Union Budget 2022-23

Capex is the new mantra for growth

KEY TAKEAWAYS

- Fiscal deficit target for FY22 stands slightly revised upwards to 6.9% of GDP compared to budgeted target of 6.8%.

- For FY23, fiscal deficit is expected to consolidate to 6.4% of GDP, premised on a nominal GDP growth of 11.1%.

- Capital expenditure and Digitization emerge as focus areas. Budget rather than announcing any substantial new measures, focuses on enhancing the contours of the prior budget and aims to take forward unfinished agenda from previous years.

- Improvement in quality of spending and fiscal transparency remain on radar, besides credible arithmetic.

- We believe there are fiscal buffers available with Government, in case, expenditure support to economy is required.

- Net g-sec borrowing to rise to a record high level of Rs 11.19 tn in FY23 from Rs 7.76 tn in FY22. With central bank’s proactive balance sheet support with respect to bond purchases likely to get muted amidst the need for policy normalization, upside pressure on yields may persist.

- We stick to our call of 10Y g-sec yield drifting higher towards 7.25% by end of Mar-23.

|

The FY23 Union Budget displayed a fine balance between fiscal retreat and maintaining focus on pushing growth. Continuing on its path of moderate fiscal path, the Budget announced a 50-bps reduction in fiscal deficit to GDP ratio from 6.9% in FY22 to 6.4% in FY23. In the aftermath of deleterious impact caused by the continued wave of Covid infections the impetus to capex from last two years was not only retained but also given an additional thrust. In addition, a fresh digital push was given to the new age economy with a vision to drive productivity and efficiency gains over the medium term. Overall, it appears to be a ‘capex driven continuity’ budget - intending to enhance the contours of the last year’s budget and take forward the unfinished agenda from previous years, with no new major big bang announcements.

Fiscal arithmetic: Realistic

Budget arithmetic appears rather credible, and perhaps a bit conservative on some items. With this the Government has kept some fiscal buffers within its ambit, lest some additional unforeseen pandemic related support is required through the course of the year.

Gross tax revenues are budgeted to increase by a sober 9.6% in FY23 compared to a robust 24.1% in FY22 as per RE. Tax growth at a granular level, is expected to be led by GST, which has shown remarkable buoyancy in FY22 on a year-to-date basis. Revenues from direct taxes are budgeted to grow by ~13.5% with downside being imparted by excise duty collections, carrying the annualized impact of duty cuts on petrol and diesel announced in Nov-21. After adjusting for tax devolution to states, net tax revenues are budgeted to moderate marginally to 7.5% of GDP in FY23 from 7.6x% in FY22.

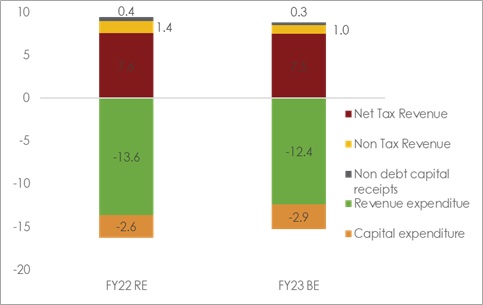

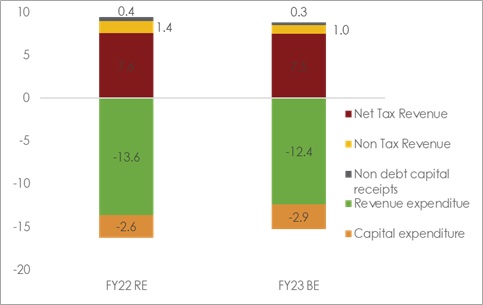

Chart 1: Anatomy of government balance sheet (as a % of GDP)

Non-tax revenues, with anticipated normalization of RBI dividend in FY23, are budgeted at 1.0% of GDP compared to 1.4% in FY22. However, bigger surprise came from budgeted disinvestment proceeds, for both FY22 and FY23. Despite Government in active mode to push through LIC in FY22 and BPCL being pushed to FY23, disinvestment proceeds were pegged at Rs 780 bn (vs. BE of Rs 1750) and Rs 650 bn for FY22 and FY23 respectively. As compared to earlier years, this is a conservative stance and given several names already identified for stake sale in FY23 such as Shipping Corporation, IDBI, CONCOR etc., possibility of overshooting the disinvestment target can offer a fiscal buffer.

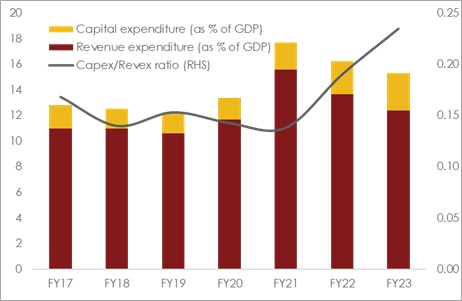

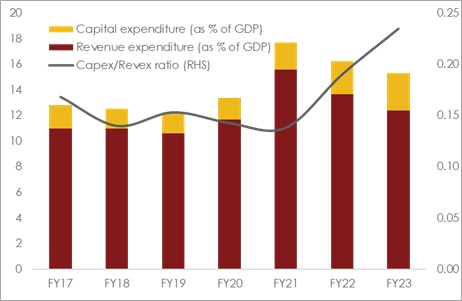

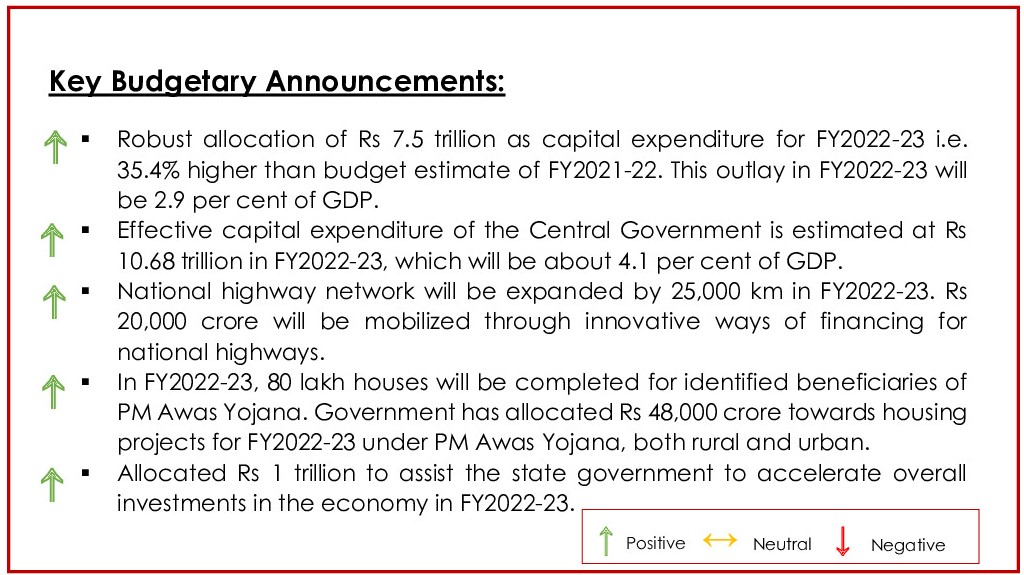

On the expenditure side, total expenditure is budgeted to clock a growth of 4.6% in FY23 vs. 7.4% in FY22. Revenue expenditure, with taper of food subsidy bill owing to discontinuation of free food grain programme, is budgeted to see only a marginal increase of 0.9%. In contrast, the Government has budgeted for capex to grow by 24.5% in FY23, which builds on the 41.4% increase recorded in FY22 (including equity infusion in Air India). As such, the quality of expenditure (i.e. capex/revex ratio) is expected to improve to an 18-year high in FY23.

Budget calculations are premised on a lower than expected nominal GDP growth of 11.1%. Given, economic survey’s growth estimate of 8.0-8.5% for FY23, and assuming GDP deflator at a conservative 4.0%, nominal GDP could be upwards of 12.0%. This too in our assessment gives government some fiscal headroom.

Infrastructure: Remains a priority

Capex spending is budgeted to rise to a near two decades high of 2.9% of GDP in FY23. This metric has risen swiftly from 1.7% of GDP in FY20, underscoring Government’s consistent thrust and commitment to invest in country’s infrastructure.

At a granular level, a large part of capex upside for FY23 has been directed towards sectors of roads, rail, and telecom. The latter reflects Government’s push to support expansion of BharatNet project along with infusion of capital into BSNL for 4G spectrum, technology upgradation and restructuring.

Chart 2: Quality of spending budgeted to see a sharp improvement

Education: Bridging the gaps

With the pandemic regressing education outcomes by two successive years, Budget accorded a higher priority to the sector. While social welfare spending is set to see rationalization in FY23 given the withdrawal of some pandemic related excesses, education sector is budgeted for a sharp increase in outlay of 18.0%. In addition, the finance minister mooted the idea of leveraging technology to achieve universalization of education. For school children, the Budget proposed the expansion of ‘one class-one TV channel’ program of PM eVIDYA along with setting up of virtual labs. Government also aims to set up a digital university to provide world class quality education with personalized learning for higher education.

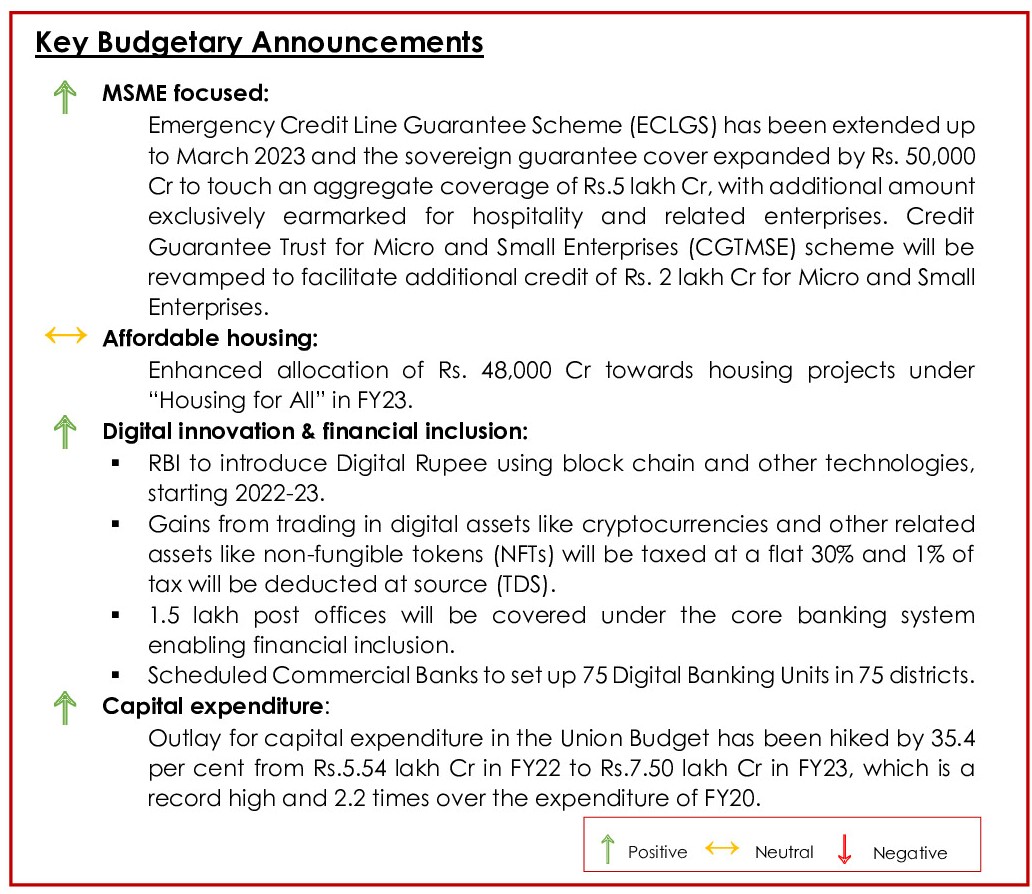

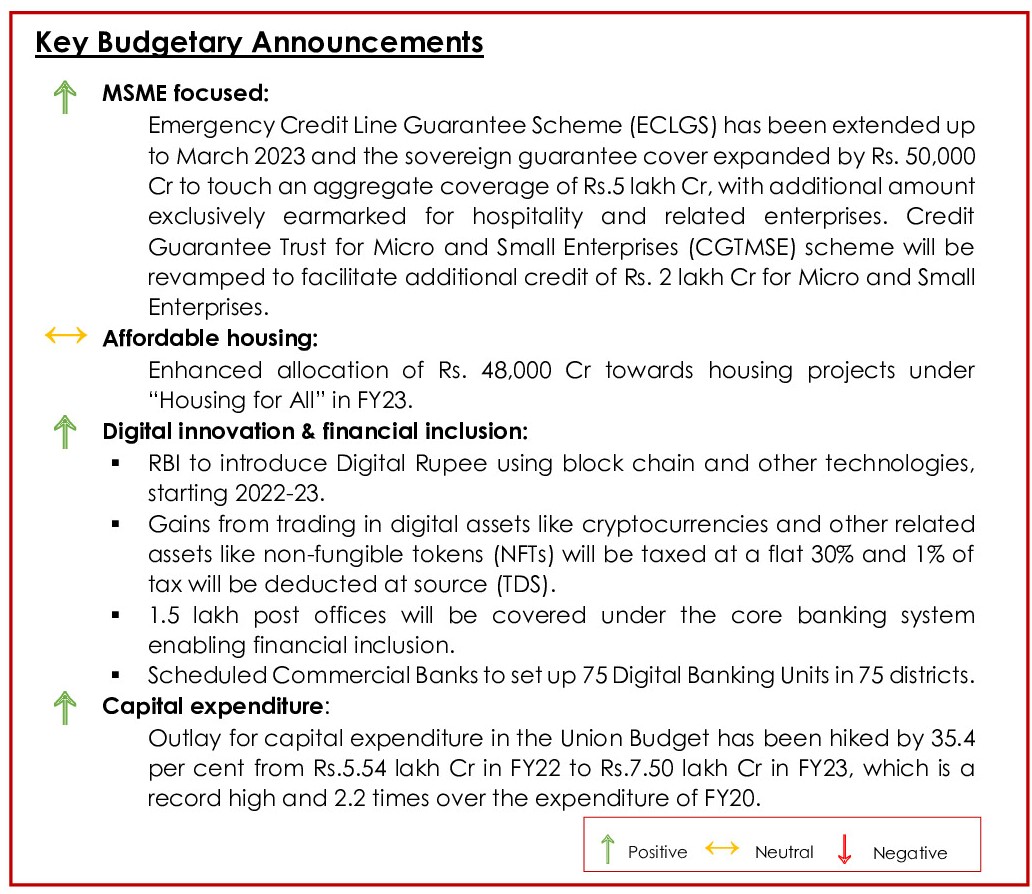

Support to pandemic affected sectors

Amidst multiple waves of pandemic having a profound negative impact on the operations of MSMEs, the budget continued to offer support via enhancement in outlay under the ECLGS to Rs 5 tn and its tenure by another year to Mar-23. Though strictly speaking this is not an on-balance sheet expenditure, as it is a credit guarantee, but with additional amount being exclusively earmarked to the hospitality sector is a positive. Additionally, plans to revamp the CGTMSE scheme (Credit Guarantee Trust for Micro and Small Enterprises) is expected to further aid in facilitating additional credit and expand employment opportunities.

Inflation-neutral budget

Despite several state elections on the anvil, the Budget FY23 is definitely non-populist. Absence of any direct tax incentives to support disposable incomes, contrary to popular perception, should be seen in positive light for not stoking demand side inflation further. Core inflation, i.e., headline ex food and fuel, has remained elevated averaging at close to 5.9% over the last 1 year. Further progress on vaccination, ebbing of Omicron wave and yet to reflect upward adjustment in telecom tariffs, could keep core inflation elevated in the near term. That said, we believe that the government’s expenditure policy will remain flexible depending on the economic scenario as well as the residual pandemic impact as it has reserved some fiscal headroom.

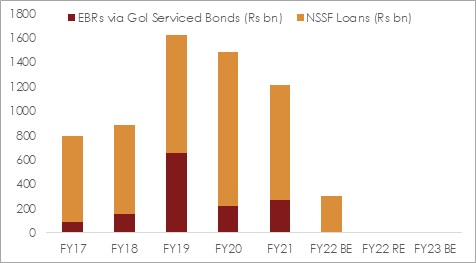

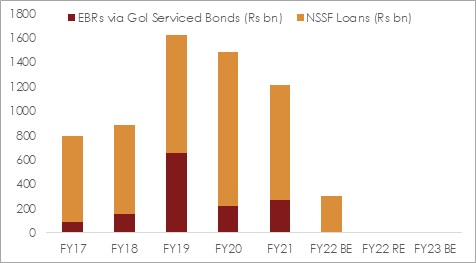

Focus on transparency continues

The virtue of fiscal transparency was steered in FY22 Union Budget by significantly downsizing ‘off-balance sheet’ funding. There was a massive scale back in mobilization of extra budgetary resources (via GoI serviced bonds and financial support extended via NSSF loans) to Rs 300 bn from Rs 1213 bn in FY21. As per the revised estimates for FY22, the off-balance sheet funding is likely to get truncated further to Rs 8 bn. Further, going into FY23, the off-balance sheet funding is budgeted to drop to zero. This is a welcome cleanup exercise, which would help boost overall fiscal credibility.

Chart 3: Off balance sheet spending to stop

FRBM objective and debt mindfulness

While the FY23 Union Budget carries forward the tenet of fiscal transparency, there are few minor disappointments from the perspective of medium-term fiscal policy strategy.

- The 15th Finance Commission had recommended the central government to bring down its fiscal deficit ratio to 4.0% by FY26 (compared to the earlier target of 3.0%). The government was expected to follow through with codification of long-term fiscal glide path by reviewing the FRBM Act. However, the government chose to retain fiscal flexibility to effectively respond to emerging contingencies on account of pandemic induced uncertainties. Hence, amendment to the FRBM Act did not get proposed in the FY23 Union Budget, while fiscal projections for FY24 and FY25 got suspended. However, in line with the commitment made by the Finance Minister last year, the government is expected to pursue a broad path of fiscal consolidation to bring down fiscal deficit ratio lower than 4.5% in FY26. We hope that the government considering the post pandemic economic changes, would present a revised FRBM framework in next year’s budget presentation to formalize its intent for medium-term fiscal consolidation.

- Central government’s debt is budgeted to rise to 60.2% of GDP in FY23 from 59.9% in FY22. While the increase is modest, this represents the rising burden of interest payments (at 3.6% of GDP in FY23, it would be the highest in 17-years) and NSSF investment in state government special securities. Medium term fiscal consolidation (via revenue augmentation, asset monetization/privatization, and rationalization of spending) and structural reforms to enhance economy’s growth potential would be an imperative in our opinion in bringing lower the debt ratio.

Financing of higher Fiscal Deficit

The onus of funding the higher than anticipated fiscal deficit lies on market borrowing.

- Net g-sec borrowing is budgeted to rise to a record high level of Rs 11.19 tn in FY23 from Rs 7.76 tn in FY22. Taking into account the scheduled redemption of Rs 3.13 tn in FY23, the gross borrowing target also touches a record high of Rs 14.31 tn.

- For sake of comparison, the proposed gross and net g-sec borrowing in FY23 will be 2.0x and 2.4x of their respective amounts in the pre pandemic year of FY20.

- Funding via T-Bills got is budgeted for a moderation to Rs 0.5 tn in FY23 from Rs 1 tn in FY22.

- Reliance on small savings is expected to reduce from Rs 5.91 tn to Rs 4.25 tn in FY23.

- The government expects no dependence on drawdown of surplus cash balances in FY23 vis-à-vis a significant cash usage of Rs 1.74 tn in FY22.

Table 1: Funding of fiscal deficit

|

In Rs bn |

As % of Fiscal Deficit |

|

FY21 |

FY22 RE |

FY23 BE |

FY21 |

FY22 RE |

FY23 BE |

| Fiscal Deficit |

18183 |

15911 |

16612 |

- |

- |

- |

| External Financing |

702 |

197 |

193 |

3.9 |

1.2 |

1.2 |

| Domestic Financing |

17481 |

15713 |

16419 |

96.1 |

98.8 |

98.8 |

| Dated Securities |

10329 |

7758 |

11186 |

56.8 |

48.8 |

67.3 |

| T-Bills |

2032 |

1000 |

500 |

11.2 |

6.3 |

3.0 |

| Small Savings |

4837 |

5915 |

4254 |

26.6 |

37.2 |

25.6 |

| Cash Drawdown |

-72 |

1742 |

8 |

-0.4 |

10.9 |

0.0 |

| Others* |

355 |

-701 |

471 |

1.9 |

-4.4 |

2.8 |

**Includes items from State Provident Funds, Internal Debts and Public Account

Conclusion

The FY23 Union Budget rests on the following four broad strategies:

- Substantial thrust on public capex for crowding in private investment, boost job creation, and enhance supply side economic potential

- Nudging digitalization of the economy through policy incentives to boost productivity

- Some scaling back of pandemic era exceptional support measures coupled with a judicious mix of targeted development/welfare policy actions

- Finally, move forward on the path of gradual fiscal consolidation by lowering the fiscal deficit ratio sequentially

We believe the fiscal arithmetic to be broadly credible. Assuming pandemic related risks do not resurface in FY23, there could in fact be a minor possibility of improvement in fiscal metrics with a conservative Nominal GDP budgeted growth estimate of 11.1% providing further buffer.

Having said so, there are two areas of disappointment in the near term:

- The revised disinvestment target for FY22 at Rs 780 bn and the budgeted target for FY23 at Rs 650 bn is lower than the FY22 initial budget estimate of Rs 1750 bn. This is despite government carving out PSU Disinvestment policy along with National Monetization Plan. While likelihood of financial market volatility in the near term on account of monetary policy normalization by key central banks in 2022 does not offer a favorable backdrop, more clarity and effort on the divestment agenda would help investor confidence.

- The 10Y g-sec yield has jumped sharply by 20 bps (to 6.88% currently) since the presentation of FY23 Union Budget. Higher than expected market borrowing and lack of any communication on tax changes required for India’s inclusion in global bond indices has weighed on market sentiment. Unfortunately, this has come about in the backdrop of elevated global commodity prices and rising global interest rates, which is in turn also making a case for interest rate normalization by the RBI (as early as in the upcoming policy review during Feb 7-9, 2022). With central bank’s proactive balance sheet support with respect to bond purchases likely to get muted amidst the need for policy normalization, upside pressure on yields could continue to persist. We stick to our call of 10Y g-sec yield drifting higher towards 7.25% by Mar-23.

Table 2: Budget at a glance

|

In Rs bn |

As % of GDP |

|

FY21 |

FY22 RE |

FY23 BE |

FY21 |

FY22 RE |

FY23 BE |

| Revenue Receipts |

16339 |

20789 |

22044 |

8.3 |

9.0 |

8.5 |

| Gross Tax Revenue |

20271 |

25161 |

27578 |

10.2 |

10.8 |

10.7 |

| Net Tax Revenue |

14263 |

17651 |

19348 |

7.2 |

7.6 |

7.5 |

| Non-Tax Revenue |

2076 |

3138 |

2697 |

1.0 |

1.4 |

1.0 |

| Dividends & Profits |

969 |

1474 |

1139 |

0.5 |

0.6 |

0.4 |

| Non-Debt Capital Receipts |

576 |

1000 |

793 |

0.3 |

0.4 |

0.3 |

| Disinvestments |

379 |

780 |

650 |

0.2 |

0.3 |

0.3 |

| Total Expenditure |

35098 |

37700 |

39449 |

17.7 |

16.2 |

15.3 |

| Revenue Expenditure |

30835 |

31673 |

31947 |

15.6 |

13.6 |

12.4 |

| Interest Payment |

6799 |

8138 |

9407 |

3.4 |

3.5 |

3.6 |

| Subsidy |

7582 |

4879 |

3556 |

3.8 |

2.1 |

1.4 |

| Capital Expenditure |

4263 |

6027 |

7502 |

2.2 |

2.6 |

2.9 |

| Revenue Deficit |

14496 |

10884 |

9902 |

7.3 |

4.7 |

3.8 |

| Fiscal Deficit |

18183 |

15911 |

16612 |

9.2 |

6.9 |

6.4 |

| Primary Deficit |

11384 |

7773 |

7205 |

5.7 |

3.3 |

2.8 |

Sectoral Impact

Financial Services

Acuité Opinion

Overall – Moderately Positive

Impact Analysis

- The tenure extension and enhanced limits under ECLGS & CGTMSE schemes is a positive for MSME lenders including banks since the measures will not only encourage credit growth but also safeguard the balance sheets from any asset quality stress. As per RBI’s Financial Stability Report, loans amounting to Rs.2.82 Lakh Cr were sanctioned under the ECLGS till November 12, 2021, of which Rs.2.28 Lakh Cr was disbursed thereby forming 20.6 per cent of the incremental credit during the period. These schemes have been instrumental in facilitation of credit flow to MSME sector thereby addressing credit and liquidity issues faced by MSMEs during Covid-19 led disruptions.

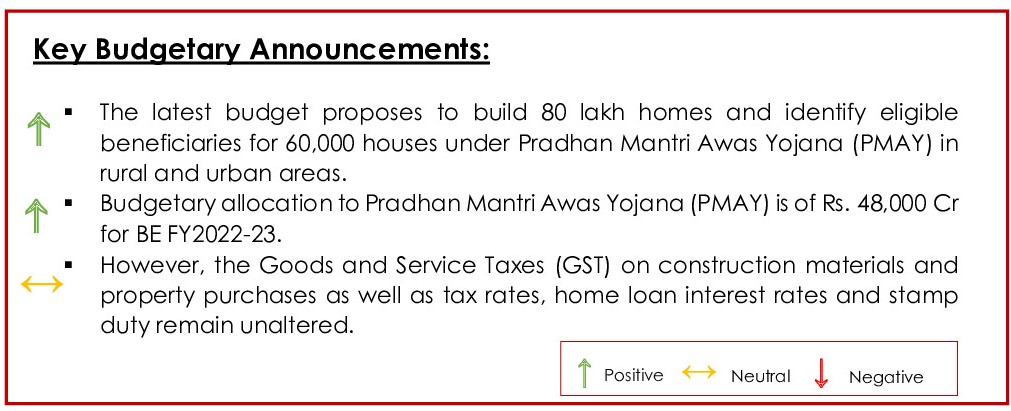

- Housing for All scheme have enabled in creating adequate supply to cater to affordable housing demand in the country. The continued government focus on affordable housing is a positive for mortgage lenders and banks.

- The recent government focus along with RBI measures to accelerate the pace of digital payment ecosystem and host of recent recommendations of working group on digital lending have been steps in the right direction. Though currently small, digital innovation and fintech adoption has been growing by leaps and bounds. This will enable efficient and cheaper currency management system. .

- Bank credit rose encouragingly by 9.2 per cent on YoY basis as on December 31, 2021. This is a significant improvement from the 3.2% growth in the comparable period of FY21 and the negative growth in the first six months of FY22. Though there has been an improvement in credit demand in Q3FY22 associated with the higher levels of economic activity, this has been limited to a few sectors only and yet to be broad based. The higher capital expenditure programme can further add to the growth momentum due to its multiplier effect on overall economy thereby spurring need for incremental lending.

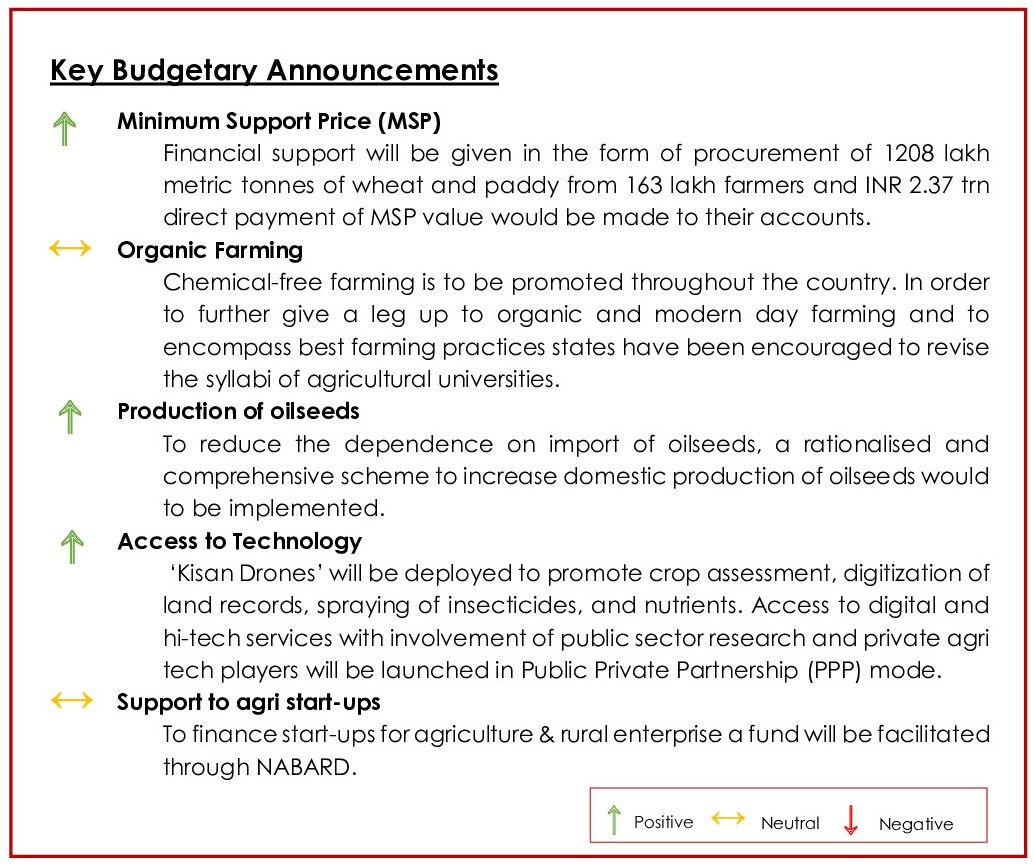

Agriculture

Acuité Opinion

Overall – Moderately Positive

Impact Analysis

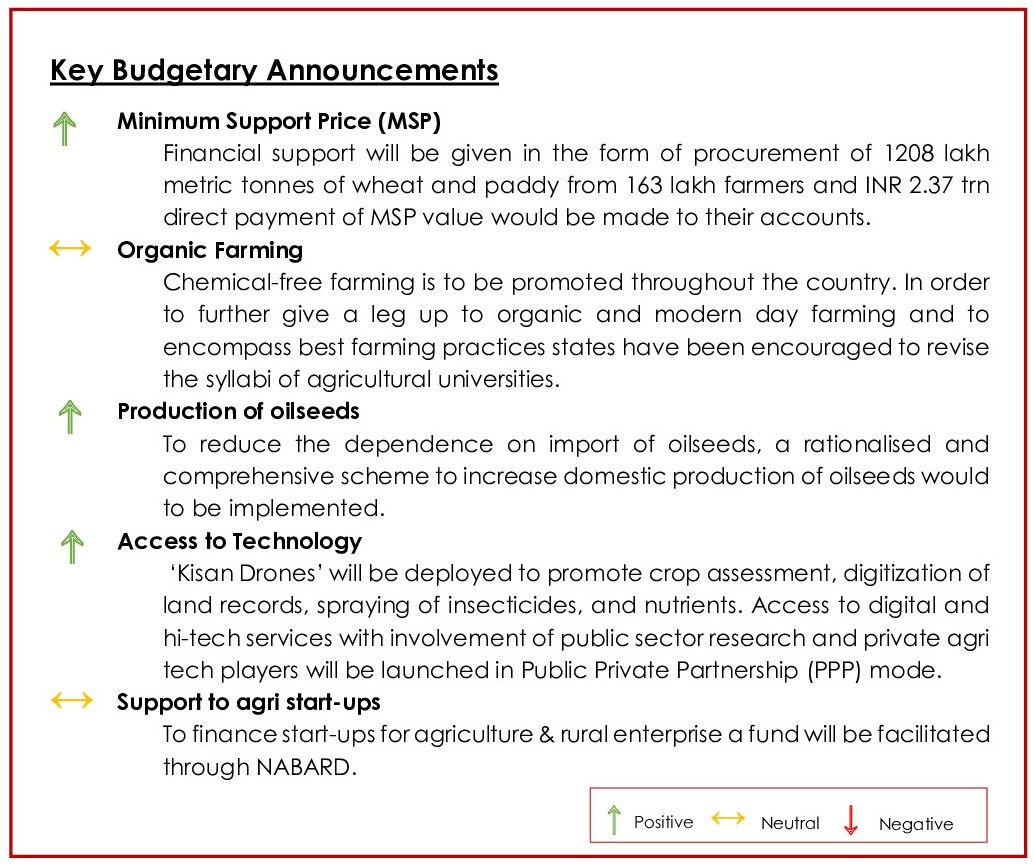

- All the above-mentioned reforms that are expected to provide much-needed access to finance, market connectivity and hi-tech services are welcome steps for agriculture sector as they seek to increase farmers income over the medium term.

- The greater focus on technological enhancements via PPP mode will streamline agri value chains and improve farm productivity. In addition, measures announced for enabling affordable broadband and mobile service proliferation in the rural areas will further aid farmers to adopt the new-age technology.

- Looking at the budgeted numbers, the overall allocation for the agriculture sector has increased marginally by 4.8% to INR 1.24 trn in FY23 BE from INR 1.18 trn in FY22 RE.

- Another bright spot in the budget is the focus on the Rashtriya Krishi Vikas Yojana (RKVY) that has been losing its sheen in the last few years. This scheme will give states the autonomy to draw up a state-specific plan of action to reform their agricultural sector.

- However, some of the other sector schemes such as Market Intervention Scheme and Price Support Scheme (MIS-PSS) and Pradhan Mantri-Annadata Aya Sanrakshan Abhiyan (PM-AASHA), which ensure MSP-based procurement operations in the country, especially for pulses and oilseeds, have seen reduction in budget allocation.

- Additionally, the provision towards MGNREGA, India’s largest rural jobs scheme has also been lowered by 25% from FY22 RE to INR 730 bn in FY23 on the expectation of an improvement in the employment scenario due to the wind down of the pandemic.

- The budget has also rationalized allocation of total subsidies lower by 27% to INR 3.18 bn which was contrary to market expectations of a significant rise in food and fertilizer subsidies amidst several state elections being round the corner and surge in global fertilizer prices.

- While the government has resisted populist expectations including immediate cash handouts given the inflationary concerns and resilience of agriculture sector during the pandemic, we believe that the agricultural reforms announced in the budget has largely addressed the need to create long-term sustainable growth.

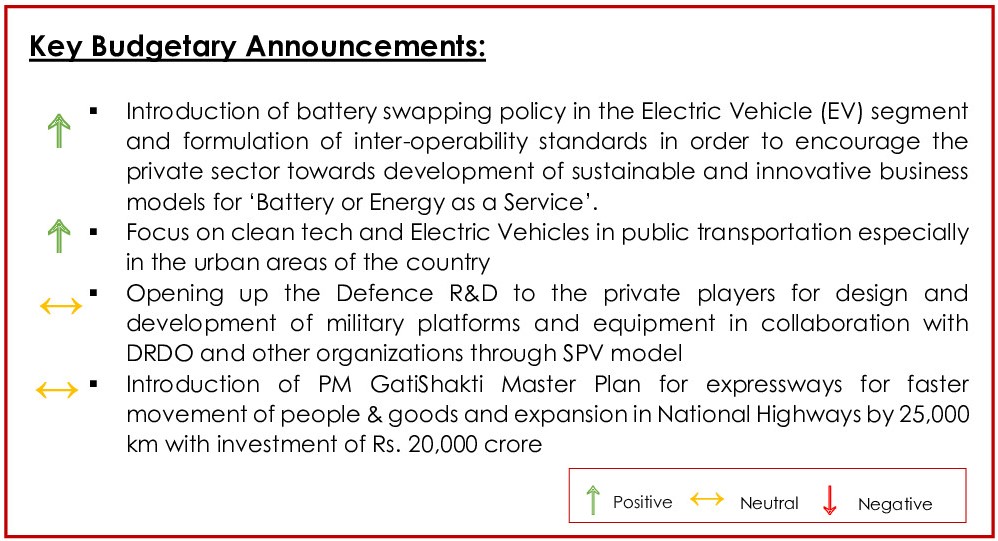

Auto and Auto Ancillaries

Acuité Opinion

Overall – Neutral

Impact Analysis

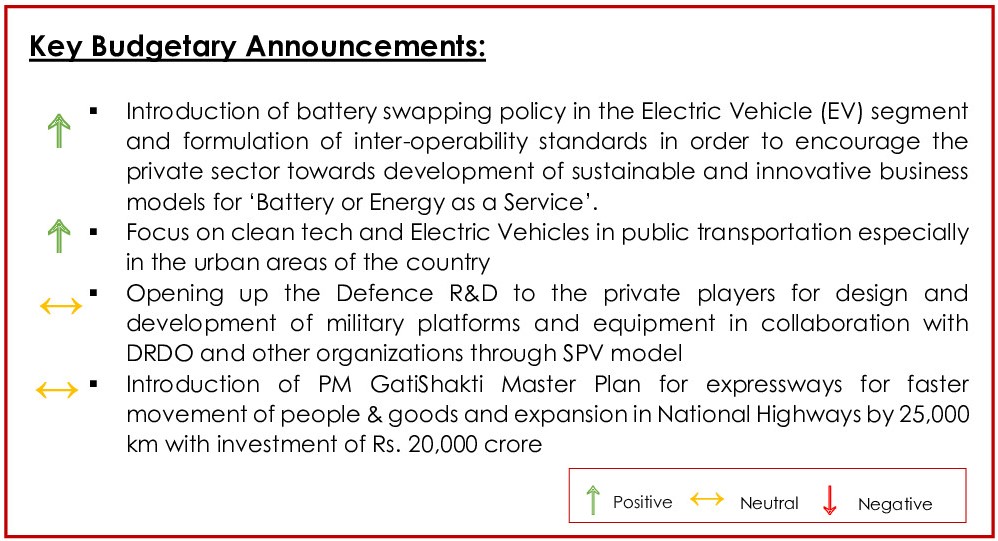

- One of the major announcements in the budget was the introduction of battery swapping policy in the EV segment which is expected to increase the investment in EVs by the auto companies

- With the focus on developing EV infrastructure, the policy is also likely to boost the adoption of EVs in public transportation, delivery aggregation businesses and personal mobility space as it will reduce the effective charging time for EVs

- The government focus towards usage of public transport with clean and sustainable environment will further push commercial EVs especially buses

- The government push towards road infrastructure with the expansion of 25,000 km national highways and an investment of Rs. 20,000 crore is expected to increase the demand of Commercial Vehicles (CVs)

- Although no major announcement was made for auto ancillary industry but the opening of defence R&D to the private players is somewhere expected to encourage few auto component companies to diversify their business models into the aforementioned segment

Cement

Acuité Opinion

Overall – Positive

Impact Analysis

- The cement industry has been emerging from the Covid-19 induced demand slowdown. Cement demand in India has historically grown at 1.2x of real GDP growth. The cement industry in India is an indirect beneficiary of higher government spending. Thus, any improvement in spending augurs well for this sector.

- Budget is expected to facilitate and expand overall infrastructure sector which will positively boost cement demand. Furthermore, higher allocation in the road and housing schemes such as Pradhan Mantri Awas Yojana (PMAY) from the Government is expected to boost cement demand.

- The key driver of cement demand in India is housing and constitutes ~65% of total demand – rural housing 29%, urban housing 25% and low-cost housing 11%. Infrastructure and commercial construction make up the balance at 23% and 12% respectively. The focus on infrastructure sector and housing in the budget is expected to boost cement demand, including cement demand for rural housing, which is a significant contributor to the overall cement demand mix.

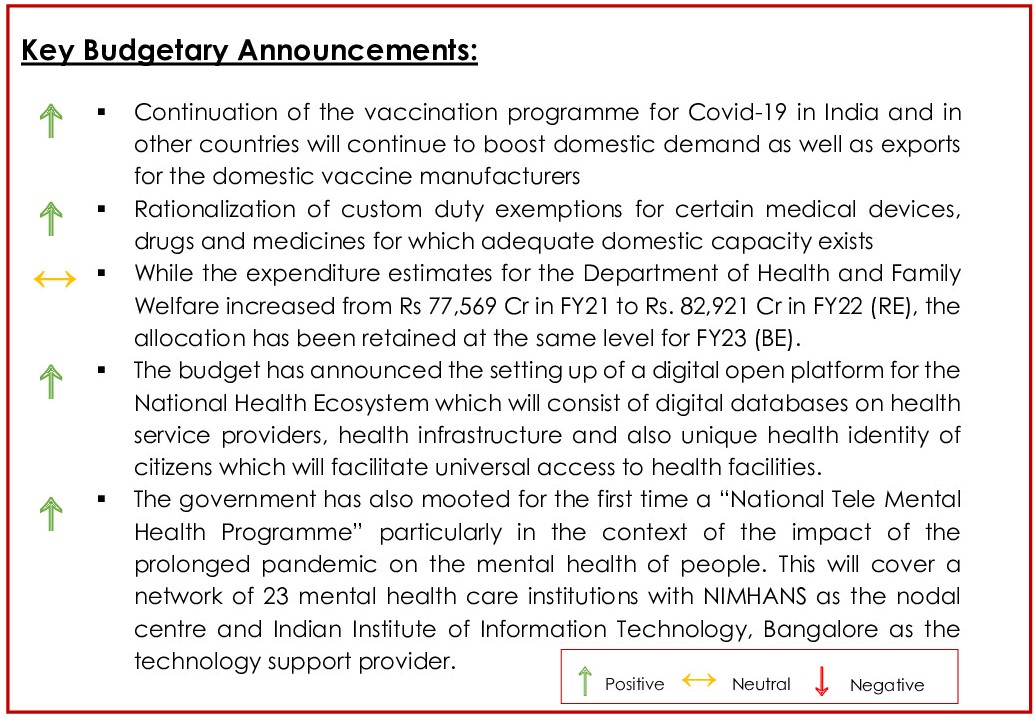

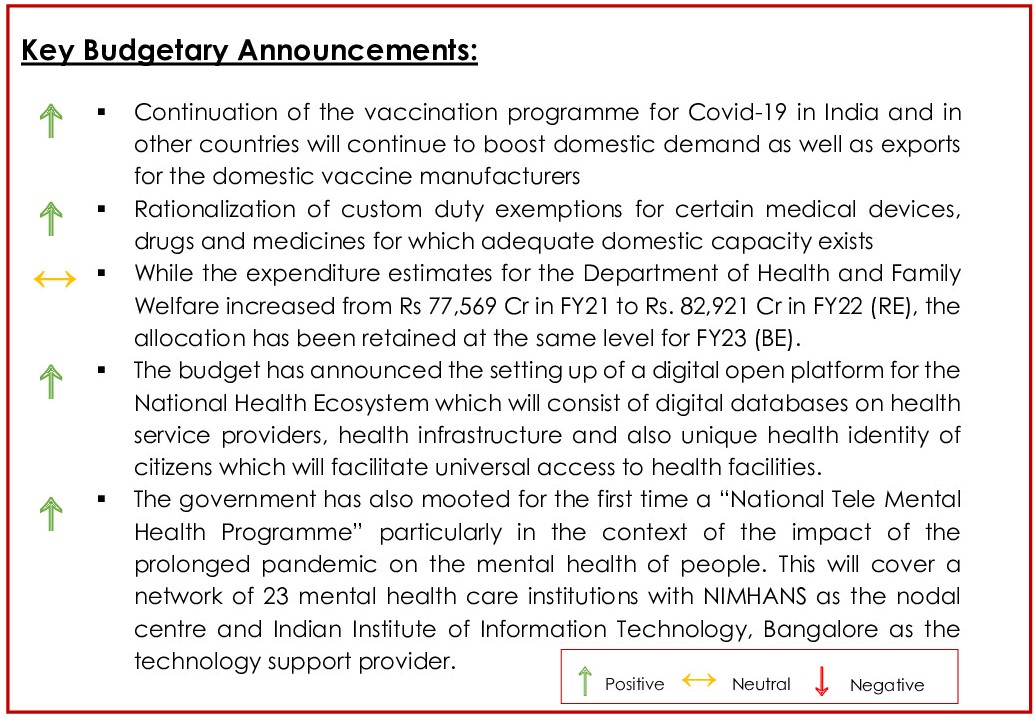

Drugs & Pharmaceuticals

Acuité Opinion

Overall - Positive

Impact Analysis

- Some of the domestic pharmaceutical manufacturers who have been impacted by imports of similar drugs will benefit as the custom duty exemptions on some of these products are proposed to be removed, thereby encouraging indigenous production.

- The continuing focus of the government on maximising vaccination coverage for Covid which includes booster doses along with high demand for such vaccines from a large number of nations, will remain positive for the approved Indian manufacturers.

- While the budgetary allocation for the health sector hasn’t see any significant enhancement, new initiatives are being taken to improve coverage of health services across the country through use of technology which will be positive for the pharma sector over the longer term.

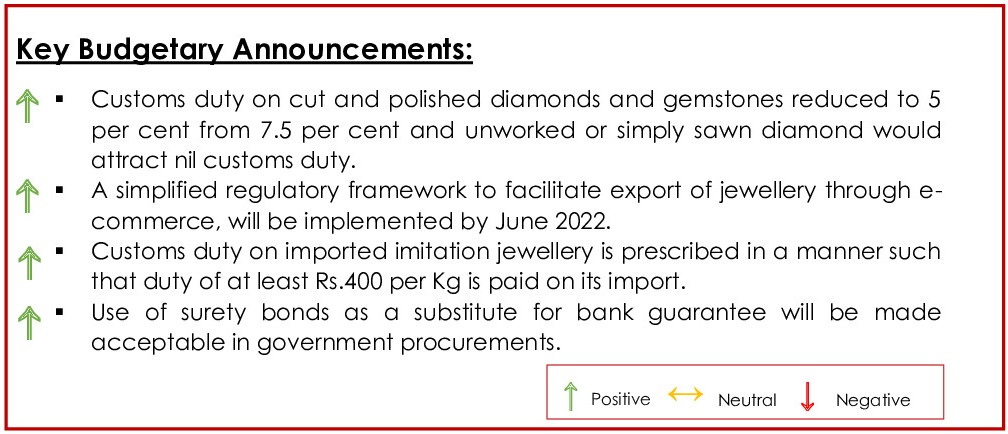

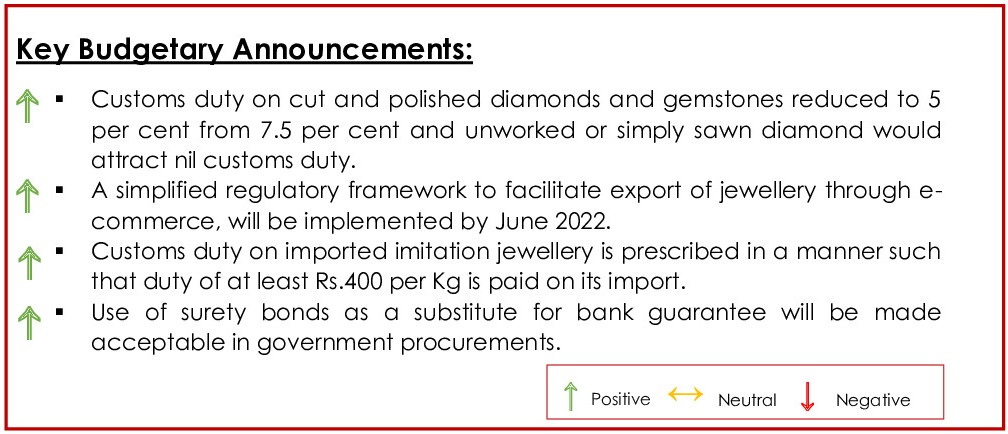

Gems & Jewellery

Acuité Opinion

Overall – Positive

Impact Analysis

- Reduction of duty on cut and polished diamonds and gemstones would reduce import costs for diamond manufacturers and traders and aid in improving the global competitiveness of Indian exporters.

- The proposed simplified regulatory framework is expected to ease the compliances and procedures involved in exports of gems and jewelry through e-commerce platforms. The initiative will support small domestic players to explore new business opportunities at lower costs and boost their business.

- The proposed duty on imported imitation jewelry will aid the large number of MSME players engaged in manufacturing of imitation jewelry, as the price competitiveness of domestically made products against relatively cheaper Chinese imports will improve.

- Acceptance of surety bonds as a substitute for bank guarantee will make gold imports relatively cheaper and simplify availability of duty free gold especially to SME exporters of gold jewelry, thus aiding gold jewelry exports.

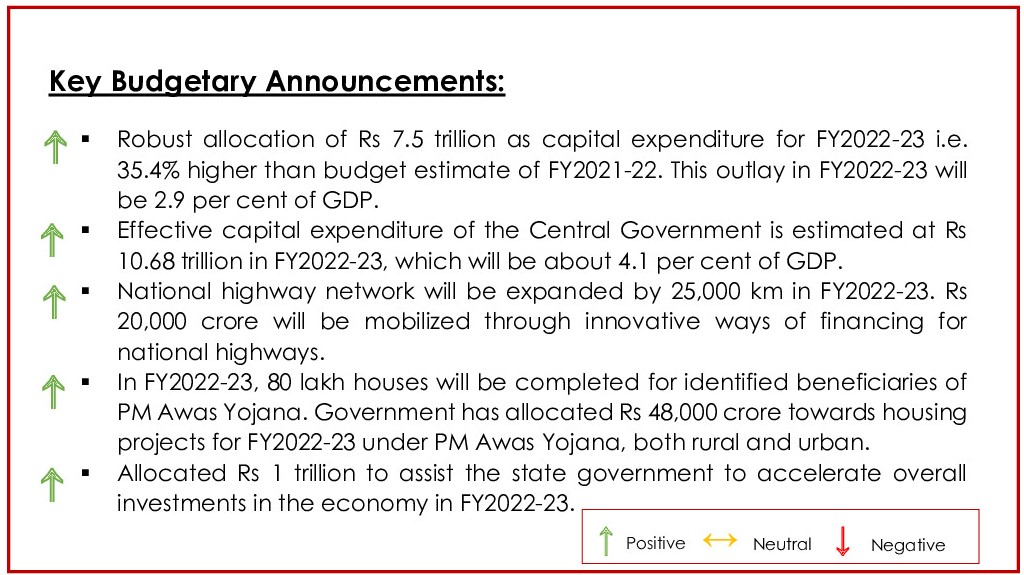

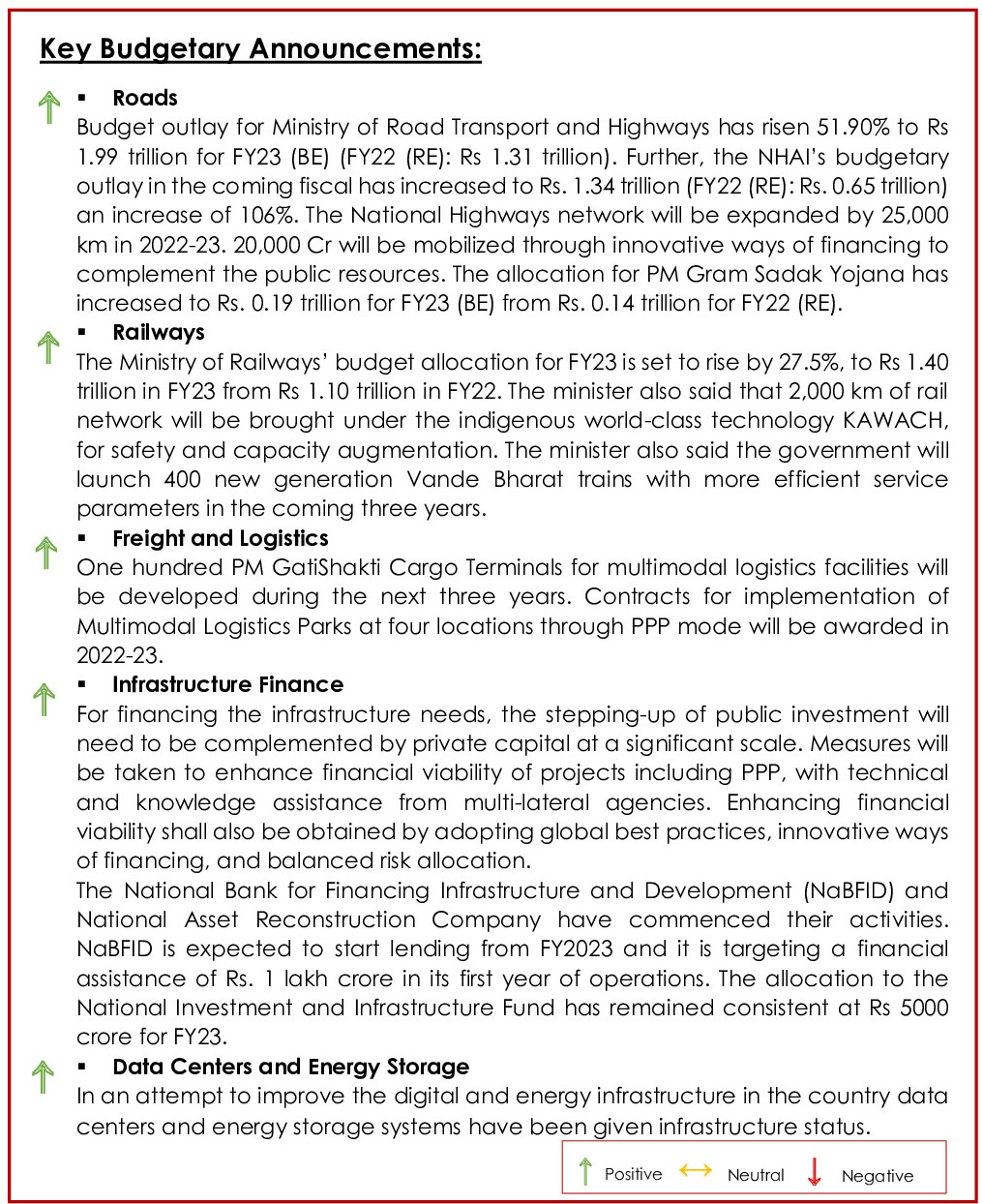

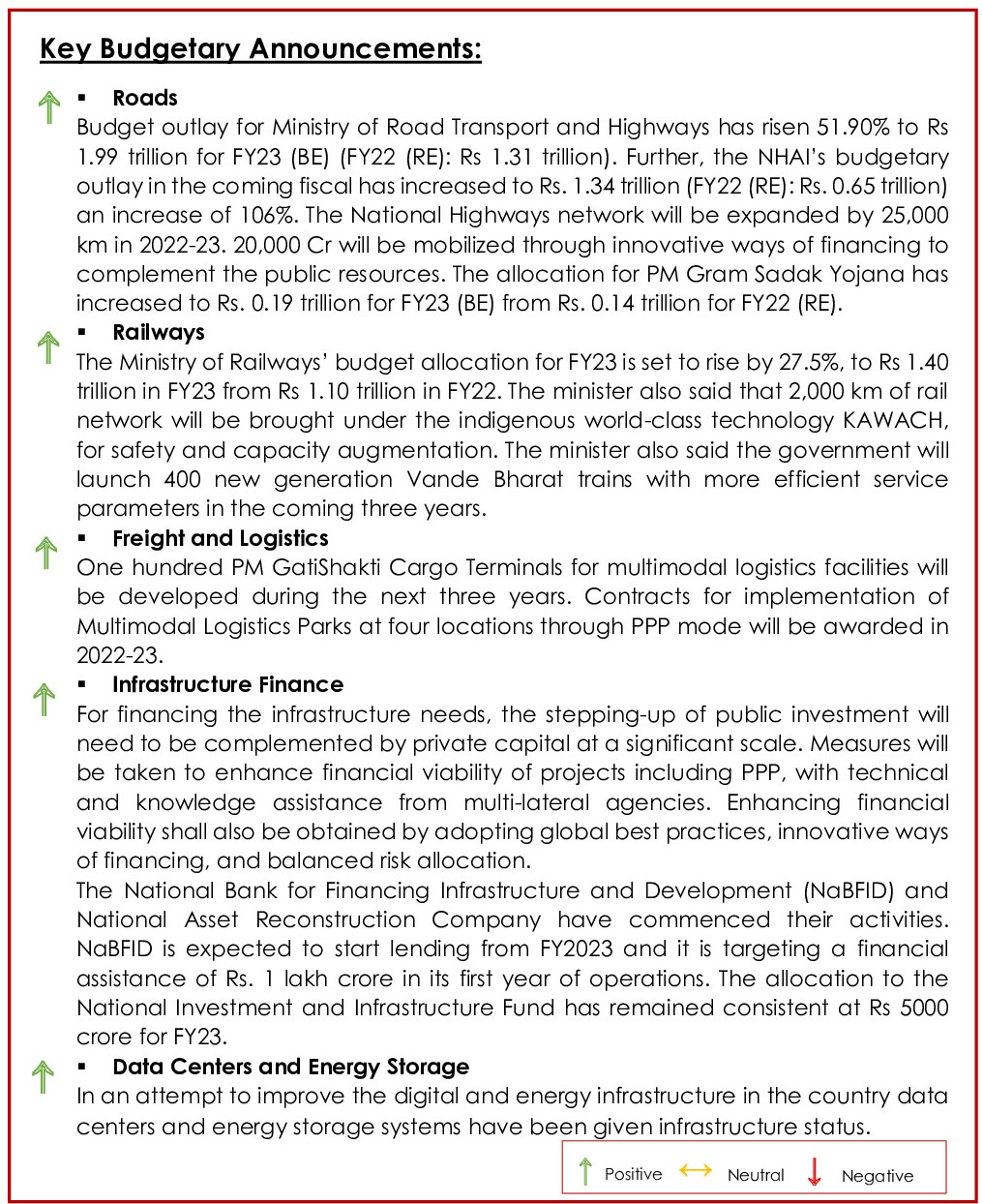

Infrastructure

Acuité Opinion

Overall – Highly Positive

Impact Analysis

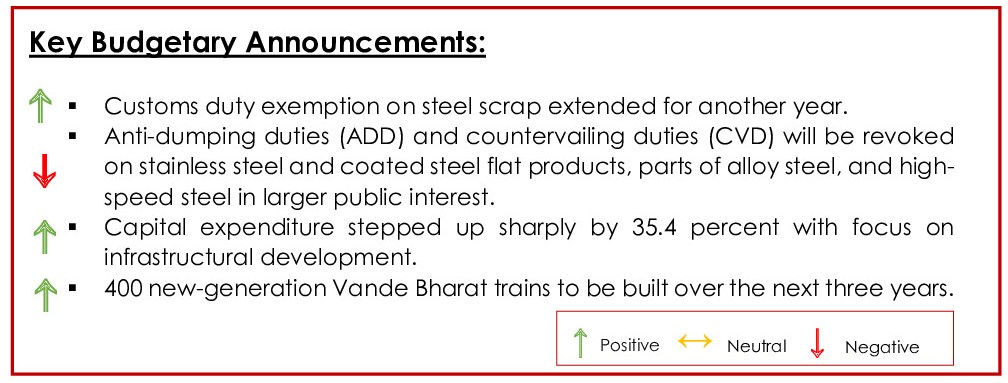

- Acuite believes that the substantially higher budgetary allocation to two key ministries (Roads and Highways & Railways) from the infrastructure perspective will help key create opportunities for private players in the segment. Added emphasis on roads is expected to provide healthy order flow to EPC contractors.

- The budgetary allocation towards adding 400 more trains under the Vande Bharat scheme which will be also manufactured in India will improve prospects for local manufacturers.

- The PM GatiShakti Master Plan will integrate 16 ministries across covering roads, railways, airports, ports, mass transport, waterways, and logistics infra segment in coordinated implementation of infrastructure projects. This is not only expected to create opportunities in the segments included under the scheme but create a multiplier effect by coordinated improvement in infrastructure across the country.

- Assistance to the private sector for increasing the financial viability of the projects by improving availability of funding through PPPs and introduction newer ways of financing is a key positive for infrastructure players. Funding availability to infrastructure projects will improve as the NaBFID commences its lending operations and the moves towards its target of Rs. 1 lakh crore in assets in the first year of operation.

- The infrastructure status given to data centers and energy storage systems will facilitate the financing available to these projects.

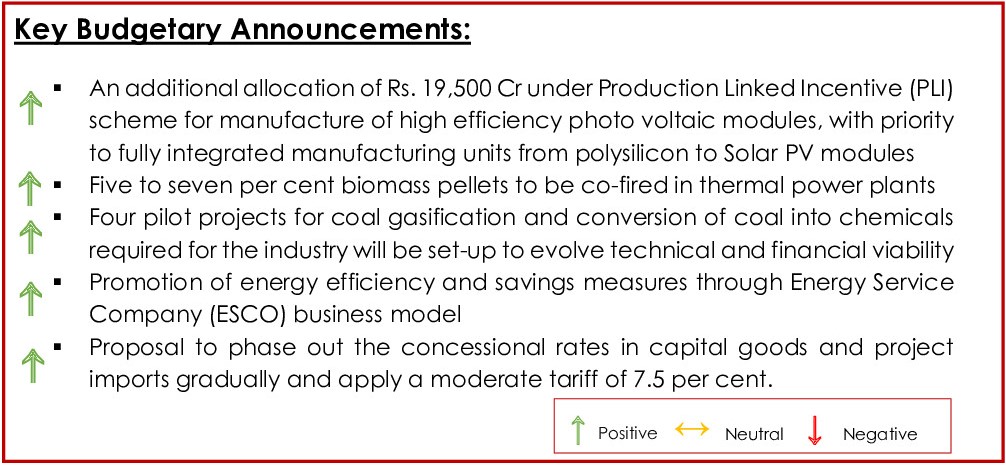

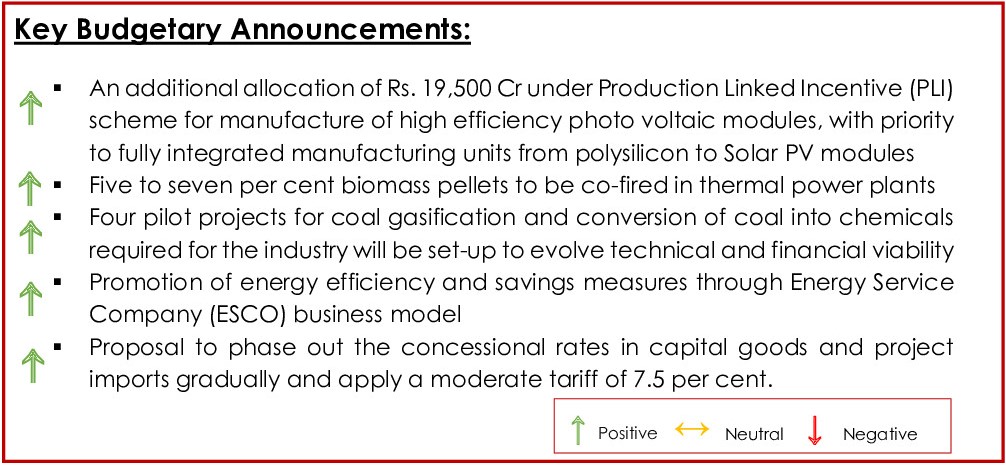

Power

Acuité Opinion

Overall - Positive

Impact Analysis

- The present allocation of funds for manufacturers of Solar Photo Voltaic modules stands at Rs. 24,000 Cr from existing funds of Rs. 4,500 Cr, post enhancement. This allocation is likely to boost manufacturing of PV modules and also domestic procurement of materials in the value chain. The PLI will be disbursed for five years post commencement of production and covers for 54,500MW of bids received (as per Ministry of Power’s estimates)

- Central government’s proposal for gradual withdrawal of concessional rates in capital goods for sectors such as power and project imports like coal mining projects, power generation, transmission or distribution projects etc would ensure growth of domestic industry, encourage local manufacturers and lead to successful implementation of ‘Make in India’ initiative.

- The use of biomass pellets in coal-fired thermal power plants would result in decrease in air pollution and CO2 savings of 38 million metric ton (MMT) annually. By using the agricultural waste that is otherwise burnt by farmers to generate electricity, this would provide extra income to farmers and job opportunities to locals in the region.

- Coal gasification is considered as cleaner option compared to burning of coal. The decision to set-up projects for coal gasification would aid in in meeting its Paris Agreement commitments.

- Acuite observes that there are currently 149 ESCOs registered by Bureau of Energy Efficiency (BEE). The announcement to promote energy efficiency and savings measures through ESCOs would facilitate capacity building for energy audits and ensure energy-efficiency related services companies to capture the untapped market.

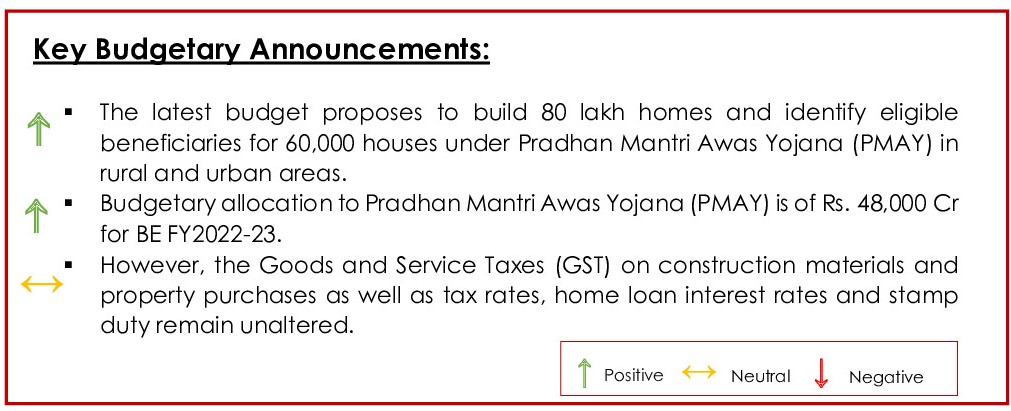

Real Estate

Acuité Opinion

Overall – Neutral

Impact Analysis

- Government’s focus is on urban planning particularly in Tier II and Tier III cities. This would be highly beneficial with the rise in population and career mobility

- The proposals announced that the Central Government and the State Governments are expected to join hands to extend the benefits made available to the affordable housing segment; by facilitating reduction of time required for all land and construction related approvals and reduction in cost of intermediation. This will continue to augment demand for affordable housing.

- Villages on the northern border are expected to be covered under the new Vibrant Villages Programme. Housing will be one of the primary activities under this programme.

Steel

Acuité Opinion

Overall - Positive

Impact Analysis

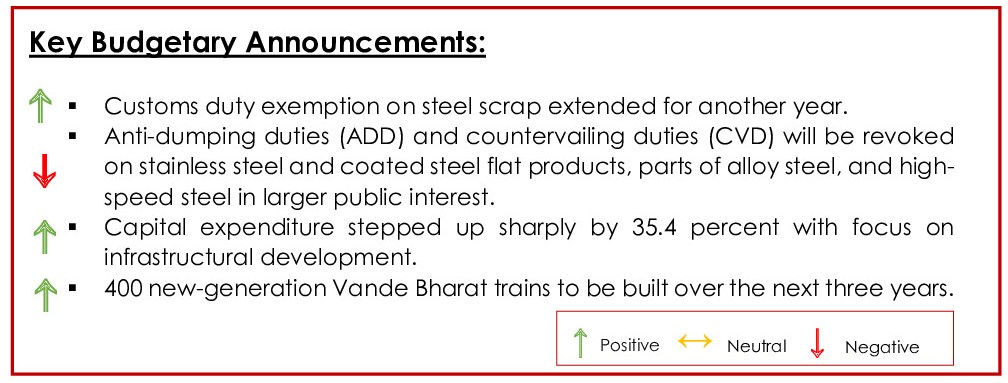

- Acuité believes that the demand for steel is slated to increase on account of Government’s thrust towards the infrastructure sector envisaged through steep increment in capital expenditure budget.

- Customs duty on steel scrap extended for another year till March 2023 to provide relief to secondary steel producers especially in the MSME segment, thereby reducing raw material costs to an extent.

- Countervailing duty and anti-dumping duty revocation on stainless steel and coated flat steel products, alloy steel and high steel bars is likely to increase imports to meet the shortage in domestic supply. This would rebound the prevailing extravagant high prices of metal thus moderating profit margins for the domestic players over the medium term.

- Sizeable capex target in FY2022-23 with focus on infrastructure development is expected to have a multiplier effect on the core sectors, thus, strengthening steel demand in the country.

- Boost to indigenous production and simultaneous expansion in railway network and trains will in turn push the domestic crude and finished steel production.