Steel, petroleum and electricity have recorded solid growth of 9.1%, 5.9 and 5.0 respectively in Apr-Feb FY17 are likely to lead the performance of core sector in future.In addition, the aggregate order backlog for machinery has already declined by (-) 11.3% in December quarter.

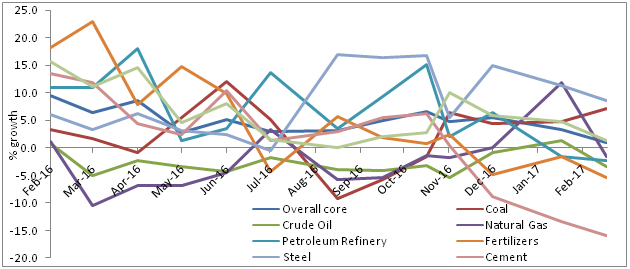

Indian core industry has disappointed by recording a 15 month low growth rate of 1% in Feb 2017. However, the Core Sectors are performing well as on date (FY17) as compared to the previous year's period. The overall collective growth during Apr-Feb FY17 is pegged at 4.4% as compared to 3.5% during the corresponding period of the previous year. Healthy growth in the core sector will guide the industrial sector's performance in the near future. In addition, the aggregate order backlog for machinery has already declined by (-) 11.3% in December quarter and continue its negative trend for 3rd quarter.

Heavyweight sectors such as Crude Oil, Natural Gas and Cement, which account for nearly 25% in overall core sectors continue on a negatively trajectory. Cement has been suffering due to unfavorable base effect, which in turn occurred due to massive capacity augmentation the previous year. The industry, driven by the construction and real estate sector, was growing at 4.8% during Apr-Oct FY17. However, demonetization highly impacted the construction and real estate sector and as a result, cement industry also lost its momentum - contracted by an average of (-) 10% in the last 4 months (Nov-Feb). There is no sign of improvement in the performance of the sector as growth rate has decelerated to (-) 15% in February 2017. Acuité expects another quarter for things to normalize.

Natural Gas has been reeling under the negative influence of the Krishna-Godavari issue and increasingly competitive imports. Imports currently meet India's 40% consumption requirements for Natural Gas. Crude on the other hand has shown no signs of improvement but we expect things to turn positive with Capex cycles coming online, especially state owned ONGC. Production of Refinery segment has expanded by almost double as compared to the previous year's 3.7% (Apr-Feb FY17).

Steel, meanwhile is a turnaround story with the provision of MIP and China capacity cuts; not to mention the infrastructure push. Coal and Electricity, on their part have witnessed healthy growth rate in FY17 (YTD) and neutralize the performance of above said sectors. Renewable sub sectors are the primary sustainers with over 5 GW capacity augmentation in Wind Energy (YTD FY17) and the planned 40 GB of Solar capacity by 2020.

Similarly, fertilizer industry that recorded robust growth rate of 11.6% during Apr-Feb in FY16 has slowed down to 2.2% during the same period in FY17. In the last three months, growth rate of the fertilizer industry has contracted by nearly 4%. Apart from lower than expected capacity utilization levels, Acuité attributes the lackluster performance to the 'Neem Coated Urea' Policy.

Healthy growth in the core sector will guide the industrial sector's performance in the near future. In addition, the aggregate order backlog for machinery has already declined by (-) 11.3% in December quarter. This indicates that the industrial sector has picked up and capacity expansion is on the cards. Considering the massive push through public spending and scope for capacity augmentation in these critical sectors, Acuité estimates that growth will maintain consistency throughout the financial year.

Principal factors influencing the category

| Economic Growth & Outlook |

| Systemic Inventories |

| Capacity Utilization Levels (CU) |

| Performance of the Index of Industrial Production |

| Repo Rate/Interest Cost |

| Government Policy & Support |

Movement in Core Industry:

(Updated as on April 20, 2017)