Business Risk

The credit profile of a particular entity is significantly correlated to the credit profile of the industry to which the entity belongs. The industry characteristics are common and overarching for all industry players. Accordingly Acuité evaluates the Industry risk while evaluating credit profiles.

A company needs to be assessed in the context of the industry it belongs to. Industry evaluation brings out the effect of various factors on business prospects and the general operating environment. Accordingly, this evaluation lays the ground work and reference point for the entity to be rated. Factors determining an industry's credit risk profile are explained in detail below.

A country's economic performance has a profound impact on the prospects of various industries and sub-industries. Key macro-economic variables considered are the economic growth rate, foreign exchange risk, interest rate risk and commodity risk as these factors have a direct bearing on the industry's profitability margins.

The current and future imbalance between demand and supply determines product price trends. This impacts realizations and hence industry profitability.

Market Structure refers to the manner in which companies across an industry are organised and the competitive moves adopted by different players. It has a significant bearing on the pricing power and profit margins. The key points to be analysed are:

The government influences the economy and its sub-segments by way of various policy measures to channelize resources based on the needs of a society. The present day policy measures include:

In assessing the regulatory framework, one must take into account the stability of these policies. Policy reversals can send confusing signals and create uncertainty for various industry participants. The overall impact of the regulatory environment can be gauged by its effect on competition, cost structure, growth prospects, profitability and ultimately on its sustenance in the near-to-medium term.

While evaluating an industry it also is necessary to assess its future profitability. An opinion on the same is a culmination of various factors mentioned before. Here's reiterating the salient ones:

This assesses the ability of the enterprise to sell its goods and services. This section examines the company specific analysis that covers risk drivers on the revenue side. The main emphasis is on analysing the competitive position of a company in the market place with respect to pricing and volumes. Key risk indicators include:

A key factor affecting future volumes and pricing power is the current and projected market share of the company in its main product categories along with the size and growth of those segments. It is necessary to ascertain customer preferences in each of the product segments and also to determine if growth drivers that were prevalent in the past continue to hold good in the future. Also, the competitive advantage of the company in the market in terms of brand, product quality, innovation, cost, customer service, and committed off-take in the form of long term contracts with existing customers, sales to group companies etc. and their sustainability need to be gauged.

Revenue diversification can be gauged by analyzing revenue break-up by product, by geography, by customer and by industry to ascertain concentration or reliance on a particular revenue stream. A diversified revenue stream is likely to withstand shocks in a particular market or geographic segment.

An additional factor to be considered while assessing a firm's future revenue is the introduction of new products and services. New product introduction can be an extension of the existing product line, compliments or in a completely new domain.

It is necessary to ascertain whether the company can maintain/increase price realisation on its products and maintain/grow volumes. This is influenced by demand-supply factors and competitive pressures. Here, brand presence and size become important factors to guard against price erosion.

One needs to analyse the presence and success of a company's market penetration efforts. Expanding the presence, new applications of existing products, ramping up delivery channels, entering into strategic alliances etc. are all important. Such factors help evaluate the sustainability of the company's projected revenue plan.

Peer analysis with respect to the following factors can provide an insight into the relative position of the company and its market standing:

|

Market Share |

Distribution network |

|

Sales and Profit Growth |

Innovation |

|

Product Range |

Geographic Spread |

|

Brand Strength |

|

Operating Efficiency takes into account the effectiveness and efficiency of different operational aspects of an enterprise in detail. Efficient operations apart from ensuring quality of product or service lead to cost competitiveness. The cost structure of the company is compared with the cost structure of competitors to identify key cost advantages or vulnerabilities. Trends of key costs elements are useful in analysing if the company is facing or is likely to face pressures on the cost front. The various factors to be examined are given below:

Firms may adopt a high fixed cost-low variable cost or a low fixed cost-high variable cost strategy. To evaluate different production formats it is necessary to compute the break-even point for each player and study the merits and demerits of each strategy. The overall cost is further broken down into constituent elements such as raw materials, power and fuel, wages and salaries, logistics cost, sales, general and administrative expenses etc. This is compared with its peer group. Operational strengths and weakness are assessed with such an analysis. While assessing input related risks one must consider the level of vertical integration, long-term sourcing arrangements for assured raw material supply, pricing power of suppliers, uninterrupted supply of utilities, labor relations etc and their cost implications. The cost of maintaining a logistics and distribution network is vital for perishables (retail industry), bulk goods (cement) and on-demand/customizable products (e-commerce).

While projecting future financials it is essential to factor in the role of technical and process improvements in shaping cost structure. Quality improvements, use of enhanced information technology applications such as ERP, CRM etc, deployment of analytical tools in determining product-mix, procurement strategy, inventory and logistics management etc., - play a vital role in optimising the supply chain, minimising costs and sustaining operations in the long run.

To forecast the cost structure it is necessary to gain understanding of trends related to key cost elements. This is driven by supply-demand dynamics of the particular commodity, presence of captive sources, use of alternatives, long-term arrangements with suppliers, government policies etc. The likelihood and impact of unexpected shocks in the form of energy shortage, fuel cost spikes, unfavorable litigation outcome, environmental issues also need be factored in along with the firm's ability to withstand the same.

Acuité also examines the sustainability of operations of the entity, compliance with pollution control norms and impact of the entity on the surroundings and environmental risks arising thereof.

Management Risk

This is a very important aspect of the evaluation. The quality of management has a crucial bearing on the performance of an enterprise. The assessment focuses on management quality, competence, governance and risk attitude. The risk framework for assessing the same has been laid down below:

Promoters influence management selection, decision making and future course of the company. Before analysing the current management and its strategy, it is essential to understand certain aspects about the promoter:

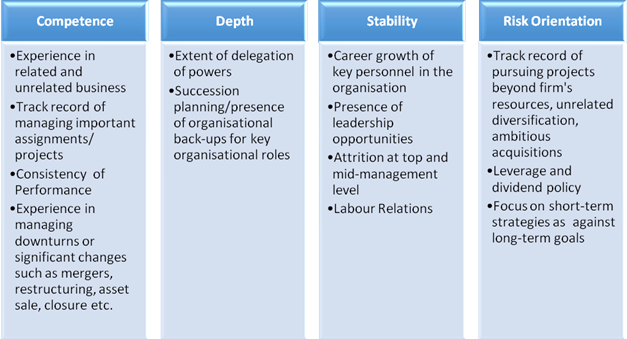

From a risk perspective the leadership potential of an organization is an important indicator of its credit risk as it influences strategy, execution and ultimately the ability and intention to fulfil financial obligations. In assessing leadership it is necessary to focus on four aspects: competence, depth, stability and risk orientation. The Key Risk Indicators (KRIs) are shown below:

Confidence of the various stakeholders of a firm is affirmed by the values of its leadership team. The manner, in which a company conducts business, has a bearing on perception of the customer (about the company) and its standing. In assessing a firm's risk, any deviation from expected and accepted norms with respect to management integrity has the potential to notch down its ratings based on the magnitude and severity of deviation. Key Risk Indicators (KRIs,) are as follows:

Strategic direction (or intent) refers to the position adopted by an organisation to differentiate itself from its competitors while simultaneously working on future plans. A firm may want to compete on cost, innovation or serve a niche segment to distinguish it from other market players. While assessing strategic risk, it is necessary to understand how a company's strategy has evolved over time in response to market forces and organizational priorities as set by its promoter and/or top management. This needs to be analyzed in conjunction with the various moves undertaken to achieve strategic objectives such as undertaking greenfield/brownfield projects, mergers and acquisitions, sell offs, tie-ups to name a few. This historical context helps place the current strategic intent and the future plans in perspective.

Along with a capable management team and an effective strategy, it is necessary for the management team to adopt the best practices in corporate governance. This gets reflected in the composition and functioning of the board, attitude towards stakeholders and disclosures among others. It is also important for the management team to undertake a systematic planning exercise that sets organizational priorities and ensures that those priorities percolate to the middle and lower management helping the organization's review mechanisms and track progress of plans and re-evaluate strategies and goals.

The Key Factors - to be considered are:

Financial Risk

The financials of an enterprise are a clear indicator of its performance. A good business and management should ultimately reflect in the financial position of the enterprise. Financial evaluation assesses the enterprise's strength of cash flows vis-à-vis its debt obligations. The focus is on accounting quality, reputation of auditors, track record of the financial performance in terms of growth, profitability, break even, value addition, liquidity, cash flow adequacy, level of indebtedness, level of overall outside liabilities, quality of receivables, and quality of investments. Aspects such as contingent liabilities, auditor's qualifications and notes to accounts are studied in detail.

While a number of financial ratios are considered, important ones are debt/equity, return on capital employed, profitability margin, asset turnover, interest cover, debt service coverage, cash accruals to debt and the size of net worth. The relative importance placed on different ratios would depend on the nature of business. These ratios are compared with peers and bench marks for different ratings.

As the rating involves assessment of an enterprise's ability to meet future debt obligations, significant stress is laid on the projected performance in terms of assumptions, sensitivity to changes in assumptions, projected capital expenditure etc.

Acuité evaluates the financial flexibility of an enterprise in terms of its ability to generate additional funds from various sources if need arises. Its track record in raising funds from the banking community, institutions, capital markets and money markets is analysed. The relationship with the lender community is important. Availability of liquid, marketable securities and assets would also impart financial flexibility to an enterprise. In addition, postponing capital expenditure, may be for a limited period, would also provide certain financial flexibility. - -

Financial risk parameters are used to evaluate credit risk. While analysing financial performance, it is essential to factor in the firm's accounting and financial policies as these play a major role in arriving at comparable figures. Apart from accounting adjustments the analyst evaluates historical trends, future financial projections and the resource mobilization ability of the company.

While using a common yardstick to compare the financial performance of various firms, it becomes imperative to adjust published financial figures and factor in company specific policies. Some of the points considered are:

Historical financials provide a snapshot of the financial health of the company. Financial projections have to be assessed in the context of historical financial metrics as any sharp departure should have a macro-economic and business justification. Historical analysis should span 3-5 years or a complete business cycle. Sub-factors considered in the analysis are:

These factors are compared with the nearest peers to find the relative risk standing.

The analyst computes future financials (profit and loss, balance sheet, cash flow, ratios, break-even analysis etc.) based on future capacity expansion plans, funding strategy, industry outlook, sourcing arrangements, price trends of underlying raw materials etc. Financials are stressed by varying key assumptions to study the impact on debt repayment ability as measured by critical metrics such as debt service coverage ratio and interest coverage ratio.

Resource mobilization ability reflects the firm's ability to access easy and cost-effective finance to fulfill obligations under normal and stressed conditions. Under normal conditions, cash inflows and planned outflows need to be matched.

|

Cash Inflows include |

Cash Outflows include |

|

Cash accruals from business |

Debt repayment |

|

Access to multiple sources of funding - equity markets, bank finance, institutional support, trade credit, asset sale etc. |

Planned capital expenditure and investments |

|

Working capital requirements |

Firms should also be in a position to raise resources under cash crunch situations that arise either due to poor firm prospects or external factors. Following factors need to be considered:

Project Risk

Projects are important for growth. But, projects undertaken by an enterprise could significantly alter its risk profile. The nature of the project in terms of green field, brown field, diversification, expansion is examined. Unrelated diversification and taking up projects of very large size in relation to its existing operations increases risk. A view is taken on the project after considering all aspects of project appraisal such as the cost of the project, means of financing, financial closure, product, technology, implementation risk, time and cost overruns, raw material availability, market and demand supply analysis, financial projections, project implementation skills and track record of the management in project implementation. All assumptions are validated and a sensitivity analysis is done to see the impact of different variables on the financial position.

An evaluation of the project risk is undertaken if the company embarks on a new project(s) either by way of expansion or acquisition or starts a new business. Projects involve considerable risk in terms of large cash outflow, tying up equity and debt funding, long gestation period for project completion, interplay of various external agencies such as regulators, vendors, shareholders, borrowers, uncertainty of revenues, mismatch of cash inflow and outflow etc. Factors to be considered while analysing project risk include:

There needs to be a clear rationale for the proposed project and the competitive advantages it offers. The project should provide synergies to existing businesses and must be commensurate with the size of the firm. The project may offer access to new markets, product technologies, customer base, access to raw materials, economies of scale or enhance market position.

Delayed or abandoned projects result in heavy sunk costs, loss of market share, lost opportunities and eventually cause a drain on cash flows. The chances of project delays are influenced by:

This refers to the ability of the firm to tie-up funds for the project both at the initial stage and on an ongoing basis. The sub-factors considered are:

The ultimate viability of the project is dependent on how the company can drive revenues, manage costs, and generate cash flows to meet its financial obligations. Revenue is influenced by industry conditions, company's product positioning and market penetration efforts. Cost competitiveness is governed by economies of scale, synergies with existing businesses, control over raw material sources, location advantages etc.

Parent and Group Support

An enterprise belonging to an established business group or a company is on a different footing compared to a stand-alone enterprise. The former could benefit from the parent/group in terms of credibility, brand equity, managerial, business and financial support. Notching ratings of individual companies up or down is based on the assumption that a company's credit worthiness, apart from its own business and financial strengths and weaknesses is also dependent on the backing it enjoys with the group/parent/government.

The degree of linkage between the entity and its group companies/parent/government needs to be ascertained to decide the extent of notching. Some of the factors influencing the degree of association are usage of common name, size of investment and holding in the entity by its parent/group/government, past instances of support etc.