A hallmark characteristic of infrastructure entities is that they are engaged in basic services and are insulated from demand risk to a large extent. The commercial viability of such entities is usually supported by government policy. The criteria therefore is applicable to Roads, Ports, Power, Telecom and other social infrastructure.

Framework for evaluation of risk in infrastructure sector entities

Unlike corporate sector entities who enjoy greater pricing flexibility, the pricing flexibility for infrastructure sector entities is limited. Also, the profitability of corporate sector entities is driven by market forces and therefore highly susceptible to change in operating condition which is in stark contrast to profitability levels of infrastructure sector entities. Hence, the risk assessment framework for infrastructure entities is materially different from corporate sector entities.

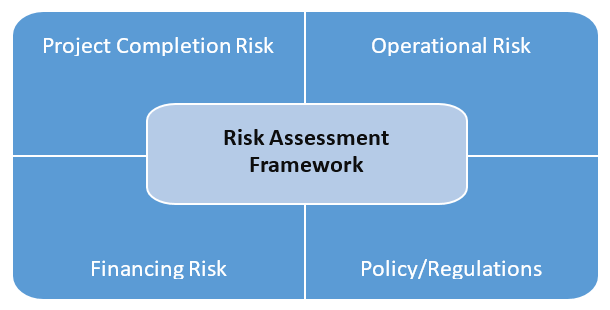

Chart 1: Risk

Assessment Framework

This criteria will apply to all entities which exhibits characteristics similar to an infrastructure asset.

Acuite conducts a comprehensive stage wise evaluation of the risk parameters defined above for credit risk evaluation of infrastructure asset to arrive at the rating. The risk assessment framework followed by Acuite provides the necessary inputs to form a view on the cushion available for debt repayment of such assets. This framework considers the typical stress factors that a project may witness over its life such as the changes in macroeconomic environment, benign/adverse changes in cost structure, risk emanating from force majeure events, changes in policy rates amongst others.

Acuite

therefore relies on sensitivity analysis to evaluate the interaction of project

cashflows with aforementioned stress factors. The analysis however has its own

limitations as the level of impact of such stress factors or a combination

thereof may result in changes to cashflow beyond what may have been considered

while arriving at the rating.

A. Project Completion Risk

An infrastructure asset has various risk involved at various stages, during the construction phase the project is subjected to risk associated with non-completion of project within stipulated time and cost budgets. A project even though is being developed right on schedule may still yield lower than anticipated cashflow if the project is not developed up to the standards as envisaged in the planning stage leading to lower cushion on debt servicing.

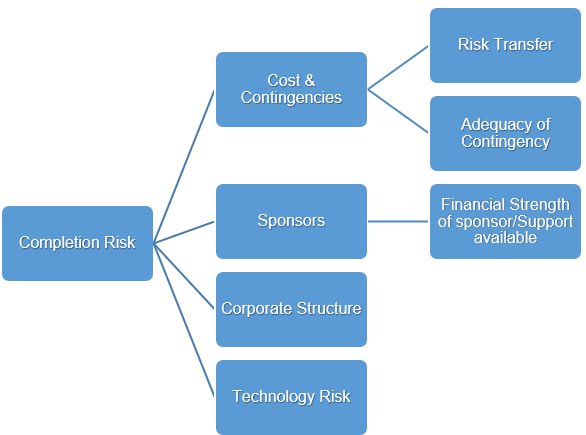

Chart 2: Project Completion Risk

An infrastructure asset has various risk involved at various stages, during the construction phase the project is subjected to risk associated with non-completion of project within stipulated time and cost budgets. A project even though is being developed right on schedule may still yield lower than anticipated cashflow if the project is not developed up to the standards as envisaged in the planning stage leading to lower cushion on debt servicing.

Cost & Contingencies

It is imperative to understand the cost structure for development of infrastructure asset from the standpoint of its adequacy. Cost inflation risk during the development phase is particularly critical as it would lead to delays in commissioning and elevated risk of defaults prior to completion.

The extent of cost inflation risk depends on the term of contracts. The risk is least for a fixed price, well designed turnkey contract with a reputed contractor who has extensive experience of delivering similar projects. In contrast, the risk is highest with a project that is significantly exposed to price risk, has limited scope and where the contractor has limited project management experience.

Acuite therefore assess the Lender’s Independent Engineer’s report to assess the extent of protection received through such transfer of risk during the under-construction phase.

Acuite consider the experience of the contractor and track record of successful completion of projects by the contractor as an important evaluation parameter. For instance, a contractor with healthy financial flexibility, diversified direct exposure (both domestic and global), and track record of delivering projects in time is more likely to partly mitigate completion risk compared to a contractor with limited financial flexibility and exposure to diversified projects or when multiple contractors are engaged in the project.

Supporting Infrastructure Facilities– One of the critical components for successful completion of any infrastructure asset is presence of supporting infrastructure. For example, a renewable energy asset despite its completion on time may still not get commissioned if the power evacuation infrastructure is absent. Acuite critically evaluates the supporting infrastructure requirements while assessing the completion risk associated with infrastructure assets.

Adequacy of Contingencies – Projects during construction phase may witness adverse events which potentially can escalate costs. A contingency fund therefore ensures liquidity support for the project. Acuite shall rely on third party reports to evaluate the adequacy of contingency funds.

Sponsors

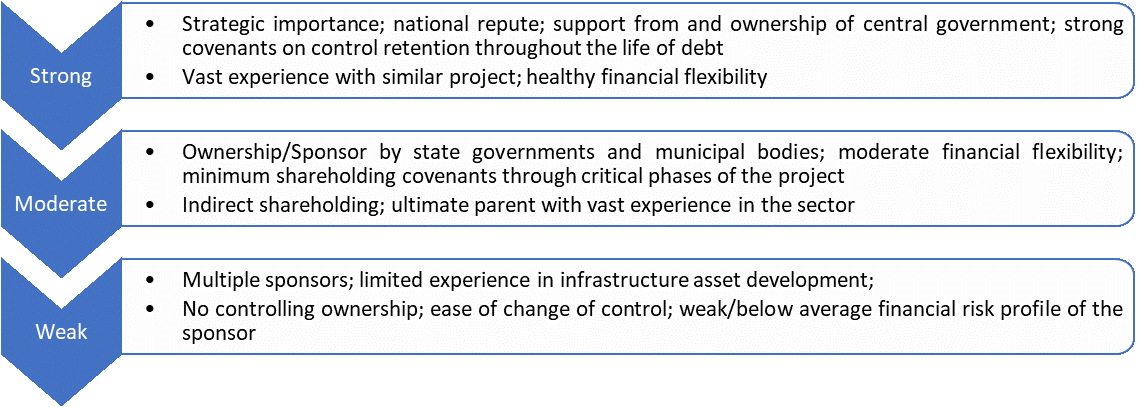

Sponsors play a critical role for an infrastructure asset during its economic life and therefore Acuite considers assessment of sponsor as a critical input for arriving at the rating of an infrastructure project. The role/extent of intervention by a sponsor in an infrastructure asset varies during its economic life according to the category of the project.

Assessment of Financial Strength of the Sponsor/Extent of Support – A sponsor of the project with healthy financial flexibility, proven track record of completing and running similar assets is viewed favourably compared.

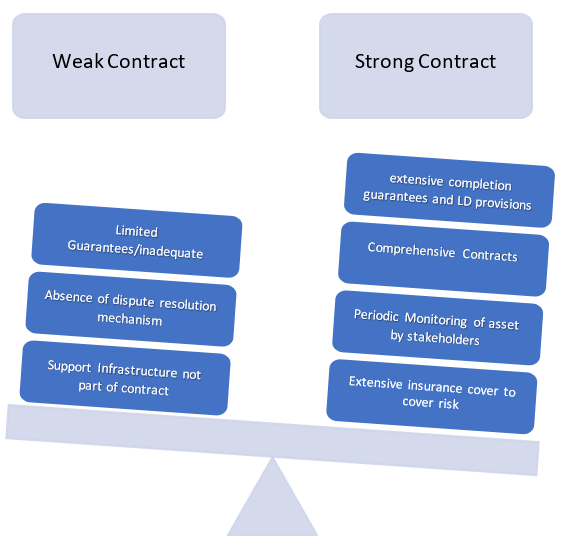

Chart 3: Attributes for evaluation of strength of the sponsor

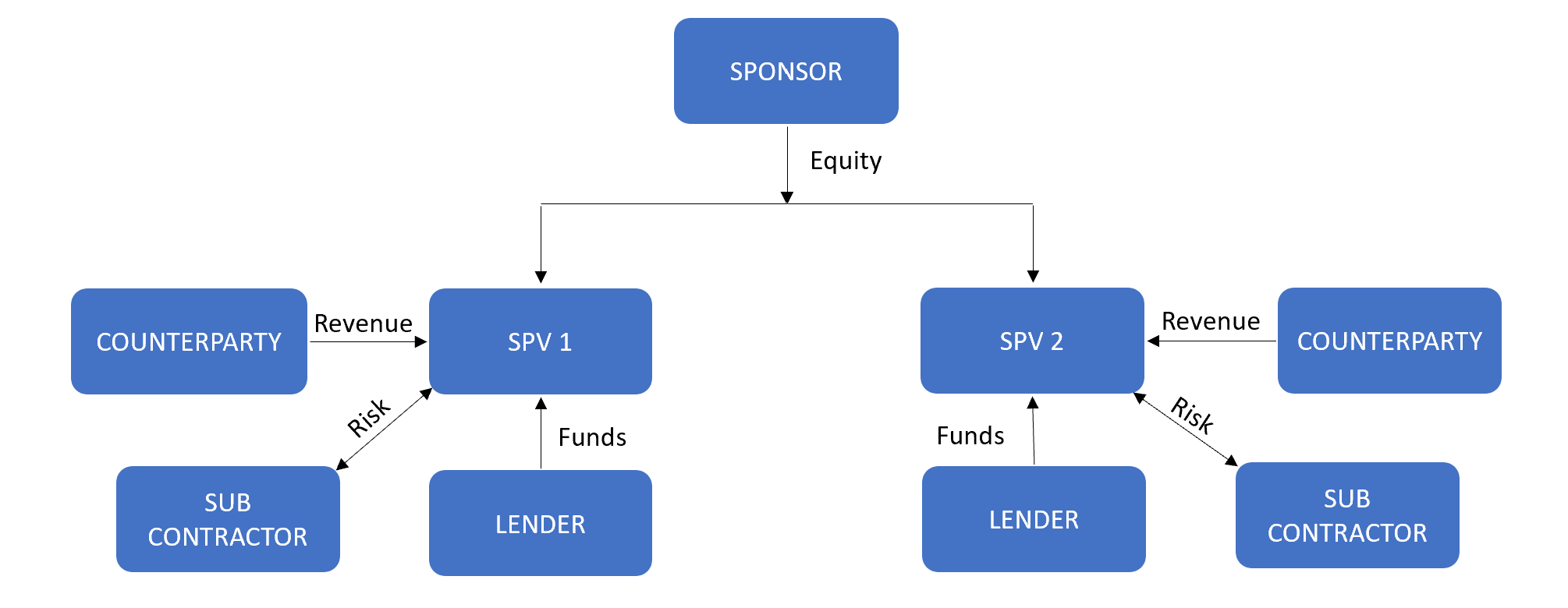

Acuite believes that corporate structure is critical to be analysed for evaluating infrastructure assets. Wherever necessary Acuite will rely upon the consolidated financial statements to understand the liabilities and availability of resources. Acuite may suitability apply it criteria on consolidation on a case to case basis wherever deemed necessary.

The shareholding pattern and the fund flow restrictions from one entity to another shall determine the level of support to be factored between Parent – Special Purpose Vehicle (SPV), between multiple SPVs of the same group.

The support from sponsor should be factored as a liquidity support to the SPV. The credit worthiness of the sponsor may also be considered as the substitute credit quality of an under construction SPV if the pronouncement of support is in the form of an unconditional, irrevocable pre-default guarantee issued to the lenders of the SPV being rated.

Acuite

shall suitably apply its ‘Criteria on Consolidation’ or ‘Parent/Group Support’

to factor support from the sponsor of the infrastructure asset.

Corporate Structure

Infrastructure assets are typically housed in SPVs in line with regulatory, tax and other relevant considerations. In addition, ring fencing of the SPV also mitigates the risk emanating from other projects undertaken by the sponsors.

During the life of the asset the involvement of the sponsor varies and consequently the support required. Acuite progressively factors the change in the credit worthiness during the life of the rated instrument.

Chart 4: Structure of infrastructure SPVs

Technology Risk

An infrastructure asset which is being constructed on the back of an established technology is more likely to be completed in time and in accordance with the performance standard customary to that technology. On the other hand, an infrastructure asset which is to be constructed on a recently developed/inadequately tested technology may lead to lower than estimated performance or could also witness implementation challenges.

Acuite shall rely on third party reports with regards to implementation challenges and opinions on the suitability of technology in the current context.

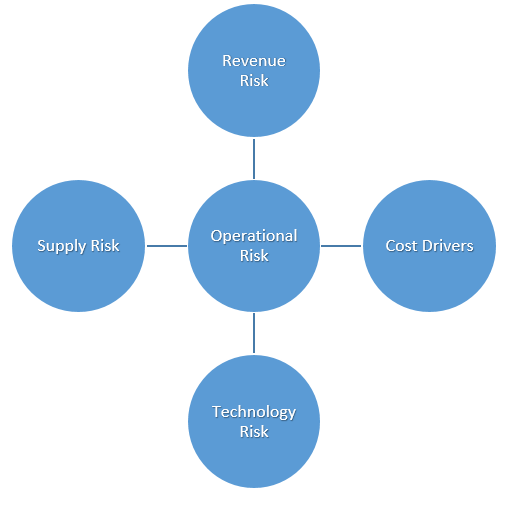

A. Operational Risk

During the operational phase of the project, risk emanates on account of revenue variability, cost escalation pressures which remains unabsorbed, limitations on supply, interest rate volatility and technology obsolescence. Acuite applies sensitivity to estimate the extent of impact on the repayment cushion on account of volatility in these parameters. Nevertheless, the impact of volatility of afore-mentioned drivers cannot be ascertained with preciseness.

The

key drivers of operational risk are explained below.

Chart 5: Constituents of Operational Risk

Revenue Risk

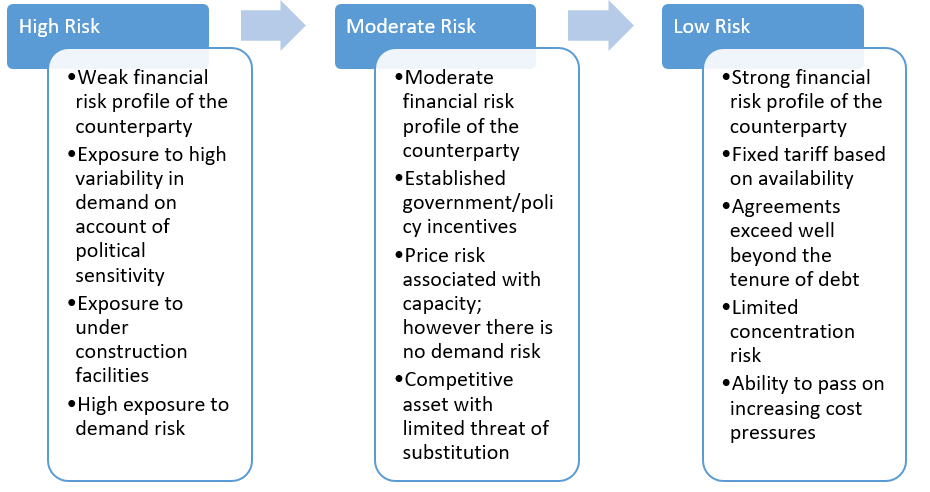

Revenue Risk refers to the inability of an infrastructure asset to generate revenue sufficient to service the debt. For an infrastructure asset the revenue stream is typically restricted to payments received from a contractually obligated counterparty for delivery of the required output from the asset. Acuite assesses the stability of the revenue stream over the medium to long term.

Key Parameter for evaluation of Revenue Risk

Revenue mix for the infrastructure asset

An infrastructure asset shall generate revenues on the basis of maintaining availability as in the case of a power plant or a road project with annuity. In the event, the entire revenue stream is based on maintaining availability of the asset, the revenue risk remains limited to assessment of counterparty risk and the performance parameters.

If the revenue mix is such that the infrastructure asset is partly exposed to demand risk, it becomes imperative to understand the competitive positioning of the asset amongst relevant peer group to ascertain the revenue generation potential for the asset. This is prevalent in the case of partly contracted capacity or if the tenure of debt is higher than that of concession agreement for the asset. In certain cases, the infrastructure asset may be particularly exposed to demand risk as is witnessed in the case of a toll road project.

Acuite relies on expert opinions and studies conducted by third parties to formulate its view on the associated revenue risk. Acuite shall make appropriate adjustments to the estimations provided by third parties to suitably based on its own understanding of the sector, terrain as the case may be.

Chart 5: Revenue risk parameters

Cost Drivers

Cost drivers are directly corelated to the operational risk that a project is likely to witness over its life. Operational risk in turn is the reduction in the performance parameters of the asset leading to lower than projected cashflows, in addition it could also be the excess over estimated costs projected for maintenance over the life of the asset. As a result, inadequate assessment of life cycle costs is likely to result in reduction in cushion over debt servicing requirements.

Acuite assess the cost drivers from the point of view of their adequacy during the operational phase. An O&M contractor therefore plays a critical role in operations of the infrastructure asset. As is frequently observed the sponsor of the project also acts as a contractor. Acuite therefore critically evaluates the following.

a)Financial risk profile of the contractor and thus the ability to perform the obligations as an O&M contractor over the life of the asset.

b)Terms of the O&M contract to evaluate the ease of replacement of the existing contractor by the SPV or the lender

c)Adequate contingency provision built into the contract

d)Evaluation of the cost structure to assess the degree of operating leverage, the lower the better provided variable costs are pass through

The SPV holding the infrastructure asset as the ability to mitigate the cost inflation pressures through fixed priced contracts with sub-contractors, however it may not be a substitute for complete insulation from inflationary pressures.

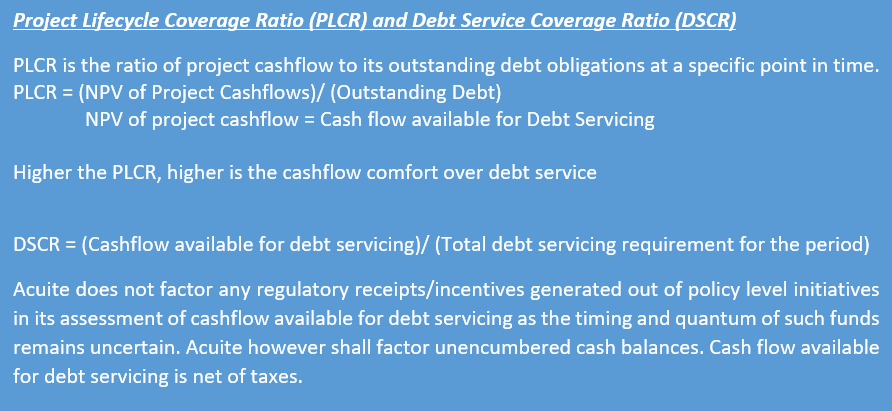

Acuite believes that timing of costs and its spread over the life of the asset has a significant bearing over the Average DSCR of the asset. Also, a cost structure for which major cost components are recoverable under the concession agreement with a stronger counterparty provide significant comfort on the stability of cashflows.

Supply Risk

Certain infrastructure assets may require a constant source of supply of raw materials to operate. For instance, a constant supply of coal is required to operate a thermal power plant and a supply of waste water is required for a water treatment plant. Acuite assesses the risk emanating from price escalation on account of availability of such resources and the pass through available to the SPV under the relevant agreements.

Technology Risk

Technology risk arises when the asset is based on a technology for which sufficient operational data is not available. Under a conventional/proven technology estimates of cost are reliable over the life of the asset and thus predictability of cashflow is far more certain. Acuite will depend on Technical evaluation reports to understand the costs involved in maintenance of the infrastructure assets.

Obsolescence of the asset: The risk arises due to increasing variant to technology or shift in demand due to higher efficiency of a competing asset. In such circumstances, Acuite assess the surplus available at the SPV and the sponsor support for augmentation of capacity to sustain the cashflows.

A. Financing Risk

Infrastructure projects require a large quantum of capital for its development, which is typically sourced in the form of equity and debt. Acuite focuses on the SPVs ability to raise the requisite finances in a timely manner. Sponsor’s equity contribution to the project SPV is analysed to understand the quantum that may be required at various stages of the construction phase. Equity contribution is a precursor to the obtaining disbursements during the construction phase. Acuite attempts to identify the source of equity and the likelihood of any delays in infusion which may impact the project completion timelines.

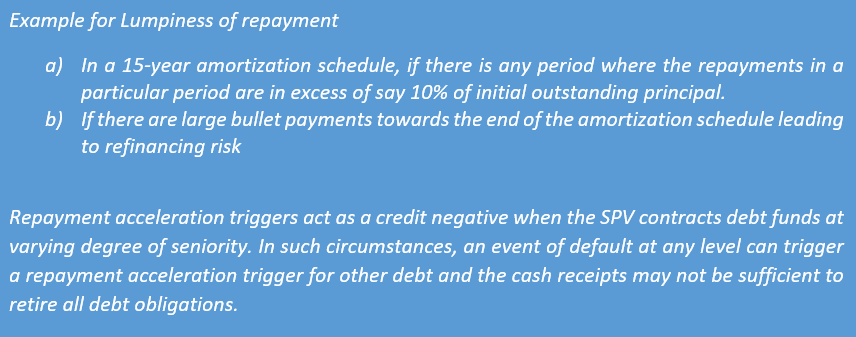

Importance of Debt Structure

While project analysis lays emphasis on the cashflows and its stability, it is also important to analyse the debt structure from the perspective of interest rate sensitivity, built-in structural comforts such as DSRA, amortization schedule, covenants and the refinancing risk associated with debt. Infrastructure assets generally contract debt at same seniority (term debt) except for debt infused by the sponsors which is generally subordinated to the project debt.

Key Parameters for assessment of debt structure

a) Amortization Schedule

– It is critical that the repayment schedule should be synchronous with the

cashflow ramp-up from the project. The debt should get amortized fully

before the end of the concession period. Lumpiness of debt repayment in any

period and cross default or repayment acceleration triggers are viewed as a

credit negative.

b)Structural Features – Key aspects evaluated by Acuite includes the following

ii.Presence of a Debt Service Reserve Account (DSRA) and the extent of coverage provided by the DSRA.

iii.Restrictions on cashflow upstreaming by the sponsor of the projects

iv.Covenant testing at periodic intervals and cash sweep mechanisms linked to cushion in available surpluses, if any

v.Replenishment of DSRA in the event of DSRA dip-in and how such replenishment is impacted (via operational cashflows/via incremental contribution by sponsors of the project)

vi.Presence of liquidity lines (working capital facilities) which remain available and can be drawn in the event of cashflow mismatch

Acuite evaluates the extent of cushion provided by these structural features as an essential component of rating. These features can be tightened or diluted on a case to case basis and therefore Acuite in its press release shall opine on the quality of structural features.

a)Covenants – Covenants can be affirmative or negative and these are used by the lenders to restrict certain set of actions which may impact the project cashflow or the sustainability of the infrastructure asset. Covenants may be specific to a particular infrastructure asset but the following covenants are common and critical to any infrastructure asset.

i.Retention of management control for a particular period of time

ii.Prohibition of incurring incremental indebtedness

iii.Prohibition on investments/mergers & acquisition/sale of assets etc

Covenants therefore are tested on a periodic basis to assess the compliance of the infrastructure asset to the conditions laid out in financing documents. Acuite obtains a compliance certificate from the company at the time of rating exercise. Acuite also takes note of the remedies available to the lenders on the occurrence of an event of default, however consider no benefit of such options while arriving at the rating.

Refinancing Risk – This is particularly relevant for instances where the debt is not amortised uniformly and therefore a large portion of debt remain exposed to refinancing risk at a higher interest rate.

Policy/Regulations

Infrastructure assets operate with an inherent risk of change in policy or regulation over a period of time. This risk remains high during the implementation stage of the project and subsequently subsides to some extent on the commencement of operational phase. Government interference through changes in policy can result not only in deterioration of cashflow stability of a project but has the potential to render the operations of the project unviable.

For instance, a change in the state government policy to exclude passenger vehicles from paying toll can lead to high impact on the cashflow of the projects.

Acuite understands that there have been instances in the country where projects have been abandoned due to large scale opposition and in many cases there have been significant delays to such projects. Acuite therefore believes that a stable operating environment remain critical for long gestation project.

Industry Risk

Infrastructure asset’s performance is also relative to the industry. An industry where demand outstrips the supply are likely to witness new capacity additions and benign policy framework. Acuite shall evaluate the relative size of the infrastructure asset and its competitive positioning to evaluate the consistency of support arising out of the policy framework.

Assumptions on Legal Compliances

Acuite assumes that the relevant legal compliances have already been complied to or are likely to be complied with. Acuite does not opine upon the legal structure while evaluating infrastructure projects. In certain cases, Acuite may rely on third party opinions on any potential legal risks wherever deemed necessary.