Real Estate Investment Trust (REIT)

29th April 2021 (Version 1)

The need for managing the risk-return trade-off while achieving optimal diversification among various asset classes has led to the emergence of several investment structures across various asset classes such as real estate, infrastructure and distressed debt. The nature of these instruments and the complexity involved makes them ideal investment options for the more evolved investor categories like high net worth investors and institutional investors. In the Indian context, an instrument that has been gaining in popularity that also witnessed the listing of the first Real Estate Investment Trust (REIT) on 1-April-2019.

The regulatory foundation for REITS was laid with the enactment of SEBI (Real Estate Investment Trust Regulations) in 2014. Subsequently, SEBI has issued amendments to these regulations from time to time.

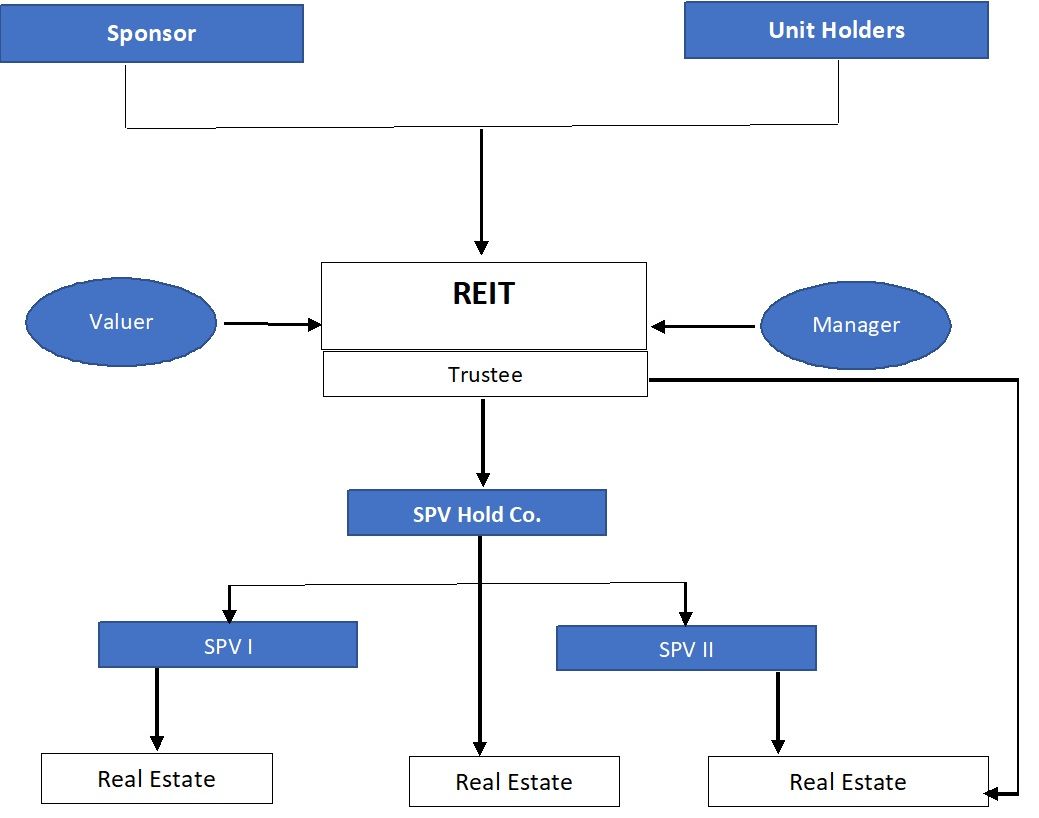

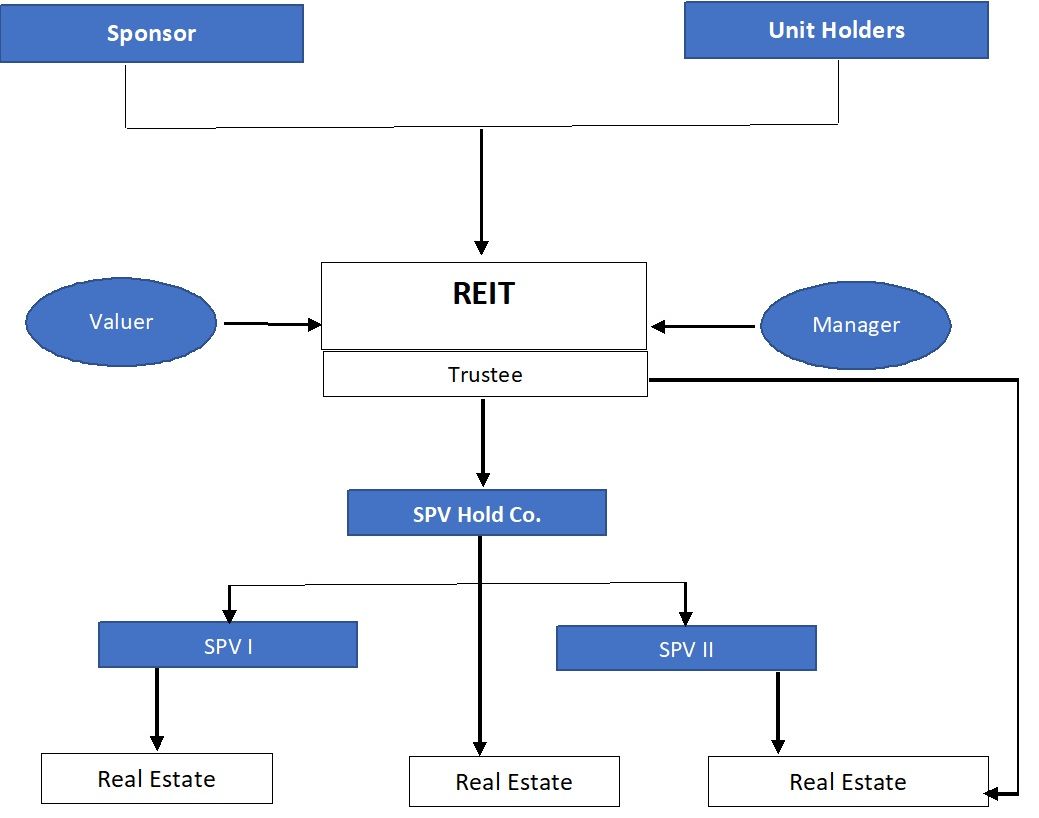

A Real Estate Investment Trust is a trust formed under the Indian Trusts Act 1882. It is structurally comparable to a mutual fund which mobilises funds from a large pool of investors for investing in a basket of securities (debt or equity). The key differentiator is that REIT as an investment vehicle raises funds from various investors (unitholders of the REIT) for investing primarily in a portfolio of completed and income-generating real estate assets. Besides investing in completed income-generating assets such as shopping malls, workspace and warehouses, REITs are also permitted the flexibility to invest in other assets like equity/debt of listed/unlisted companies engaged in real estate, mortgage back securities and also under construction properties (subject to regulatory restrictions). A REIT can either own the assets directly or through an SPV (Special Purpose Vehicle) or even through a holding company structure which in turn owns the SPVs. REIT are usually promoted /floated by real estate developers/ owner of commercial assets, which can also be private equity or real estate focussed funds (Sponsors of the REIT).

Key Aspects of the Regulatory Landscape

- Investments by a REIT can be either directly in real estate assets or through SPVs (Special Purpose Vehicles) or even through a holding company structure. The floor of 80% for completed and income-generating assets and ceiling of 20% in respect of under-construction properties, TDRs, mortgage-backed securities etc., are to ensure that the REIT cash flows are well defined, predictable and table.

- Investment in under-construction properties are allowed to the extent of 20% (ceiling) of overall assets and subject to minimum holding of 3 years from completion.

- Regulations stipulate eligibility of sponsor group such as a minimum net worth of Rs.100 Cr for the sponsor group along with specific track record criteria for real estate developer sponsors.

- Maximum leverage (on consolidated basis) including deferred payments and net of cash not to exceed 49% of the aggregate value of assets, effectively implying a consolidated leverage of less than 1.0x. The debt can be availed both at SPV level or REIT level.

- An external Credit Rating is required if the debt levels exceed 25% of the REIT assets.

- In case of listing of REITs, Sponsors, Sponsor Group & associates to hold a minimum 25% of units outstanding, on a post offer basis for 3 years.

- Minimum size of investment in a REIT by an investor is Rs.0.5 lacs. Minimum 200 investors required for listing (excluding sponsor group).

- Regulations also stipulate the conditions required for related party transactions.

- Investors in REITs include mutual funds, insurance companies, banks, multilateral institutions, FPIs etc. Certain categories of investors may have some regulatory restrictions on their investment quantum.

- 90% of the distributable surplus (NDCF) to be paid out by way of dividends to unitholders.

Advantages to Sponsor

- Avenue for Monetisation of real estate assets

- Cheaper source of funding due to inherently higher rating of a REIT vis a vis the balance sheet based borrowing of the real estate developers

- Diversity of funding profile

- Ability to leverage further to support under-construction assets

Advantages to Investor

- Low ticket exposure to real estate

- Higher & steady yields vis a vis other asset classes: mandatory distribution of 90% of NDCF as dividends

- Professional management

Key stakeholders in a REITs & their Primary Role

Sponsor: Generally, a real estate developer/ real estate focussed investor with significant experience in developing and managing real estate assets/ properties (For eg: Embassy Group, K. Raheja Group, Brookfield)

Unitholder: The investors in a REIT who are allotted units as per the quantum of their investment, indicating their pro-rata ownership of the net assets.

Manager: Entity vested with operational responsibility of managing the real estate assets

Trustee: Managing the trusteeship functions for the unitholders ( akin to a debenture trustee for debenture holders)

Valuer: A registered valuer responsible for the valuation of the assets under the REIT

REIT DIAGRAMMATIC REPRESENTATION

Assessment Methodology

Since a REIT functions as a conduit (pass through) structure between the unitholders on one side and real estate and related assets on other, the focus of assessment is on cash flow adequacy and asset coverage (valuation). Acuité’s rating on REIT instrument indicates its opinion on the ability of the trust to meet the debt servicing commitments to external lenders in a timely manner. It does not indicate likely return potential to the investors (unitholders) or future valuation of the REIT or viability of its underlying projects.

The key parameters to be considered while rating a REIT are group under Business Risk Analysis, Financial Risk Analysis & Management Risk Analysis are as under

BUSINESS RISK ANALYSIS

- Counterparty Risk: The quality of the key counterparties (anchor tenants of a mall/ office/warehouse etc) is a key factor to be considered in any REIT structure. Higher the credit quality of the counterparty, lower is the credit risk of delay /delinquency. The assessment of counterparty profile is relatively straightforward in case of office space segment where the clientele would be limited and likelihood of churn over the medium term is also low. However, in case of a larger number of lessees (i.e. in case of malls/ large commercial complexes) the assessment becomes slightly complex. In case of a mall, typically there would be 4-5 anchor clients such as a multiplex, reputed multibrand retail players etc., who generally provide long term stability to the rental stream. Due to their large area requirements and their ability to attract large client footfalls, these anchors enjoy a concessional pricing vis a vis the other multiple smaller lessees occupying smaller areas. The anchor clients are relatively stable vis a vis smaller lessees who may witness a churn based on market wide and unit specific factors. In a multiple lessee situation, the top 5/ 10 clients (in terms of revenues) can be evaluated to gauge the overall clientele profile and also extent of client concentration risk. The granularity of the lessee portfolio, whether in the office or commercial space, is an important element in the REIT consolidated business profile. While excessive dependence on 2-3 clients for rental revenues may be perceived to be risky, it has to be evaluated from the credit quality of these clients and the expected stability of the revenues from these clients. In view of the recent trend of having a minimum rental plus a variable revenue sharing model, the cash flow projections may need to factor in the inherent volatility in that scenario.

- Revenue Stability, Early Exit Risk & Renegotiation Risk: From a lending perspective, the steady revenue stream associated with the lease rental based term loans transactions differentiates them from other project-based term loans. In order to assess the revenue stability, Acuité seeks to understand the underlying lease contracts with existing clients such as start date & end date of lease agreement, area occupied, rental to be paid, security deposit, step up provisions etc. Usually, the lease agreements for retail space, especially in non-anchor category are initially entered for tenures of 3-5 years with renewal clauses. The revenue stability could be impacted on account factors like non-renewal of agreements, sharp decline in the credit quality of existing clients and unanticipated early exits due to lower than expected business levels. All lease agreements usually have clauses which stipulate an initial lock in and early exit clauses which provide the lessee to seek an exit prior to the expiry of the regular lease term. Since early exits cause a disruption in the revenue streams of the lessor, as a risk mitigation, the lessees are required to pay a pre-agreed amount in case of early exits. The security deposits placed by the lessees can also be adjusted against such payments. The key risk to the lessor (borrower) in case of early exits by an existing lessee is of identifying a suitable alternative lessee within a reasonable time span to minimise the impact on revenue streams. The concept of WALE (Weighted Average Lease Expiry) assume importance as a metric in REIT structures for tracking revenue stability from existing clients. These risks are accentuated in an economic downturn when more clients may opt for early exits due to challenging business conditions and it may be difficult to find alternative lessees, thereby impacting the overall occupancy levels of the property.

From an analytical standpoint, the aspects to be evaluated are (i) length of association of the lessee, (ii) extent of lessee’s investment in fitouts/ infrastructure at the said property, and (iii) criticality of the said space to the overall operations of the lessee. Generally, the longer the association, lower are the chances of early exit by the lessees. Similarly, a significant investment in fitouts and infrastructure by the lessee will act a deterrent to early exits. The nature of operations carried out at the leased facility also has a bearing on decision to seek an early exit. For instance, in case of a highly profitable branch of a retail jewellery company or a bank or a branch of an IT company with a large headcount of highly skilled personnel working out of that space, any change in location could be disruptive to the lessee’s operations.

- Demand Supply Dynamics & Location: The demand supply dynamics of real estate market depend on several factors like level of economic activity in the region, retail spending patterns, current projects in the pipeline, government policies. Again within real estate, the dynamics of the retail segment will diverge from the demand for office space. For retail space, the location of a property is a critical factor influencing its revenue profile and ability to maintain optimal occupancy levels. A mall in a central location of a city with developed infrastructure like adequate parking spaces and well connected to surrounding residential localities will be an attractive option for the retailers. Such a mall may, in fact, command a premium in its rentals in view of the high footfall expectancy and large catchment area in the initial stages of development of the city/town. However, with the gradual development of the city/metro in its satellite regions and across the periphery, these properties will face competition from newer properties. In case of office space, key factors influencing demand are connectivity, availability of supporting infrastructure like parking spaces, proximity to government offices and banks, proximity to clients and suppliers and quality of common clients like restaurants etc. Shifts in pockets of economic and commercial activity could impact the demand for office space in any given region. The demand supply dynamics could also be influenced by slowdown in level of economic activity which could result in lower demand for office space forcing corporates to go in for rationalisation of headcount, shifting to low cost locations, outsourcing or streamlining processes by bringing them under one location etc.

These macro aspects have a bearing on the valuation of the real estate assets and the future rental streams. The rental dynamics and occupancy levels, in turn, influences REIT’s stability of cash generation and its ability to meet its debt commitments in respect of its external lenders and its dividend distributions.

FINANCIAL RISK PROFILE

In a REIT structure, the prime focus is on valuation and cash flow coverage. The regulations stipulate the maximum leverage and the distribution of net distributable cash flows. The adequacy of the cash flows will be critically examined and sensitivity to future rental movements will be examined. The key metrics will be LTV ratio, Interest coverage, Net Debt/ EBITDA and adequacy of cash flows vis a vis debt servicing commitments. In case of longer tenor debt with bullet amortisation structures, Acuité will assess the mechanism to ensure adequate cash flows for redemption.

As is normally the approach followed in case of real estate projects, cash flow based approach (rather than a Profit and loss approach) is preferred wherein periodic cash inflows (net rentals & allied inflows like parking charges, CAM recoveries) are compared with cash outflows (operating expenses, interest costs and principal repayment obligations) to assess the debt servicing ability . In view of the steady rental cash flows from a diversified basket of completed income generating real estate assets and safeguard mechanism such as escrow accounts in place, a lower DSCR ( vis a vis a realty business with ongoing construction projects) is acceptable in such cases. Since a significant proportion of the cash flows at the SPV level / holding company level are up streamed to the REIT and the debt levels are also monitored at a consolidated level, Acuité will consider the consolidated approach while assessing the cash flow adequacy. The financial flexibility in terms of ( existing debt vis a vis existing value of assets) is also assessed to understand the buffer available to raise additional debt to support under construction properties/ fresh asset acquisitions.

Presence of DSRA mechanism

In certain transactions, Debt Service Reserve Account is stipulated, which could be a fixed deposit on which the lender has a lien. Typically it would be comprising debt servicing obligations for a period of say 3-12 months. The DSRA serves as a liquidity buffer. In the event of a shortfall in inflows due to factors like delays in rental payment by some of the lessees, the lending institution can utilise the amount under DSRA for making good the shortfall in debt servicing obligations. Subsequently, the DSRA will have to be replenished. The presence of a DSRA is a strong positive from a rating standpoint, especially if the DSCR metrics are subdued.

Management Risk Analysis

Integrity

Any past instances of defaults/ delinquencies/ composition with lenders by the sponsor management. Any instances of serious punitive action by Real Estate Regulator

Competence

- Demonstrated expertise in real estate activities across geographies, number of properties developed and managed across various segments (i.e. malls, office space, commercial complexes, warehouses etc.) both in terms of volume (million sq.ft.) and value.

- Demonstrated ability to attract and retain marquee clients across various sectors in existing properties

- Track record of repayment in LRD debt of the sponsor in the past

- Ability to raise funding at competitive rates through diverse sources

Risk Appetite

Propensity to grow aggressively by overleveraging (Maximum LTV ratio to be maintained will be the key determinant)