Key Takeaways:

Liquidity:

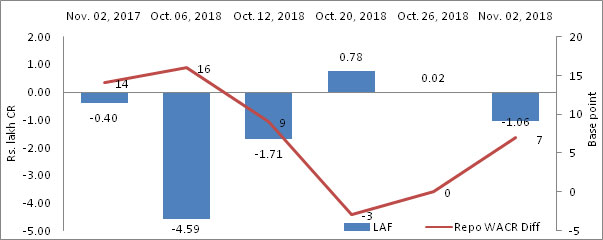

There is a sign of improvement in liquidity condition in the banking sector. With Rs. 100 billion infusion through OMO operation, the WACR stands 7 bps lower that repo rate in first week of November. It is noted that the differential was in parity in last week of October. Moreover, stability in the forex market has also further improved the domestic liquidity condition. However, further increase in Credit Deposit ratio indicates the liquidity condition is likely to remain tight in the coming weeks.

Capital Market:

Indian 10-year G-Sec bond yield has declined to three month low in second week of November, 2018. A de-trend in oil price and USD-INR currency pair gives a positive sentiment to the markets. Rising oil price was a concern of inflation as well as fiscal deficit. Therefore, G-Sec bond yield has been responding positively to the fall in oil price. In the US bond market, with the unchanged in US fed rate, normalization is expected in the US bond yield, which is almost at seven year high.

Currency Trend:

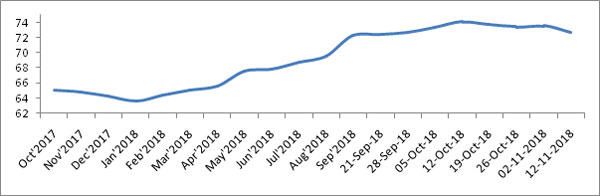

With a positive trend in capital inflows and fall in commodity prices, Indian rupee is appreciating against the US dollar. As market forces are appreciating Indian rupee, RBI has given pause to the selling of its forex reserve. The central bank had sold its forex reserve of around $8 billion in one month in October to control the currency volatility. We expect the USD INR currency pair to remain in upward trend in November, 2018.

Interest Rate & Ratio:

|

Nov.03, 2017 |

Oct. 05, 2018 | Oct. 12, 2018 | Oct. 19, 2018 | Oct. 26, 2018 | Nov.02, 2018 | |

| Policy Repo Rate | 6.00 | 6.50 | 6.50 | 6.50 | 6.50 | 6.50 |

| Call Money Rate (WA) | 5.86 | 6.34 | 6.41 | 6.53 | 6.50 | 6.43 |

| 364-Day Treasury Bill Yield | 6.25 | 7.77 | 7.58 | 7.50 | 7.47 | 7.48 |

| 2-Yr Indian G-Sec | 6.47 | 7.79 | 7.65 | 7.58 | 7.44 | 7.43 |

| 10-Yr Indian G-Sec | 7.12 | 8.02 | 7.96 | 7.88 | 7.84 | 7.84 |

| 10-Yr US G-Sec | 2.33 | 3.15 | 3.19 | 3.07 | 3.20 | 3.18 |

| 10Yr Indian Spread (bps) | 479 | 487 | 477 | 481 | 464 | 466 |

| AAA Indian Corporate | 7.63 | 9.00 | 8.31 | 8.63 | 8.89 | 8.70 |

| AA Indian Corporate | 7.97 | 9.74 | 9.49 | 8.97 | 8.97 | - |

| AAA to10 YR Indian bond spread(bps) | 51 | 98 | 35 | 75 | 105 | 86 |

| Credit/Deposit Ratio | 72.92 | - | 76.30 | - | 76.75 | - |

| USD LIBOR | 2.51 | 2.40 | 2.43 | 2.47 | 2.58 | 2.61 |

Source: RBI, Investing.com

Money Market:

| Deposit (In Rs. Lakh cr) | Bank Credit (In Rs. Lakh cr) | |

| As on Oct 26, 2018 | 117.71 | 90.33 |

| As on May 25, 2018 | 113.52 | 82.23 |

| As on Oct 27, 2017 | 107.97 | 62.23 |

| YTD (% change) | 3.69% | 9.85% |

| YoY (% change) | 9.02% | 45.16% |

| Commercial Paper (Fortnight): | Outstanding (In Rs. Lakh cr) | Amount issued (In Rs. Lakh cr) |

| 31-Oct-18 | 5.88 | 0.95 |

| 30-Sep-18 | 5.56 | 0.79 |

| 31-Oct-17 | 3.96 | 0.53 |

| % Change (MoM) | 5.76% | 20.25% |

| % Change (YoY) | 48.48% | 79.25% |

Source: RBI

Bond Market:

Corporate Bond Position (in Rs. lakh cr):

Source: RBI, Acuité Research

Liquidity Operation by RBI:

Source: RBI

Note: Net injection (+) and Net absorption (-)

USD-INR Movement:

Source: RBI, Acuité Research