As expected the Monetary Policy Committee (MPC) has cut the REPO by 25 bps to 6%, accordingly bringing down the Reverse REPO to 5.75%. While deciding upon the interest rates the central bank considered the following factors;

Inflationary Situation: At below 2%, CPI has been continuously falling and is consistently recorded at an all-time over the past six years (the start of the current time series). The healthy monsoon, which is over 1% higher than the Long Period Average (LPA) this year as well as rising Minimum Support Prices (MSP) have helped shore up food production in certain deficient categories. Overall, sown areas in the ongoing kharif season are higher than the previous year. Apart from Oil Seeds, production of most agro commodities is expected to be higher than even last year's; if the buffer stock for wheat at 1.5 times is anything to go by, food prices are expected to remain range bound. The committee however believes that because of rising rural incomes, demand for protein based food items as well as certain vegetables will begin an upward trajectory and this may cause some inflationary pressure in the near term. Having said this, even though headline inflation has been falling significantly due to inventory buildup in food and fuel categories, core inflation has been seen building pressure towards the second half of the financial year. We believe that the committee's assessment of a CPI averaging 3.5% to 4% is realistic despite record low numbers currently.

International Circumstances: The committee noted that solid growth recorded in most developed markets such as the US, Europe and Japan will have a spillover effect on the domestic economy. Despite current account deficit almost doubling in June, there is a strong message emanating from policy makers that AEs are the growth drivers of the global economy and strong consumer demand will benefits emerging economies. Also, it must be noted that Rupees solid performance vis-à-vis the Dollar signals towards dwindling of investor confidence in US President's policies and that global capital may move freely towards high potential markets such as China and India. Safe haven demand despite being strong and having shored up the Japanese Yen and Euro, does not warrant a significant fall in Rupee or Yuan. We continue to see Rupee performing well and maintaining its level at 64 ± 0.5. Also, US Fed's ongoing monetary tightening will have a lower than expected impact over emerging market currencies (including the Rupee) given the fact that the last two hikes were priced in by the market and the fact that $4 trillion worth of US debt is still carried on the Fed's balance sheet. Coming back to the domestic market, as crude continues to languish at sub $50 levels due to inventory build-up in the US along with lower than expected commodity prices (including metals), the balance of trade will benefited.

Macro Conditions: Imports have remained robust given strong consumer demand and appreciating Rupee giving importers an extra dynamism. With reserves of nearly $395 billion, India continues to have robust coverage of nearly a year's worth of imports. Industrial production has however remained poor and most variables including IIP and PMI are auguring dismal outlook. Services performance has been a bit better manufacturing is overwhelmingly crowding out any positive sentiment. Consumer non-durables, after being realigned recently has been performing strongly given a strong rural demand (especially from the FMCG sector), traditional performer, consumer durables has been reeling under pressure.

Even though IIP has been recording lower than expected growth numbers (< 1%), RBI surveys have revealed that future outlook remain strong for manufacturers. The primary reason for a fall in production levels is lower capacity utilization level, which in turn is a pigment of uncertainties coming from the GST implementation. Also, the manufacturers (along with their wholesalers as well as retailers) are facing high inventories in the system and there is an apparent demand supply mismatch currently doing the rounds. We do not believe that the condition will normalize before more information is revealed regarding the impact of the GST on the economy, i.e. towards the end of Q3 FY18. The time is also expected to coincide with the actuation of the CAPEX cycle. Most core categories including Cement, Fertilizers and Electricity have shown contractions or lower growth at this time. Capital goods category continues to show a poor work in progress scenario as well. This perhaps gave the MPC a window to reduce interest rates.

Liquidity Scenario: Acuité believes that the liquidity scenario is now improving over the situation in April and Q4 FY17. Our Systematic Liquidity Index (SLI) has been showing consistently lower liquidity as over the last three months and this has given the RBI a chance to lower interest rates. Even though the RBI has kept its monetary stance at neutral, we believe that the central bank will continue with a somewhat dovish stance given sable macro numbers as well as favorable international conditions. The estimate for GVA for FY18 has remained at 7.3-7.4% and a tweak in interest rate was perhaps optimal at this time in order to reinvigorate the industry. Acuité expects the rate of inflation to remain under control. Business activity in the domestic market is expected to improve after the smooth implementation of GST. Considering this improvement growth rate in GVA is expected to pick up the pace, which was decelerating in past three quarter. Therefore, the RBI is likely to hold the repo rate at 6% till end of Q3.

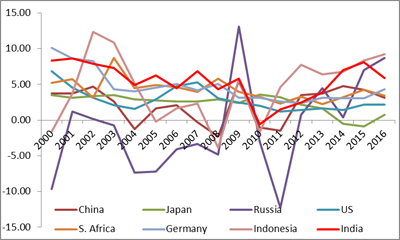

Annual real rate of interest:

Source: World Bank, Acuité Research

Note: Real interest rate lending interest rate adjusted for inflation