Key Takeaways:

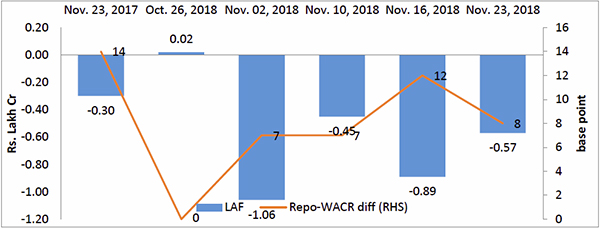

Liquidity:

The repo WACR differential stands at 8 bps indicates in the 4th week of November. The differential remains close to 10 bps indicates liquidity condition in the banking sector is in the comfortable zone. This is a result of net infusion of Rs. 320 billion by the RBI through OMO operation. Going forward, the Central Bank is likely to infuse another Rs. 400 billion through OMO operation in December, 2018 only. This will further ease the liquidity condition in the market and banking sector will have enough cash to lend. The credit deposit ratio, on the other hand, has exceeded 77. Higher credit demand is also weakening commercial banks liquidity condition.

Capital Market:

During last FOMC meeting, the Fed had indicated that fed rate has almost normalized. Considering pause in the fed rate hike cycle, the sovereign bond yield for most of the countries has been declining. In case of India, the 10 year G-Sec bond yield has dropped to a three month low of 7.77% in 4th week of November. As a result, the spread between Indian and the US 10-year G-Sec bond yield stands at a low of 431 bps. In addition to the FOMC note, country specific factor such as macro-economic stability in India is also boosting investors’ confidence on Indian economy.

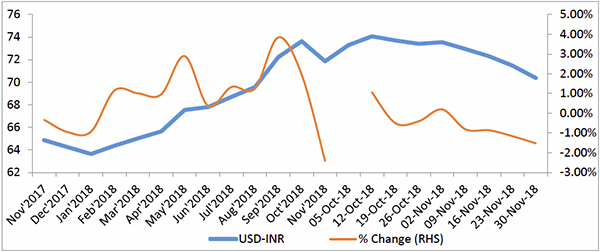

Currency Trend:

In last week, among the major currencies, South African Rand, Chinese Yuan, Russian Rubble, and Indian Rupee are highly appreciating against the US dollar. Normalization in global geo-political condition is restoring investors’ confidence on the economic outlook of Emerging Markets including India. We believe that net capital inflows to India are likely to accelerate in the coming months. Positive trend in net capital inflows along with lower crude price will further appreciate the Indian rupee against the US dollar.

Interest rates and ratio

| Interest Rate | Nov.17, 2017 | Oct. 26, 2018 | Nov.02, 2018 | Nov.10, 2018 | Nov.16, 2018 | Nov.23, 2018 |

| Policy Repo Rate | 6 | 6.5 | 6.5 | 6.5 | 6.5 | 6.5 |

| Call Money Rate (WA) | 5.86 | 6.5 | 6.43 | 6.43 | 6.38 | 6.42 |

| 364-Day Treasury Bill Yield | 6.29 | 7.47 | 7.48 | 7.42 | 7.33 | 7.27 |

| 2-Yr Indian G-Sec | 6.6 | 7.44 | 7.43 | 7.42 | 7.35 | 7.3 |

| 10-Yr Indian G-Sec | 7.21 | 7.84 | 7.84 | 7.81 | 7.85 | 7.77 |

| 10-Yr US G-Sec | 2.36 | 3.2 | 3.18 | 3.08 | 3.05 | 2.99 |

| 10Yr Indian bond Spread (in bps) | 424 | 464 | 466 | 473 | 480 | 431 |

| AAA Indian Corporate | 7.63 | 8.89 | 8.7 | 8.67 | 8.78 | 8.76 |

| AA Indian Corporate | 7.97 | 8.97 | NA | NA | NA | NA |

| AAA to10 YR Indian bond spread | 41 | 105 | 86 | 86 | 93 | 99 |

| Credit/Deposit Ratio | 73.41 | 76.75 | - | 77.05 | - | - |

| USD LIBOR | 1.69 | 2.58 | 2.61 | 2.64 | 2.64 | 2.69 |

Source: RBI, Investing.com

| Deposit (In Rs. Lakh cr) | Bank Credit (In Rs. Lakh cr) | |

| As on Nov 09, 2018 | 118.25 | 91.11 |

| As on Oct 26, 2018 | 117.71 | 90.33 |

| As on Nov 10, 2017 | 108.35 | 79.31 |

| YTD (% change) | 0.46% | 0.86% |

| YoY (% change) | 9.14% | 14.88% |

Source: RBI

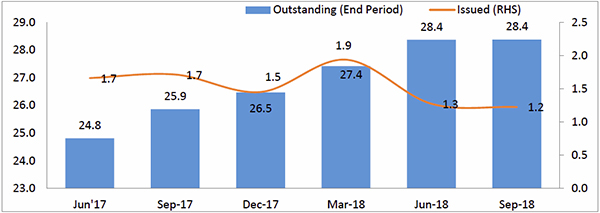

Bond Market:

| Commercial Paper (Fortnight): | Outstanding (In Rs. Lakh cr) | Amount issued (In Rs. Lakh cr) |

| 15-Nov-18 | 5.85 | 1.07 |

| 31-Oct-18 | 5.88 | 0.95 |

| 15-Nov-17 | 4.82 | 1.03 |

| % Change (MoM) | -0.62% | 12.63% |

| % Change (YoY) | 21.37% | 3.88% |

Source: RBI

Liquidity Operation by RBI:

Source: RBI

Note: Net injection (+) and Net absorption (-)

Corporate Bond Position (in Rs. lakh cr):

Source: RBI, Acuité Research

USD-INR Movement:

Source: RBI, Acuité Research