27th November 2023 (Version 3)

PREAMBLE

The economic development of any country is largely aligned to the level of its infrastructure spending. In order to spur economic growth, it is imperative that significant investment is made in infrastructure sector like roads, bridges, ports, power assets, airports etc. A developing nation like India needs significant investments in infrastructure to maintain a healthy growth trajectory. Infrastructure Projects are typically long gestation projects which require significant long term capital financing. The traditional financing options like domestic banks/institutions have time horizons between 5-15 years which may not always be synchronous with the cash flow profiles of these long tenure projects. The sector has been exploring various options like takeout financing and long term funding from overseas markets etc. An Infrastructure Investment Trust ( InvIT) is a preferred option which has been gaining in popularity over the recent past. InVITs come within the regulatory purview of SEBI which released the initial SEBI (Infrastructure Investment Trust) Regulations, in 2014. Subsequently there have been amendments to the regulatory framework. As per the last amendments announced in February 2023, SEBI has focussed mainly on the corporate governance and management aspects of the InVITs.

An

InvIT is an investment vehicle which mobilises funds from a large pool of

investors (analogous to a mutual fund) and invests in a portfolio of income

generating infrastructure assets like road assets, power transmission assets,

airports, solar/wind energy assets etc. A listed InvIT is structured as a trust

under Indian Trusts Act 1882. Typically the InvIT is promoted by infrastructure

players such as a road developer with a large basket of infrastructure assets

or a power transmission assets player or investors like private equity funds

Key regulations stipulated by SEBI for InvITs (Source: SEBI/HO/DDHS/DDHS/CIR/P/2019/59)

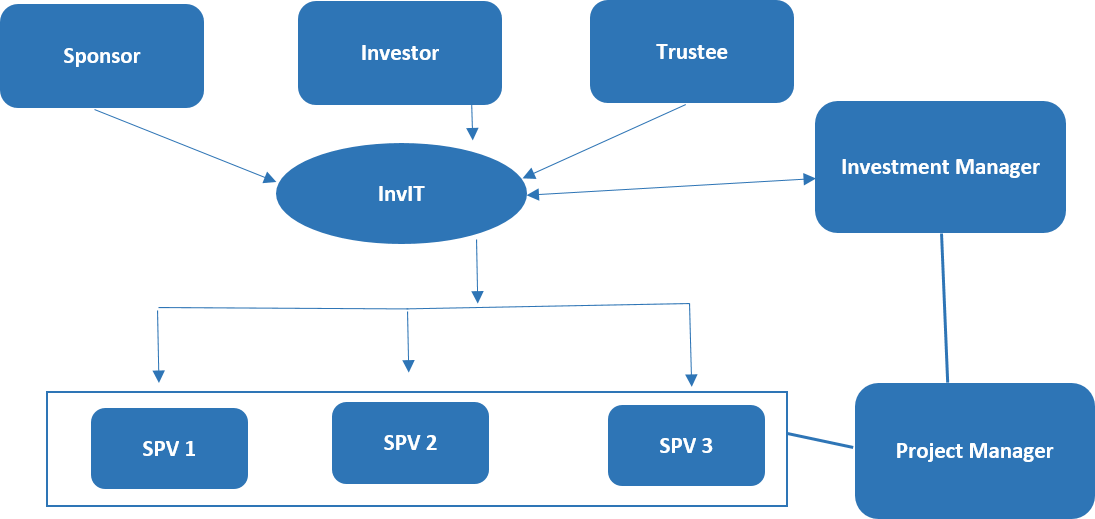

Structure of typical InvIT

The debt raised at the level of SPV can be credit enhanced through a guarantee from the InvIT to achieve the benefits of cash flow pooling.

The debt raised at the level of SPV can be credit enhanced through a guarantee from the InvIT to achieve the benefits of cash flow pooling.Investor protection and governance norms are relaxed for privately placed InvITs, key features are mentioned below:

Risk assessment framework for arriving at the credit rating of an InvIT

It is proposed that the framework for the assessment of risk in an investment trust be based on the following

Evaluation of business risk should be focused on the quality of the assets under the InvIT. The quality assessment should cover the following revenue risk associated with each of the projects, the tenure of the contract and the protection available to the issuer under the contract (including the termination clauses), the re-pricing risk associated with the contracts, demand and supply situations affecting the future cashflows.

For assets under pay and use model – viz. toll roads, airports and ports; in case of an existing asset, the track record of traffic movement may be well established, and historical traffic data is required for ascertaining the traffic trend. However, for a project with a limited operational track record, forecasting traffic volumes and measuring market risks can be challenging, given the absence of reliable and sufficient historical traffic data an estimate may be used to assess the future revenue potential for the asset.

Counterparty credit risk associated with the asset – This is more applicable to the assets which are not under use and pay model. In the situation of financial stress with the counterparty, there could be delays in realization of cash. Diversification of counterparty is likely to mitigate counterparty risk to a certain extent.

Operating Risk – Conformance with the desired performance levels over the period of concession or under the PPA as the case may be. Any delays in the timely maintenance and lack of provisioning for maintenance expenses could lead to the material weakening of the project and thus is likely to impair the revenue-generating capacity of the project.

Diversity of Asset base in the InvIT – A diverse asset base for an InvIT should have no single assets dominating the cashflow for the InvIT, should not have a major concentration in one geography, should not be dependent on a single revenue model (can be a mix of toll and annuity for road assets)

Sustainability of cashflows – The lesser the variability of cash flow, the better is the sustainability of the asset (Annuity Road Assets have lower variability of cash flow compared to toll assets).

Stable Returns: An asset which has a defined cost structure and adequate provisions for routine maintenance is more likely to build in adequate buffers to counter any delays in receivables (annuity roads, lease rentals etc.). A thorough analysis of the cost structure, therefore, needs to be conducted to ascertain if all the major cost components are thoroughly covered while arriving at the profitability.

Assessment of liquidity: Cashflows from an asset should also be assessed from the perspective of the potential to generate adequate liquidity during its initial period of operations. The Debt Service Coverage Ratio (DSCR) is required to be evaluated by applying reasonable stress to the operating conditions. Acuite will assess asset level DSCRs over the life of the concession agreement as one of the critical inputs amongst others.

Any Asset/Investment Trust (when debt is raised at the level of the Trust) with a limited track record of operations may present itself with a reduced level of certainty for the prediction of cash flows. In such situations, the presence of structural features which provide adequate cushion for debt repayment becomes critical. A project shall be viewed favourably if the structuring of the debt provides for trapping of the cash generated, creation and maintenance of DSRA, ballooning of the repayment structure to tide over the initial period of the ramp-up of operations, creation of provisions for incurring large expenditures, ring-fencing of the cash flows.

The analysis of cash flows should also include the priority of application of cash flows so generated towards various requirements. For instance, a payment waterfall which prioritizes application of funds towards shortfalls in maintenance reserves over payment of dividends should be viewed more favourably vis-à-vis a project where cashflows are released directly post application of funds towards debt servicing.

Acuite also takes note of the controls that the lenders exercise in such transactions, such as the imposition of restrictive covenants on leverage, or defining the total permissible borrowings or restricting repayments on junior debt.

A review of the regulatory risk is critical where the operating assets are subjected to high levels of government intervention from time to time. There have been instances in the past where government interventions such as stopping toll collections for passenger cars has led to a substantial reduction in the toll revenues for developers, while there are remedies available to the developer under such circumstances. The evaluation of the history of such interventions and the compensations awarded and the timeliness of such compensations assumes criticality in the assessment of regulatory risks.

The evaluation of management risk should be centred around the following: