Overview

Commercial Paper (CP) is an unsecured money-market instrument, issued by corporate borrowers, financial institutions and primary dealers to raise short-term funds (usually ranging between 7 to 365 days) for funding working capital requirements. In India, CP has traditionally been used as a low-cost instrument to replace working capital borrowings from the banking system. In recent years, highly-rated non-banking financial companies (NBFCs) have also started accessing CP in a large way to meet their short-term funding needs resulting in NBFCs and financial institutions accounting for around 60 per cent of CP issuers.

CP has several inherent risks. While some of these are specific to the instrument, many others are about the entity being rated. More often than not, entities have a tendency to rollover and refinance their CP Issue as a regular long term practice, warranting a long term view along with the short term.

To this effect, Acuité believes that the process of rating a CP Issue not only involves assessing the fundamental risks in the entity, but also ascertaining the structural (instrument specific) risks in the issue. This largely covers liquidity and refinancing risk apart from credit enhancement mechanisms (if any).

Scope

This document outlines Acuité's approach towards rating of Commercial Paper and covers the following.

Methodology for Rating Commercial Paper Issues

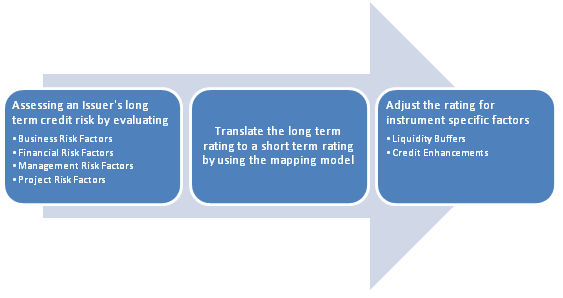

The three stage process for rating CP Issue is given below:

While CP is a short term instrument, since it is generally rolled over on maturity, it tends to remain afloat on a long term basis. In case the issuer fails to rollover the CP, the issuer's ability to refinance the CP is a function of its long term credit risk as the issuer must depend on fresh borrowings from Financial Institutions/banks or from the capital markets to prevent default on its CP related obligations. Therefore, the long term credit rating is indicative of the refinancing risk and the roll-over (or repricing) risk inherent to an issuing entity.

In order to assess the long term credit risk of the issuer, Acuité believes that an organisation needs to take into account three primary sources of risk:

Acuité places special emphasis on understanding the liquidity risk of the issuer, the long term resource mobilization ability and financial flexibility.

After arriving at the long term rating, Acuité believes that it is imperative to evaluate the issuer's liquidity position and stability in the periodic cash flows. To this effect, two key aspects are analyzed:

Commercial Paper issues tend to be refinanced and thus Acuité believes that it is imperative to analyze the entity's ability to refinance its CP issue on expiry – either by rolling over the issue or through alternative sources of funding. Acuité adopts a three stage approach to ascertain the same:

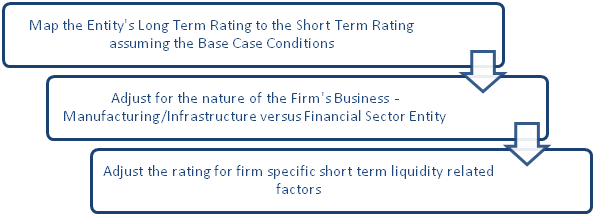

Acuité-assigned Short Term Ratings are dependent on the Long Term Ratings. Given below is the two-step processfollowed by Acuité to map the ratings.

Acuité may assign a higher or lower credit rating as against the base case mapping model presented below, to account for substantial differences in an entity's liquidity profile. For instance, availability of comfortable short term liquidity in the form of cash collateral or liquid investments or any other similar factor reduces the short term liquidity risk of the entity. Acuité may take an upward deviation and assign a higher short term rating for a particular long term rating as indicated in the mapping model below.

|

Long Term |

Short Term |

|

Acuité AAA |

Acuité A1+ |

|

Acuité AA+ |

|

|

Acuité AA |

|

|

Acuité AA- |

|

|

Acuité A+ |

Acuité A1 |

|

Acuité A |

|

|

Acuité A- |

Acuité A2+ |

|

Acuité BBB+ |

Acuité A2 |

|

Acuité BBB |

Acuité A3+ |

|

Acuité BBB- |

Acuité A3 |

|

Acuité BB+ |

Acuité A4+ |

|

Acuité BB |

|

|

Acuité BB- |

|

|

Acuité B+ |

Acuité A4 |

|

Acuité B |

|

|

Acuité B- |

|

|

Acuité C |

|

|

Acuité D |

Acuité D |

A Liquidity Back-Up facility is a mechanism that allows the CP Issuer to draw funds from a pre-arranged line if they choose not to roll over the issue. Such lines constitute lines of credits from banks and other financial institutions and are factored in assigning ratings to CPs. However, no credit enhancement is extended on account of the mere presence of such facilities. The reason behind the same is the possibility of such lines not being made available by banks, in case of a steep deterioration in the credit quality of the issuer.

CP Ratings are only enhanced by the presence of Credit Enhancement Options in the form of unconditional and irrevocable credit support facilities such as Back Stop Facilities, Guarantees by commercial banks or corporate entities. Such facilities are evaluated on three parameters:

In such cases, the rating is enhanced based on the credit risk profile of the entity providing the credit enhancement.