made available to the affordable housing segment, which could not be fully availed due to COVID lockdowns in FY2020-21. This will continue to augment demand for affordable housing.

- The extension of increased safe harbour limit is expected to facilitate faster real estate transactions as it expands tax incentives to larger number of transactions.

- Going forward REITs are expected to be key investors for completed commercial real estate projects, thereby facilitating refinance of banks and NBFC loans. The TDS benefits for REITs are expected to improve their attractiveness as an asset class that can lead to increased funding availability to real estate projects.

- The budget also proposes to set up an ARC that can take over bad loans from the banks. This will facilitate focused resolution of bad real estate loans and lead to completion of delayed projects

Overall Industry Risk Score: 13/20 Marginally Favourable

Steel

Impact Analysis: Acuité Opinion

OVERALL - NEUTRAL

Key Budgetary Announcements:

- Reduction of customs duty from 10-12.5 per cent to 7.5 per cent on imports of long and flat products of alloy, non-alloy and stainless steel.

- Steel scrap duty exempted till March 2022

- Revocation of anti-dumping duty (ADD) and countervailing duty (CVD) on imports of alloy-steel bars, rods and flat steel products, including those from China till September 30, 2021.

- Substantial increase in allocation for the infrastructure sector

- Acuité believes that the Government’s thrust towards the infrastructure sector envisaged through steep increase in capital expenditure budget would strengthen the demand for long steel products.

- The vehicle scrappage policy introduced in the budget is expected to provide impetus to the auto sector and therefore, demand for flat products.

- However, the withdrawal of ADD and CVD would moderate any improvement in the profit margins of domestic players at least in the near term.

- The duty cut on alloy steel products is unlikely to impact the domestic steel producers negatively since majority of the imports continue to occur with nations with whom India already share a free trade agreement such as Korea and Japan and also majority of imports are due to shortage in domestic supply.

- The extension of duty exemption for steel scrap till March 2022 will support metal recyclers especially in the MSME segment and also reduce raw material costs for secondary steel manufacturers to an extent.

Overall Industry Risk Score: 12/20 Marginally Favourable