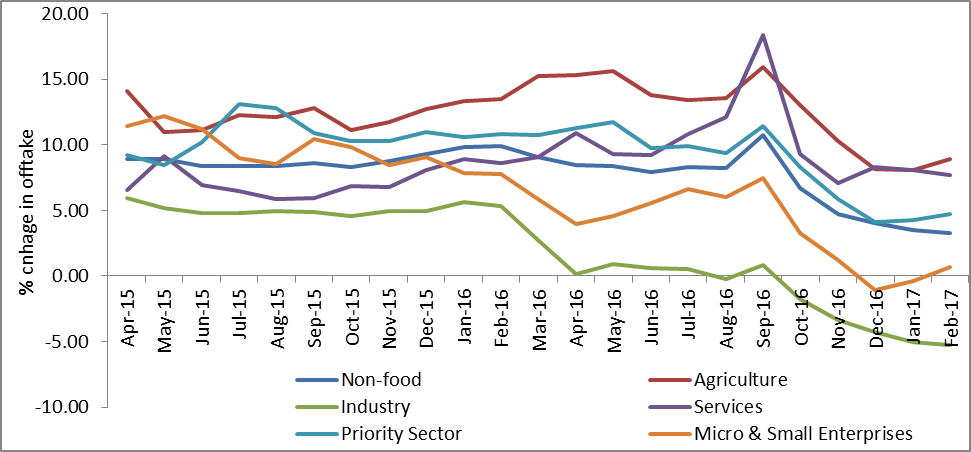

Credit offtake in non-food category has decelerated to 3.3% in Feb 2017 from 10.8% in Sept 2016. The overall non-food credit outstanding stands at Rs. 66.86 trillion by the end of Feb 2017. No major segment has been left untouched and traces of contraction are visible pan industry; as a result, Agriculture, Industry and Service have shown bearish trends in terms of supply of credit. At a sub sector level, petroleum and coal products, fertilizers, and vehicle sector have shown a significant improvement. While offtake in petroleum products is driven by current capacity augmentation, especially taking place in the refinery space, the vehicle offtake in Vehicles category is driven by a strong consumer demand. As inventory levels fall, OEMs have been engaged in Capex in order to indigenize products, increasing model mix as well as becoming more prices competitive in the local market. Also, a strong growth in retail loans concerning Consumer Durables (+18.2%) correlates well with the prevalent market realities. Offtake in petroleum & coal products and fertilizer have increased by 10.9% and 18.6% as against 3.1% and 6.5% respectively in previous year. Similarly, offtake in automobile sector recorded a growth of 6.7% as compared to 4.6% in the previous year.

The priority sector that accounts 34% in the non-food category has recorded 4.7%. Micro & Small enterprises lending falls to 0.7% as compared to near 8% same time last year, while Medium enterprises continued with their double digit contraction and experienced a contraction of over (-) 12%. Large industries, which are primarily responsible for high NPA levels due to their comparative higher leverage experienced a contraction of about (-) 4.9% as compared to a 7% expansion same time last year. With Asset Quality Review (AQR) mandates becoming stricter and risk weightages taking their toll on margins, banks are increasingly skeptical on offtake to the said category.

Consumer durable category, as mentioned earlier along with strong auto demand, seems to be the top performer and has maintained a growth of over 18% in credit offtake for FY17 YTD. On the other hand, offtake in infrastructure, a key part of government policy has disappointed with a contraction of (-)9.6% during the said month.

On a macro level, the growth in credit offtake is in contrast with the performance of the economy. According to CSO's advance estimate, India's GDP is expected to post 7.1% in FY17. Private consumption that accounts 56% in overall GDP and is a mainstay of domestic demand is likely to grow at 7.2%. Government expenditure (accounts for 10% in GDP) and is likely to expand by 17%. The fall in offtake augurs that this growth is primarily driven by consumption that is in turn taken care off by unsold inventories and underutilized capacities. A slow growth in investment is also pointing toward poor demand for credit as the Gross Fixed Capital Formation (GFCF) is likely to grow at just 0.6% and continues to be below 30% of GDP.

In first half of FY17, domestic demand was leading the economic growth when performance of external sector was poor. With the healthy growth in agriculture sector, implementation of OROP and 7th pay award the private consumption is likely maintain its pace in the near future as well. A robust growth in exports however over the past few months along with a maturing global appetite for trade is indicative of the external sector's solid rebound. Export Credit expanding in double digits over the past nine months is a strong indicator of a robust external demand for Indian goods; a favorable base effect is also at play though. Schedule Commercial Banks (SCBs) on their part, have reduced lending rate by around 70 bps in Jan 2017 and therefore lower lending rates are expected to encourage investments. We expect MCLRs to come down further due to cuts in Small Saving Schemes that will enable banks to remain competitive while maintaining their Net Interest Margins (NIMs).Based on this scenario, Acuité believes the credit offtake has bottomed out and is expected to expand strongly in the near term. We expect the credit offtake to expand by average of 3.6% in Q1, FY18.

Principal factors influencing the category

| Economic Growth & Outlook |

| Systemic Inventories |

| Capacity Utilization Levels (CU) |

| Performance of the Index of Industrial Production |

| Repo Rate/ Interest Cost |

| Government Policy & Support |